A slow recovery of the financial satisfaction of people in Belgium is taking place following last year's drop caused by the energy and cost of living crises.

The proportion of people living in Belgium who find it (very) difficult to make ends meet fell from 16.3% at the end of 2022 to 13.9% in the first quarter of 2023, figures from Belgium's statistics office Statbel based on a survey of some 5,000 people about their living conditions showed.

"The decrease in the percentage of people struggling to make ends meet with their income is greatest for Brussels (from 32.9% to 25.8%) and for Wallonia (from 19.6% to 16.6%)," Statbel reported. People living in these regions in Belgium are more at risk of poverty and financial fluctuations than those living in Flanders.

The survey found that satisfaction with household finances has also improved, with Belgians giving an average score of 6.9 out of 10 on this sentiment, compared to 6.7 at the end of December. From July to September last year, this score was as low as 6.6/10, down from 7/10 a year earlier (July 2021).

Rising wages, but confidence remains stable

The rise in satisfaction can mainly be pinned down to the fact that more people are reporting a higher income now compared to this time last year – 36.9% of Belgians in the first quarter of 2023, compared to 21.4% in the fourth quarter of 2022 – which is mainly the result of wage indexations in Belgium to combat the effects of the skyrocketing inflation in 2022.

"Indexation of wages is given as the reason for higher income in 82.7% of cases in the first quarter of 2023," Statbel noted.

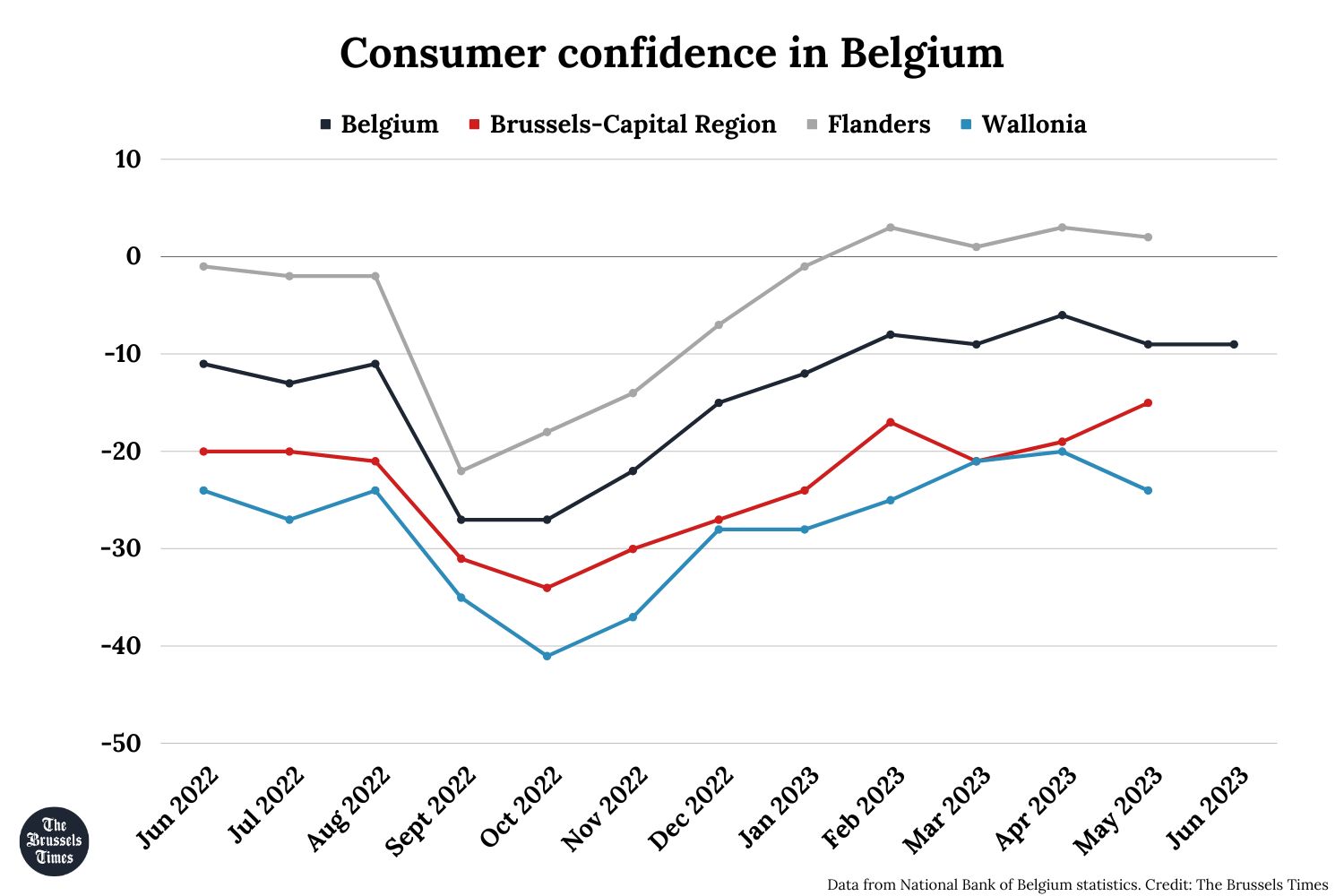

While it seems some households are tentatively sighing a small sigh of relief when it comes to their household finances, it seems the purse strings are not fully being loosened, as the most recent consumer confidence indicator by the National Bank showed Belgian consumers' confidence remains below its long-term average at -9, the same level as in May.

The National Bank reported that consumers were more optimistic about the general economic situation. However, it found that financial concerns and intention to save even increased slightly. This is due to Statbel monitoring the first three months of this year, while the National Bank only looked at June.