The job of budget minister is hardly easy in any country. And it is even more difficult in a federal state like Belgium, where effective budget coordination between the central government and the regional and local governments is required. The Brussels Times met budget minister Sophie Wilmès to interview her about her job and challenges. Her office is located at the Finance Tower opposite the Botanical Garden in the centre of Brussels.

What made Sophie Wilmès become a politician? “I have always been interested in working for the public good and being useful to my fellow citizens,” she replies. “Very naturally, my political involvement started on a local level in Uccle, where I offered my help to the late Eric André, an alderman (échevin), who was also active on a regional level as secretary of state.”

Sophie joined his list and, to her surprise, was elected to the local council although she was placed far down on the list. A few years later, after she got married and moved to another municipality, Rhode-Saint-Genèse, just outside Brussels (a linguistically mixed municipality located in Flanders), she became alderman, in charge of the budget, finance, local economy and education.

As budget minister, one of the high-profile posts in the federal government, she deals with figures. Sounds boring but not for Sophie: “My passion for figures was born already when I worked as a financial officer at the European Commission. I had studied communication science. But I decided then to go back to university and get an additional diploma in Finance.”

She was appointed to minister of budget in the federal government on 22 September 2015. “It’s a day I will always remember.”

| Belgian economy in a nutshell The Belgian economy is expected to grow steadily by approximately 1.4% in 2017 and 1.6% in 2018 according to the European Commission’s updated Winter 2017 economic forecast. Domestic demand is also projected to strengthen gradually. Unemployment is forecast to continue decreasing steadily, falling to 7.6% in 2018. Inflation is set to hit 2% in 2017 and 1.8% in 2018. That does not imply that there are no clouds that darken the economic horizon. Belgium has tight trade links with the United Kingdom as an export market, which will be affected by Brexit. Belgium also struggles with a structural deficit of 2% of GDP in 2017 and, in particular, a public debt of about 106.5 % of GDP for the same year. The European Commission mentions in a recent country report that Belgium has had difficulties consolidating public finances in the wake of the financial and economic crisis. The report also lists structural problems such as shortcomings in the design of a complex tax system and in the functioning of the labour market with its high long-term unemployment. |

Equal participation of women and men in decision-making positions is a matter of justice and is needed to better reflect the composition of society and to strengthen democracy. What do you think about the participation of women in Belgian politics?

“There is definitely room for improvement,” Sophie replies. “There are only four women in the federal government of 18 ministers and state secretaries. We have a rule in Belgium that 50% of all candidates on party lists in elections must be women, but this in itself doesn’t guarantee equal representation."

Compared with other EU member states, the proportion of women in the national parliament is relatively high at 40%. The proportion of women in the federal government was almost the same in the past, so the current low rate seems only temporary.

Sophie Wilmès at a Council of Ministers meeting led by Prime Minister Charles Michel.

“Personally, I haven’t experienced any disadvantage of being a woman in politics,” Sophie adds. “And I don’t regard myself as a model for other women who want to enter politics, although I hope that they’ll feel encouraged to do it.”

Growing up and living most of your life in Brussels, what has struck you the most in terms of Brussels’ development? And how do you see its future development?

“Brussels is the capital of Belgium, and we are of course all concerned about its development. There is a distribution of competencies between institutions on local, regional and federal level. It’s quite complex in Belgium and few people understand it. While functions are linked and intertwined, we have to respect the different competencies.”

Sophie Wilmès explains that the federal government is responsible for employment, defence, police, justice, healthcare, social security and national train transport, for example. The regions and municipalities are responsible among others for infrastructure, transport, education and culture.

To discuss cross-level issues, there is a special platform for cooperation and coordination (Comité de concertation) where representatives from all levels, incl. the Prime Minister, meet to exchange views and raise cross-level issues.

“The federal budget plays also a role in the development of the Brussels region, as the capital of the country. One recent example: in 2016, after the terrorist attacks, we decided to allocate €400 million to security issues. It’s a multi-thronged programme on fighting radicalisation and violent extremism, which will also benefit Brussels.”

As budget minister, she is member of Beliris, a federal body that decides on funding projects that help Brussels’ development and support its influence (rayonnement international). Beliris mainly funds big infrastructure and transport projects.

How would you describe your work as minister of budget and what has been your policy or agenda?

“As minister of budget I have an overall responsibility for the budget,” Sophie explains. “I’m directly responsible for the expenditures in the budget, while the minister of finance is directly responsible for the revenues. I receive the budget requests for the different policy areas from the ministers who are in charge of them. The budget is for one year and can be amended during the budget year.”

It could be expected that budget problems involving other ministries would be difficult to resolve but Sophie was careful not to discuss any topical problems. “In general, we analyse and discuss the figures with the ministers concerned, but the final decision on the budget is taken by the entire government or the council of ministers. Of course the budget also has to be approved by parliament.”

