In the first months of 2024, Europe's tourism industry experienced a strong recovery as the number of international arrivals (+7.2%) and overnight stays (+6.5%) surpassed 2019's pre-pandemic figures, according to data from reporting destinations.

The recovery is largely driven by strong intra-regional travel fuelled by Germany, France, Italy and the Netherlands, coupled with demand from the United States, which continues to be Europe's most significant long-haul source market.

"The early figures for 2024 reveal a positive outlook for European tourism this year. Consumer travel spending is set to rise notably across Europe, hitting record numbers in the coming months," said the European Travel Commission's (ETC) President, Miguel Sanz, in a press release.

In 2023, the percentage of international tourists was just 1.2% below 2019 levels, and nights just 0.2% below. The post-Covid upward trend has continued this year, according to the latest edition of the 'European Tourism Trends & Prospects' quarterly report released by the ETC on Tuesday.

High prices and geopolitical risks

This report monitors the performance of European tourism in the first quarter of the year and the macroeconomic and geopolitical factors impacting the industry's outlook on the continent.

"This boost will support the travel and tourism businesses heavily impacted by the pandemic years and ongoing economic instability," Sanz said. "Still, high prices and geopolitical risks remain key hurdles for tourism, as the sector also strives to adopt more responsible practices to benefit locals and preserve the environment."

Year-to-date data shows that destinations in Southern Europe are leading the recovery in terms of international visitor numbers compared to 2019 levels, including Serbia (+47%), Bulgaria (+39%), Turkey (+35%), Malta (+35%), Portugal (+17%) and Spain (+14%). These destinations offer competitively priced holiday experiences, often coupled with milder winter temperatures.

Credit: Unsplash / Glade Optics

Nordic countries are also witnessing an uptake in tourist activity, as overnight stays grew above pre-pandemic levels. The increase is particularly evident in Norway (+18%), Sweden (+12%) and Denmark (+9%) – with high interest partially driven by winter sports tourism and the allure of the Northern Lights.

Meanwhile, countries in the Baltic region continue to lag behind due to Russia's invasion of Ukraine, with Latvia registering the lowest number of post-pandemic international arrivals (-34%), followed by Estonia (-15%) and Lithuania (-14%).

The first few months of 2024 also showed an uneven long-haul source market performance: the US and Canada continue to dominate, mirroring trends from 2023.

There was also an increase in visitors from Latin America, particularly Brazil, during the first quarter of the year. Conversely, though the Asia-Pacific region shows signs of improvement compared to last quarter, recovery remains modest and uneven: while Chinese tourists are beginning to return to Europe, recovery from Japan is still slow.

Despite challenges, consumer demand remains strong

Inflationary pressures and geopolitical uncertainties remain significant concerns for the European tourism industry. For tourism industry professionals, accommodation costs (59%), business costs (52%) and staff shortages (52%) are seen as the biggest challenges.

Conversely, online social conversations surrounding travel in Europe have been overwhelmingly positive, surpassing discussions about other global regions such as the Americas, Africa and Asia-Pacific in early 2024. Highlights included praise for seasonal beauty, outdoor adventures, and unique cultural events such as Carnival celebrated across European countries.

Consumer data also shows that travel remains a top priority in 2024. Both intra-European and long-haul tourist spending increased in early 2024, with forecasts indicating that travellers will spend €742.8 billion in Europe this year – a 14.3% increase compared to 2023.

This can be attributed to both inflation and evolving travel preferences, with travellers potentially opting for longer stays or more diverse experiences. Germany will be a main source of traveller expenditure, accounting for 16% of total spending in Europe in 2024.

Credit: Anne Jea / Wikimedia Commons

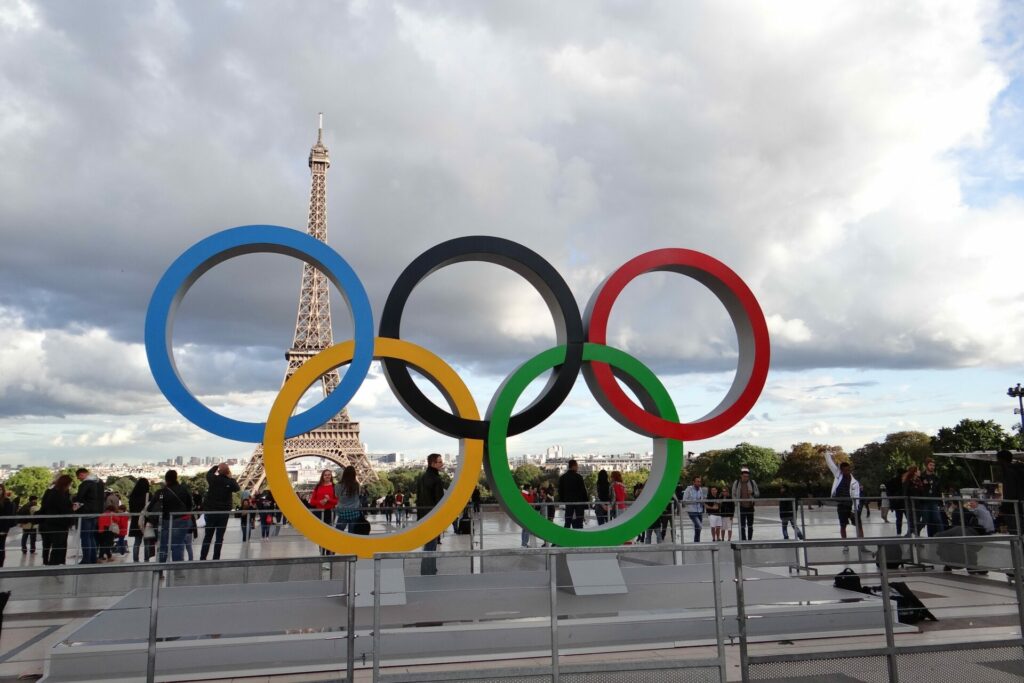

Additionally, this summer will bring two major sporting events to Europe: the Olympic Games in France and the UEFA European Football Championship in Germany – which are both expected to drive demand in the respective countries.

The Olympics are expected to attract a surge in domestic and international tourism, with the impacts extending beyond the city of Paris itself. Inbound spending growth is projected at 13% for Paris and 24% for all of France on 2019 levels.

The Euros will be less concentrated in the German capital, with games taking place across ten cities. This is expected to offer a more dispersed benefit, with all participating cities poised to experience a significant rise in tourism revenue.