"There's no shortage of reasons why people don't invest in the stock market, but are they sensible or is it time to rethink our attitudes to money management? In this article, we debunk five myths about the stock market.

1. Investing is gambling, just like going to the casino.

In popular culture, investing is portrayed as very risky and with outcomes that are almost random.

On the one hand, it is true that stock prices are often volatile and unpredictable, making the stock market random and risky in the short term. Investing for the short term without a sound strategy can, in this case, be compared to gambling.

But you can also invest in a way that minimises the randomness and allows you to catch the benefits of the stock market while reducing the risks.

The two main approaches for this are:

Diversify: by investing in multiple types of assets (stocks, bonds, etc.) you reduce the risk of a single asset impacting too much your overall portfolio. Diversification has been shown to be the best way to optimize the performance of your investments while managing risks and volatility (as explained by Nobel Prize Winning Research on the Modern Portfolio Theory of Harry Markowitz in 1952).

I like to say that "If you're scared of the casino then you should simply buy the casino, because the house always wins." Invest in the entire stock market and benefit from the power of diversification.

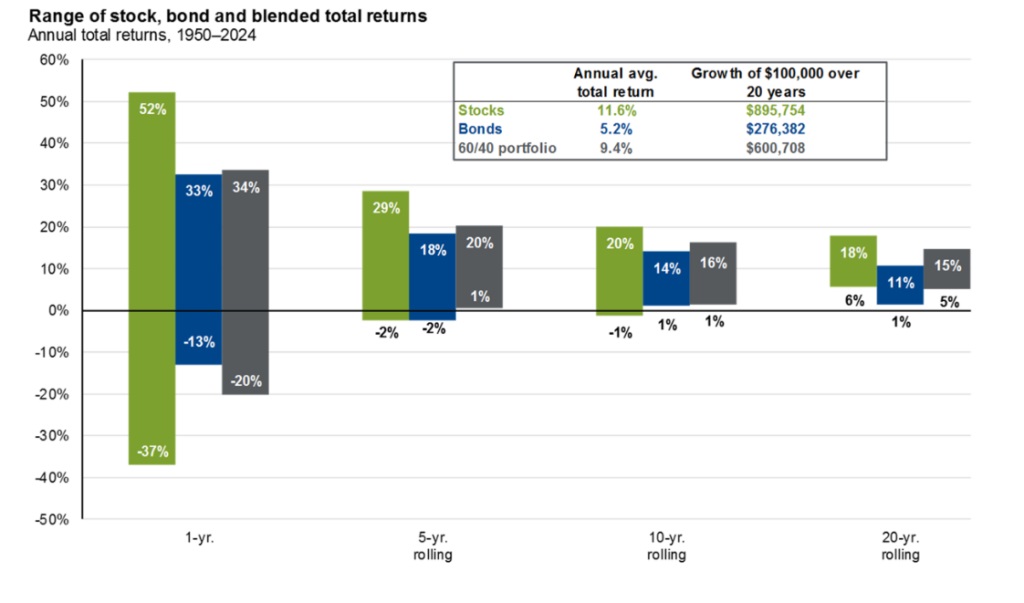

Invest for the long term: over the short term, stock markets can be very volatile. But history has shown that over longer periods of time the performance of the stock market becomes more consistent. Historically, investing over a period of one year comes with the risk of losing a large part of your investment in the worst-case scenario. When investing over decades, the returns are positive with averages varying between 5 and 11% per year.

2. Investing is for the rich

For a long time, investing in the stock market required large sums of money. But in the past 30 years, with the development of internet-based brokers, index funds and with the reduction in trading costs, investing has become much more accessible.

You don’t need €10,000 to invest anymore. You can start from €100 or less. There are great investment funds available for less than €100.

In fact, some platforms allow you to start investing from just a few euros, thanks to fractional shares. Rather than being for the rich, investing is one of the tools available for you to build wealth. Of course, the more money you invest the more you can benefit from the stock market.

3. To win, you must time the market

The entire financial industry is focused on one thing: maximizing investment returns. For this to happen, experts attempt to buy and sell investments at the right time.

But doing this right is extremely difficult and rare. Most experts and professional investment managers (including bank fund managers) fail to beat the market. The vast majority fail to do better than simply buying a low-cost broadly diversified index fund.

In fact, investing in a low-cost broadly diversified index fund gives you higher performance than the vast majority of actively managed funds. All you have to do is buy and hold. And wait for the stock market to work its magic over time.

This is proven by countless studies, including the SPIVA Scorecard and the Morningstar Active vs Passive Barometer.

4. Investing well takes time

Most people believe that investing in the stock market requires ongoing research, monitoring and trading. While that is one strategy that many professional investors use, we have already explained above that actively trying to beat the market and time the market is a losing game.

A far better strategy to increase your chance of good performance is to buy-and-hold index funds that track the market. Once it is set up, this approach is mostly passive.

You simply buy-and-hold. No research and analysis, no monitoring, no stressful decisions to make on a daily basis. You review and rebalance your portfolio once a year and that’s it. It takes about one to two hours per year.

5. You need a degree in financial markets or trading to be a successful investor

The entire financial industry thrives on the fact that people believe investing is too complicated for them. They make it so that you feel like you have no choice but to pay for their services.

But that’s not true. As we’ve seen, most active investing strategies fail to beat the market. So what we need to know is how to invest in the entire market in a simple and effective way. And this is something most people can learn in just a few weeks, via books, blogs, podcasts, courses, etc.

You can also join communities of people who are on the same journey, such as the FIRE Belgium Facebook group. It’s an English-speaking community of almost 10,000 people in Belgium who are learning to invest in Belgium in a simple evidence-based way.

Sébastien Aguilar is the founder of FIRE Belgium, a community of professionals in Belgium who take control of their finances and learn to invest simply and effectively for the long term. He shares his journey and tips in his column for The Brussels Times.