An Overview of the Rarest Precious Metal’s Growing International Market

Osmium in its crystalline form has become a superstar in the precious metals market. In the mere eight years following the discovery of its crystallized form, the rarest, most value-dense, and arguably the most beautiful precious metal is becoming the most popular precious metal exchanged today.

Important building materials are becoming increasingly unaffordable. Lumber is becoming more and more expensive. The supply of gas and oil is no longer certain. The international humanitarian and economic consequences of the war in Ukraine grow by the day. At the risk of painting the devil on the wall, one might say that it is becoming increasingly apparent the world is overpopulated, that we are heading for a climate catastrophe, and that more and more autocrats are ruling the world while looking solely after their own personal interests.

At a time when the preservation of personal wealth is paramount, one naturally turns to tangible assets. Historically, they offer high degrees of reliability. Most recently, one asset in particular – crystalline osmium – stands out from the rest, for various reasons:

1. Unforgeability

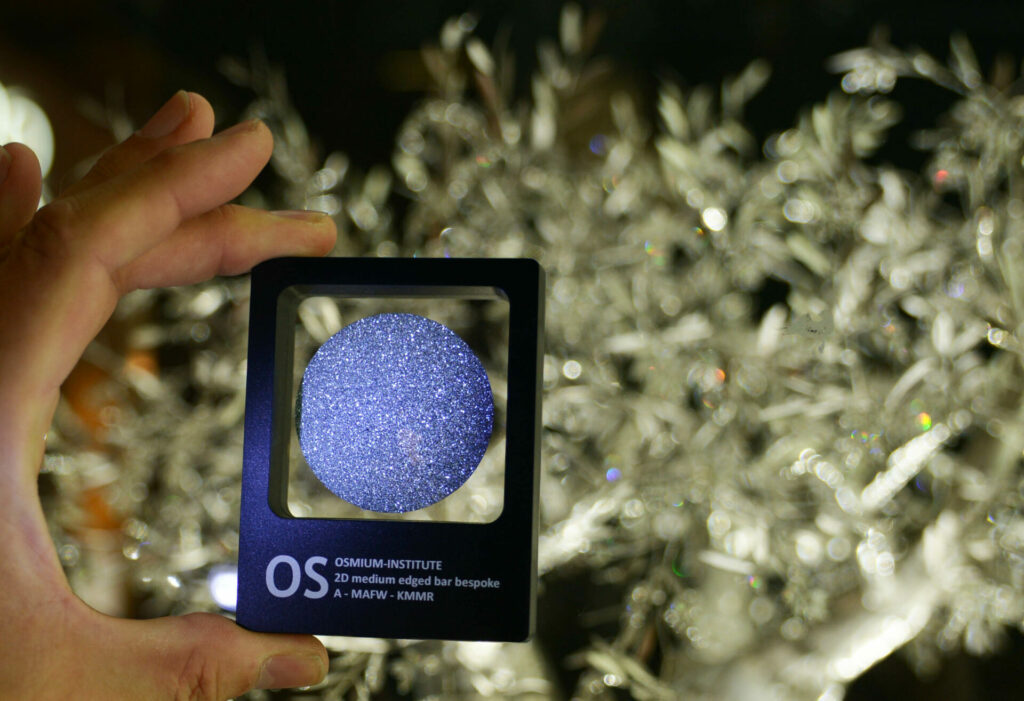

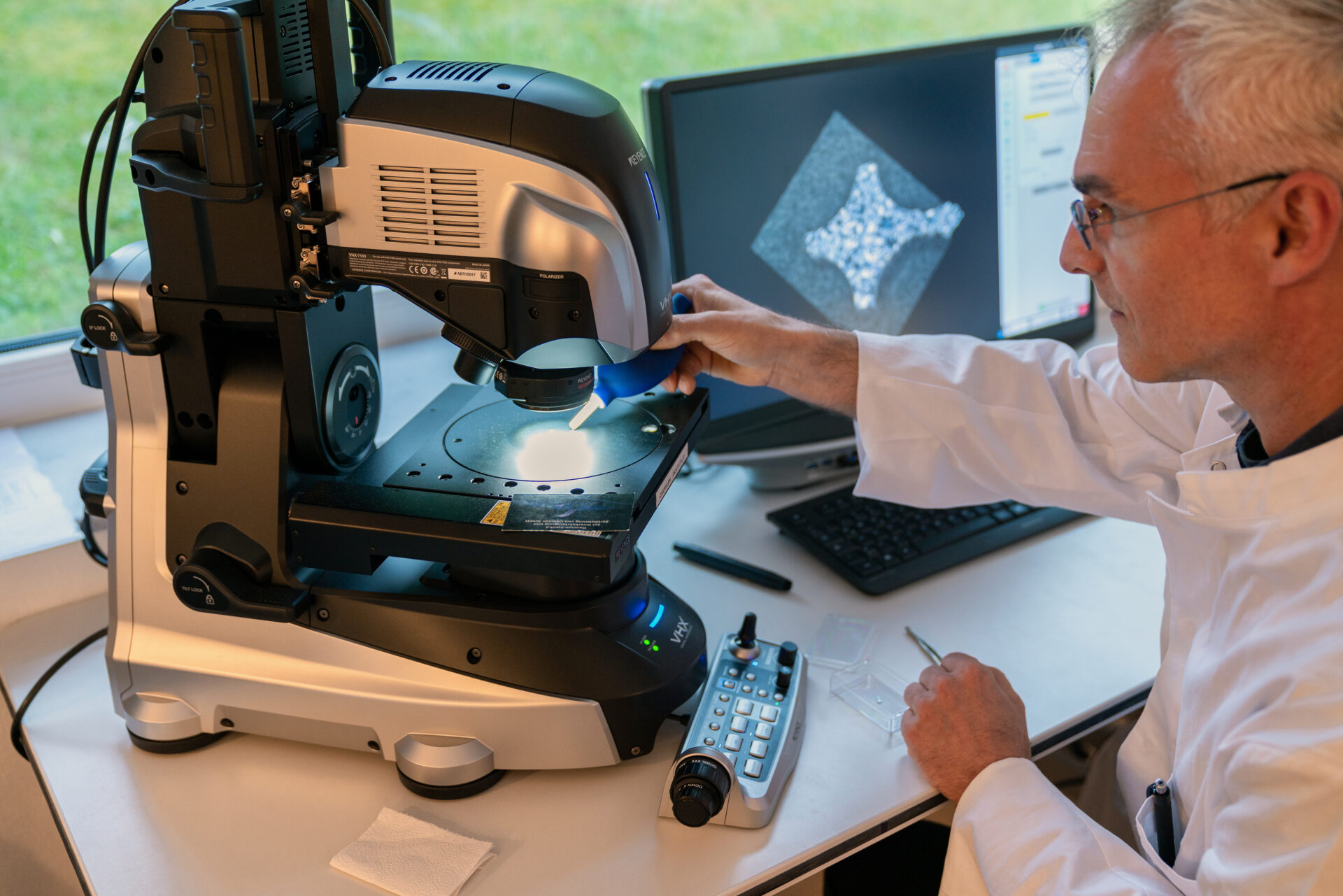

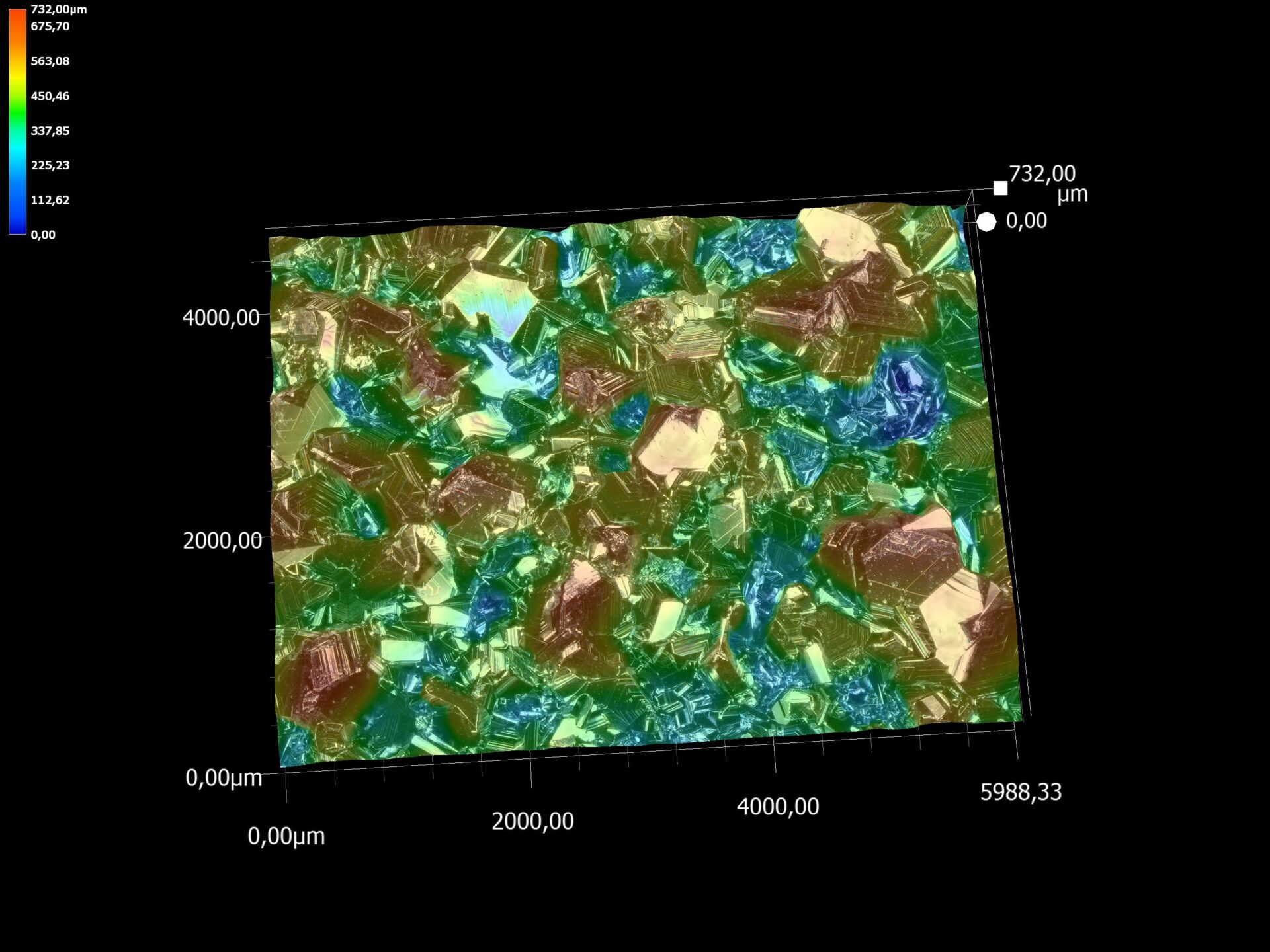

Osmium is absolutely unforgeable, or impervious to counterfeit. This characteristic, particularly attractive to investors-in-kind, is due to the fact that the crystalline structure of osmium cannot be reproduced or falsified. Every piece of certified crystalline osmium has had its crystal structure 3D-imaged and archived in a secure centralized database. The crystalline structure of every osmium piece, otherwise known as the “osmium fingerprint,” is linked to an Osmium Identification Code. The Osmium Identification Code is up to 10,000 times more secure than a human fingerprint.

During the certification process, crystalline osmium is scanned down to the nanometer. In addition, there is no material with the same density as osmium; osmium is the densest metal known to man. So, even a simple density test could expose a forgery. Anyone familiar with osmium could even recognize its authenticity by its unique blue hue.

2. Resale

There is now also a secondary market for crystalline osmium aimed at tangible asset investors. This secondary market is called the Osmium Marketplace. 1,400 dealers around the world can trade and broker osmium deals from private individuals. It is always wise to look at the secondary market before buying new goods. Osmium does not age; it is billions of years old and will continue to exist for billions of years without tarnishing or losing its surface structure. If unsure, one can have the authenticity of osmium confirmed by one the many osmium institutes.

3. Rarity

Osmium, the element with the atomic number 76, is the rarest non-radioactive element in the cosmos. It is much rarer than gold or silver. The amount of osmium actually available in the Earth's crust was a question debated at the Third International Osmium Symposium in Dubai in June 2021. Every year, the leaders of the osmium world meet to exchange views on new developments in the world osmium market, the extraction of osmium worldwide, and new government and customs agreements concerning the import and exportation of crystalline osmium. According to the latest findings, the world's osmium resources are estimated at 17 m3, of which approximately 1 m3 is likely to be mined.

Alternatives?

