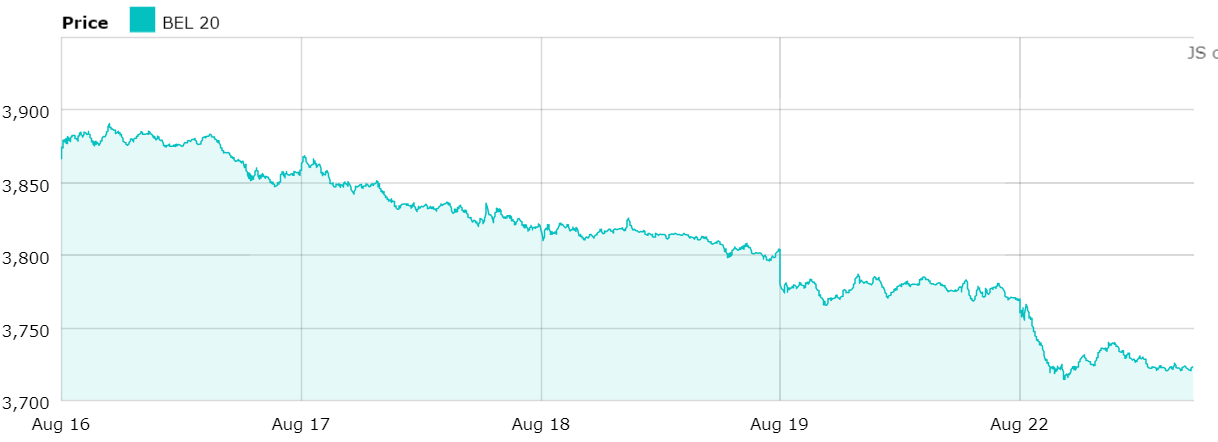

The Brussels stock exchange, like many European stock markets, has fallen sharply on 22 August. By the end of the morning, the BEL20 slipped 1.4% to 3,717.07 points.

The share price of most major companies listed on the Brussels stock exchange slipped significantly.

At the time of publication, Luxembourgish steel producer Aperam fell 4.77%, Belgian bank KBC by 3.99%, and Belgian chemical company Solvay by 3.83%. Only two companies, the Belgian transmission system operator Elia and pharmaceutical company Argenx saw increases in share price.

Credit: Euronext

“Investors continue to struggle with important issues such as inflation and the monetary policy applied to it,” Lynx investment specialist Justin Blekemolen told AMB Financial news. “After last week’s federal reserves minutes, the market fears that the Fed will raise interest rates by another 75 basis points at the end of September.”

A recent poll of leading economists conducted by news agency Reuters anticipates that the Fed will indeed raise rates again by 50 basis points in September, all but confirming growing recession worries. Inflation in the United States and much of Europe is at a four-decade high, driving central banks to massively raise their rates, ending negative interests offered to many borrowers since 2014.

Investors will be looking ahead to the annual Jackson Hole Economic Symposium, which is set to take place from 25-27 August, to gauge U.S Treasury yields for the coming months.

Worldwide drops

The BEL20 had previously experienced six days of consecutive rises, with 13 major components showing steady rises. This latest slump has wiped nearly 100 points in value from the market, with the threat of recession in Europe becoming a real possibility.

At the time of publication, the FTSE 100 is down 0.38%, Euronext 100 -1.67%, CAC 40 -2.12%, and the DAX has fallen by 2.56%.

Related News

- De Croo: ‘The next five to ten winters will be difficult’

- Germany to prioritise coal trains over passenger trains

- Belgian investors lose more than €30 billion in March-June

Belgian investors have a generally pessimistic view of the market. Four in ten Belgian investors who bought shares this year regret the decision.

Belgians are also now extremely risk averse. 30% will now only invest into a stock if it has increased in price over the course of the last year, and 28% refuse to invest if the value of a stock has fallen at all within this period. 59% of Belgian investors are no longer ready to take any risk with their savings at the moment.

ING’s monthly investment barometer reveals that Belgian investor confidence is now 28 points below its normal value, down for the sixth consecutive month.