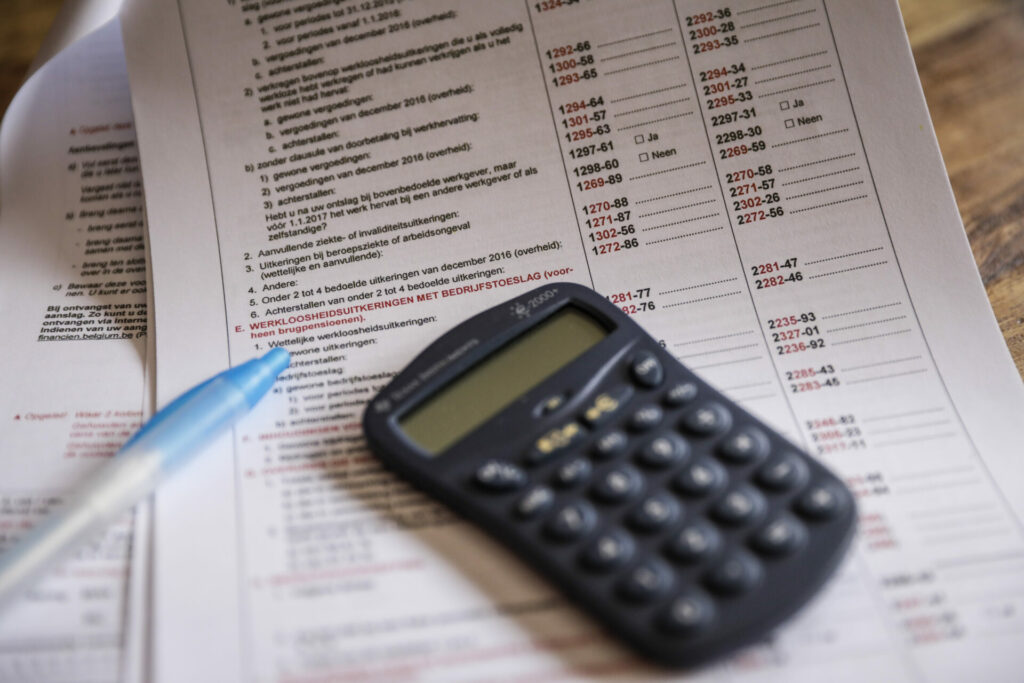

Belgian citizens may now assign a relative, friend or anyone else they wish to file their taxes for them.

This will be possible through the 'Citizen Tax Return' mandate, which the Ministry of Finance announced on Thursday. The mandate allows two individuals to formally declare that one is helping the other with filing their taxes.

"With the new Citizen Tax Return mandate, we now offer authorised persons the possibility of using their own means of connection to act easily on behalf of their loved ones without having to be next to them," the Ministry stated in a press release. "This also meets the need for family administrators to be able to act on behalf of a protected person."

The form can be accessed here. Once signed, the appointed citizen will gain access to the other's MyMinfin tax file and all related documents. They will be authorised to enter tax returns, check simplified tax return proposals, request payment plans, reply to letters from Ministry of Finance and consult rental contracts.

Related News

- Expats, border workers or trainees: What to know when filing taxes in Belgium

- Belgium tightens tax rules for expats

If assistance is needed but no family member is available to help, the individual in question can avail of professional guidance (such as from a chartered accountant) via a separate new tax return mandate called 'IPP-INR'.

The Ministry underlines the fact that the primary individual will still be liable for all tax transactions even if they are carried out by someone else on their behalf. Either party is free to terminate the mandate at any point.