In recent years, a number of interesting tangible investment opportunities have presented themselves. These include vintage cars, rare art pieces, and real estate. Of these, real estate holds a unique position because it will always be needed and has a predictable behavior as an investment asset. But we must also be honest and recognize that all three asset classes are not suitable for transport in times of crisis. It may sound sarcastic, but none of the fleeing Ukrainians have their favorite painting under their arm or are sitting in their favorite vintage car. The truth is that clothes, cash, and precious metals are taken along. But there are restrictions here, too. For the currency must also be durable and precious metals must have a high value density in order to be transportable. The authenticity of diamonds is not recognizable. In addition, their price has been falling at double-digit rates per year for years, as lab-grown diamonds are cheaper and better. The diamond market is dying at a breathtaking pace.

How Will Osmium Develop Now?

If platinum demand continues to decline in the face of growing global dependance on electromobility, osmium production volumes will also decline. According to estimates, there will be no more than a total of 20 tons left to mine. Realistic figures are difficult to research and are always subject to a high uncertainty factor, as some states treat their resources and reserves as state secrets.

The availability of osmium has always been limited due its natural rarity and dependance on platinum production. It is not entirely improbable that osmium could reach the status of a means of payment, meaning that it could be physically passed from one person to another. This is because osmium is not traded on the stock exchanges, nor are derivates or futures osmium metal sold. It is only available as a physical and real commodity.

What else should one take into consideration when evaluating a tangible asset? Only tangible assets whose authenticity can be proven should be sold or exchanged to another person. This is where osmium can make full use of its advantages. It has the highest value density of all materials and can be easily transported. There is also no way to produce counterfeit osmium. Its crystalline structure is stored in the Osmium World Database as a nanometer-precise scan. It is already more than 10,000 times more secure than a biological fingerprint.

The Secondary Market

An exciting secondary market for osmium is currently emerging, helped largely by the osmium marketplace. Precious metals have always been regarded as reliable tangible assets. However, gold and silver’s place as the forerunners in investment metal markets could be overtaken in this decade. This is due largely to factors such as the unforgeability and resaleability of gold and silver.

It is important to note that osmium is the last of the eight precious metals to be introduced into investment and jewelry markets worldwide. There exists no ninth precious metal. There is no other precious metal to be discovered. Further mining areas are also unlikely to be found.

Price-Driving Effects on the Osmium Market

1. The Osmium Big Bang

In the event that demand for osmium surpasses its worldwide availability, prices for crystalline osmium could shoot up rapidly. This would also be caused by a decline in platinum production – after all, osmium’s availability is tied directly to the production of platinum.

2. The Osmium Thin-out

Every year, a certain amount of osmium – currently about 3 per cent – goes into jewelry production. If and when the Osmium Big Bang occurs, osmium will be in scarce supply. It could be predicted, however, that jewelry production would continue to increase. This means that the volume of osmium being allocated to jewelry production will remain the same or increase slightly. Since the total supply of osmium would stagnate or fall, the ratio of available osmium consumed osmium would shift rapidly and sharply. The result could be an eventual unavailability of osmium.

Taxes?

Most investors store osmium at home rather than in bonded warehouses. This is partly because people like to show off their osmium. The second important reason for storing osmium at home is because of taxes.

VAT is paid on osmium when it is first purchased. When selling from private to private, however, this VAT it is never paid again. If the tax has been paid once, it is not due a second time. That is why the resale price of crystalline osmium is also based on the gross prices. This means that the value-added tax is not lost for the tangible asset investor. If the price of osmium continues to rise, as is commonly expected, a higher price than necessary would have to be paid in the future when the metal is taken out of a bonded warehouse, since the value-added tax must be paid when the metal is taken out.

Of course, it is possible to hold osmium as more than a tangible asset in one's own portfolio; it is also possible to sell it again. With the Owner Change Code (OCC), which is assigned to each piece of crystalline osmium at the time of purchase, both ownership and possession of the respective piece can be transferred by the owner. Resale, gifts, or inheritance are therefore carried out by means of this Owner Change Code. The OCC is used to grant the new owner access to his own data in the osmium world database. This secures his right to the respective piece, which automatically invalidates the previous owner's right of ownership to this item. The procedure can be compared to a vehicle license or a land register entry for a property.

Outlook

A look at the performance to date shows that the osmium price is also not correlated with other asset classes or commodities, nor with precious metals. Against this background, adding osmium to a larger portfolio or fund should provide good diversification and value protection. Interested investors can see this in various percentages at www.osmium-portfoliotheorie.com/en

You can find more information at www.osmium-belgium.com or contact Richard Reis, the Belgian State Institute Partner via email or phone: richard.reis@osmium-institute.com; +32 492 549 658