The National Bank of Belgium's (BNB) annual report has painted an extraordinarily bleak picture of Belgium's current economic predicament and suggested that the country faces a serious risk of deindustrialisation in the coming months as high energy prices continue to threaten business competitiveness.

The study, published on Wednesday, also highlighted that mortgage affordability has fallen to "historically low levels" across Belgium due to sharp increases in housing prices and mortgage rates. Belgium's budget deficit — one of the largest in the EU — was deemed both "worrisome and unsustainable".

The bad news didn't end there, as analysts concluded that Belgium's system of government-mandated wage indexations "disproportionately affects companies with a relatively large number of employees", making them far more susceptible to relocation to other parts of the world or bankruptcy.

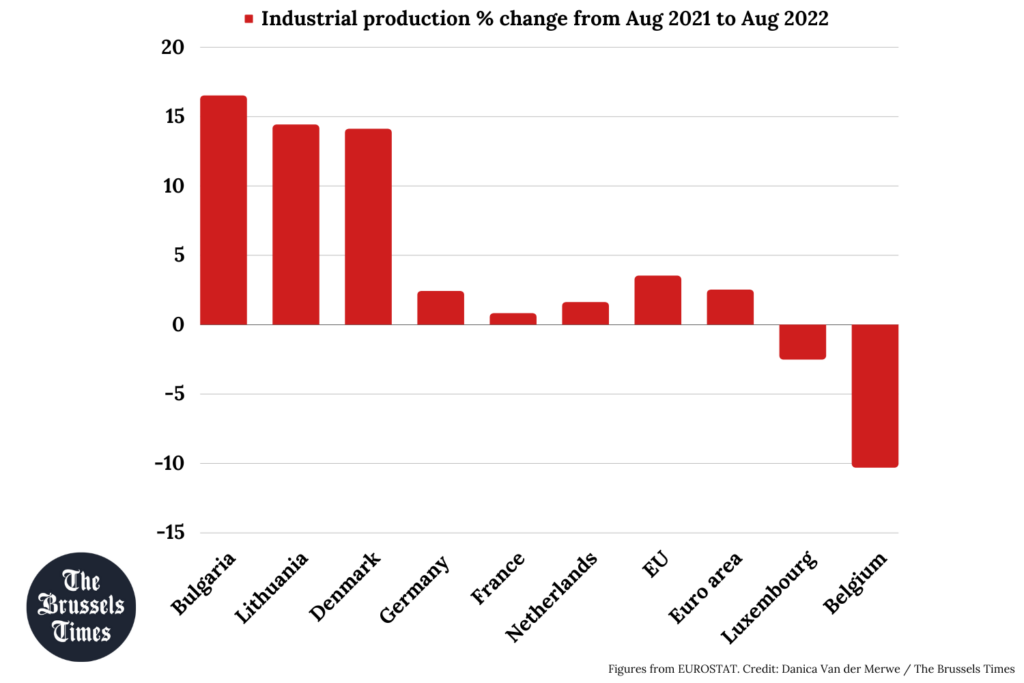

Belgium's industrial sector has taken a heavy hit recently and the country risks losing business as companies move abroad.

Finally, the BNB found that Belgium has not done enough to address fundamental structural challenges, including its low labour force participation rate and the transition to a green economy. It acknowledged that progress has been hampered by the multiple crises faced by Europe – from the Covid-19 pandemic to the war in Ukraine to soaring inflation.

"The employment rate is too low, the budget deficit is too high and greenhouse gas emissions are falling too slowly," BNB Governor Pierre Wunsch told De Tijd. "In addition, a new challenge has been added: the decline in competitiveness."

Rising employment: A silver lining?

Wunsch also noted that, despite the country's low labour force participation rate, the principal reason why the Belgian economy has been able to stave off near-total collapse is actually the "strong" performance of its labour market. In particular, a total of 101,000 jobs were created in Belgium last year — the largest number since records began in 1953.

"The resilience of the economy is mainly due to the strong labour market, which supported consumer confidence," Wunsch explained.

However, it is unclear how long this resilience will last. As the BNB report noted, job creation this year is expected to be "significantly lower" than in 2022. Moreover, the report made clear that "the competitiveness of Belgian companies is now deteriorating sharply". It fears that businesses might look elsewhere to conduct their activity.

Related News

- 'I don't dare say the worst is over': Financier predicts deepening social unrest in Europe

- Belgium at 'real risk of deindustrialisation', leading CEO says

Unfortunately, the BNB thinks it unlikely that Belgium will regain its competitiveness any time soon: "According to current projections, any catch-up (in competitiveness) will only be partial." It might even be further reduced if inflation falls more slowly than currently expected.

If Europe's energy prices remain high, the national bank warns that the whole continent could decline, seeing Europe lose its status as one of the world's richest economic hubs: "Persistent disruption to the competitiveness or financial health of businesses could threaten longer-term prosperity."