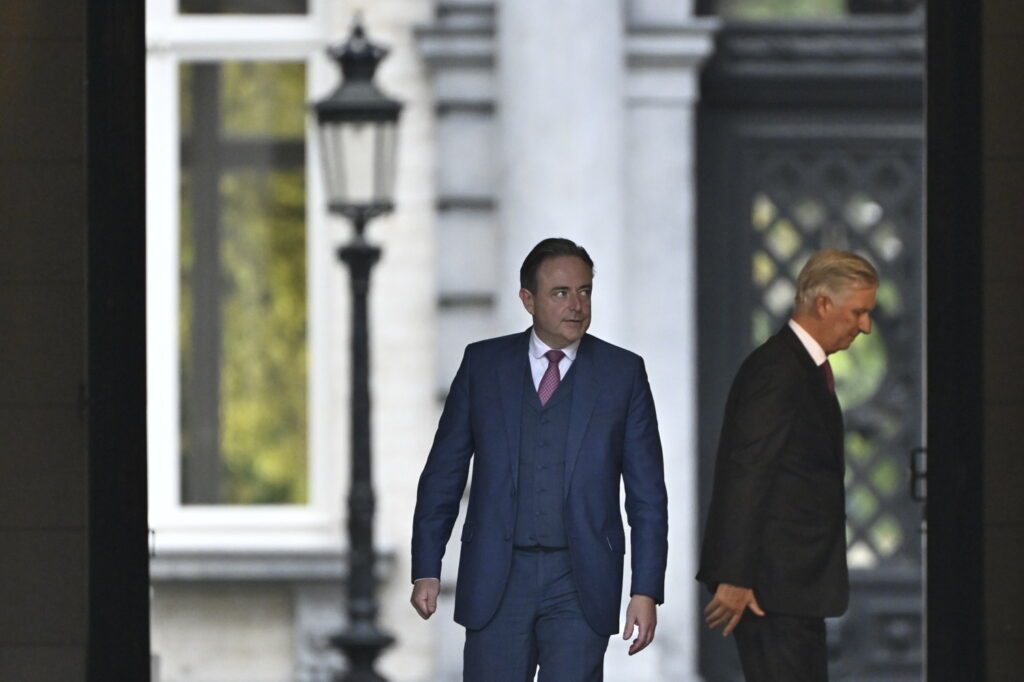

Federal Government formation talks resumed last week in the wake of local elections. Bart de Wever's latest proposals attempt to appeal to both the socialists and the liberals at the table.

The text currently under discussion will need to be agreed by mid-November if N-VA leader and formator Bart de Wever's self-imposed deadline is to be respected.

Belgium has been called out by EU regulators for overspending and has been granted an extension to submit a financial recovery plan, which now must be done by the end of the year. An agreement by mid-November would give coalition partners time to hammer out the budget.

The latest version of De Wever's "super note" aims to balance the demands of Arizona's centre-right and right-wing partners (N-VA, MR and Les Engagés) and the only left-wing partner, the Flemish socialists Vooruit.

Early retirement

The super note proposes early retirement at the age of 60 for individuals who have worked for 42 years. Retirement is already possible at 60 for people who have worked 44 years; it is possible after 43 working years for people aged 61 and 62.

De Wever is therefore reducing the threshold slightly, which would allow 6,000 workers to retire earlier every year. This proposal is likely calculated to appease Vooruit which with its French counterpart the Socialist Party (PS) has long been pushing for retirement reforms. Ths didn't happen under the outgoing Vivaldi government.

Vooruit's Conner Rousseau (left), Les Engagés' Maxime Prévot (middle) and MR's Georges-Louis Bouchez (right). Credit: Belga

Capital gains tax

The super note also contains proposals designed to appeal to George-Louis Bouchez' liberal party Mouvement Réformateur (MR), notably with a capital gains tax.

De Wever has suggested a 10% tax on capital gains without retroactivity. Some taxes will be deductible, including a basic exemption of €15,000 in order to exclude small investors from the regulation.

As it stands, Belgium is one of the only countries in the world with 0% tax on investment profits (known as capital gains), under certain conditions.

Related News

- Federal Government formation: De Wever pushes for swift progress as financial pressure rises

- How Belgium's local election results will impact the Federal Government formation

- 'Cordon sanitaire' broken in Ranst but its architect does not fear chain reaction

Other measures include tax reforms for property income, the simplification of company car expenses, the introduction of a minimum interest rate on savings accounts, an increase in excise duties for cooking oil (making every 1,000 litres €15 more expensive) and a modification to fuel excise duties which would bring them into line with the European average (duties would be lowered in the event of a global price rise).

All negotiating parties want to form a "socio-economic recovery government" but they disagree on how this would be realised. Despite significant ideological differences, there is hope that the November deadline will be met. Chief negotiators will meet again on Thursday.