As a cautious politician, she did not elaborate on her budget policy. “I see my role as a guardian of the budget. In this role, my task is to ensure that the budget rules — whether national or European — are followed, and that budget decisions comply with the regulatory and financial framework.”

Asked about major changes — budget savings or increases foreseen in the 2017 budget — Sophie Wilmès mentioned security and health.

“As already mentioned, there has been an increase in the budget on security issues. We have also carried out a reform in the health care sector. The health budget used to increase automatically by 3% each year. Thanks to cost-effectiveness measures, the health budget will continue to increase (this year by €583 million) but not as much as before.”

There is also a long term pension reform, adopted in 2015, that will encourage people to remain active in the labor force. Amongst different measures, the pension age will be raised to 66 years by 2025 and to 67 years by 2030. The minimum age and number of career years required for qualifying for early retirement will be raised in 2018 and 2019.

“We are also taking additional reform measures to boost the economy and create more jobs. Altogether, the measures taken on both the expenditure and revenue sides of the budget should reduce our budget deficit to 1.2% of GDP in two years.”

A large part of spending power has been devolved to regions and municipalities. In addition, the central government — which is responsible for most of the debt and faces the bulk of age-related costs — does not have the legal authority to impose budget targets on regions and communities.

Figures released by the European Commission show economic differences between Flanders and Wallonia. This is a politically sensitive issue and Sophie Wilmès prefers not to comment on it. She stresses that every region is responsible for its own deficit. The regions have also the right to decide on and collect regional taxes.

The public debt as a percentage of GDP (106.5 % in 2017, according to the latest forecast) is still high and will likely remain so for several years. The European Commission estimates that while short-term risks linked to high public indebtedness appear to be contained, longer-term sustainability indicators paint a less benign picture, with Belgium facing high sustainability risks in the medium term, for up to 10 years.

“The debt problem is not something new. It took many years for it to reach this unsustainable level and will also take time until we reduce it. What’s important is the trend,” comments Sophie. Although taxes and revenues are not part of the budget minister’s direct responsibility, we could not avoid asking about them, as they obviously affect the goal of a balanced budget.

Belgium has one of the highest tax burdens in the OECD with high marginal taxes and a focus on labor taxes and social charges. Is this going to be changed with on-going or planned shifts in taxation on consumption and green taxes (to reduce greenhouse emissions)?

Sophie Wilmès highlighted the tax shift as an ambitious reform by the Belgian government, aiming at an estimated shifting in tax revenues of €8.3 billion by 2019. The two main goals are to stimulate purchasing power and improve Belgium’s competitiveness (and thus sustain job creation). Employees will see an increase in their net income, especially those with a low salary.

To sustain competitiveness, social charges for employers will decrease from 33% to 25% by 2018. Social charges for the first recruited employee have been abolished, with no time limit. This will benefit entrepreneurship and new SMEs (small and medium sized enterprises). Social charges are also reduced gradually for the second to the sixth employee.

“The tax shift and other governmental reforms have already proven to affect the growth of jobs in Belgium: more than 100,000 jobs were created during the period 2015-2016,” says Sophie Wilmés. “We are also working on a general reform of the corporate tax that will benefit all companies, including the SMEs.”

To round up the interview, we saved the most difficult question for the end: as a local “Brusseler” could you tell us your favourite Brussels bar and which neighbourhoods are closest to your heart in the city?

“That’s very easy to answer: I don’t go to bars any longer — only to restaurants and there are many good restaurants in Brussels. I visit mostly local restaurants close to work. Ironically, one of them located near the federal parliament is called Pasta Bar.”

By Mose Apelblat

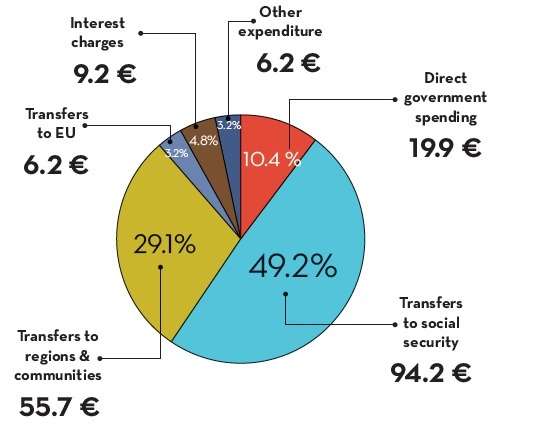

Federal budget in billion €

|

Direct government spending consists of security (defence, police and justice) and other expenditure. Transfers to the social security sector are dominated by social benefits, such as pension, health and unemployment allowances.