Former UK Prime Minister Winston Churchill once claimed that "a nation trying to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle".

Belgium, however, appears to have achieved what the British wartime leader deemed impossible: not only is it by some measures the world's richest country, but it is also among the most heavily taxed nations on Earth.

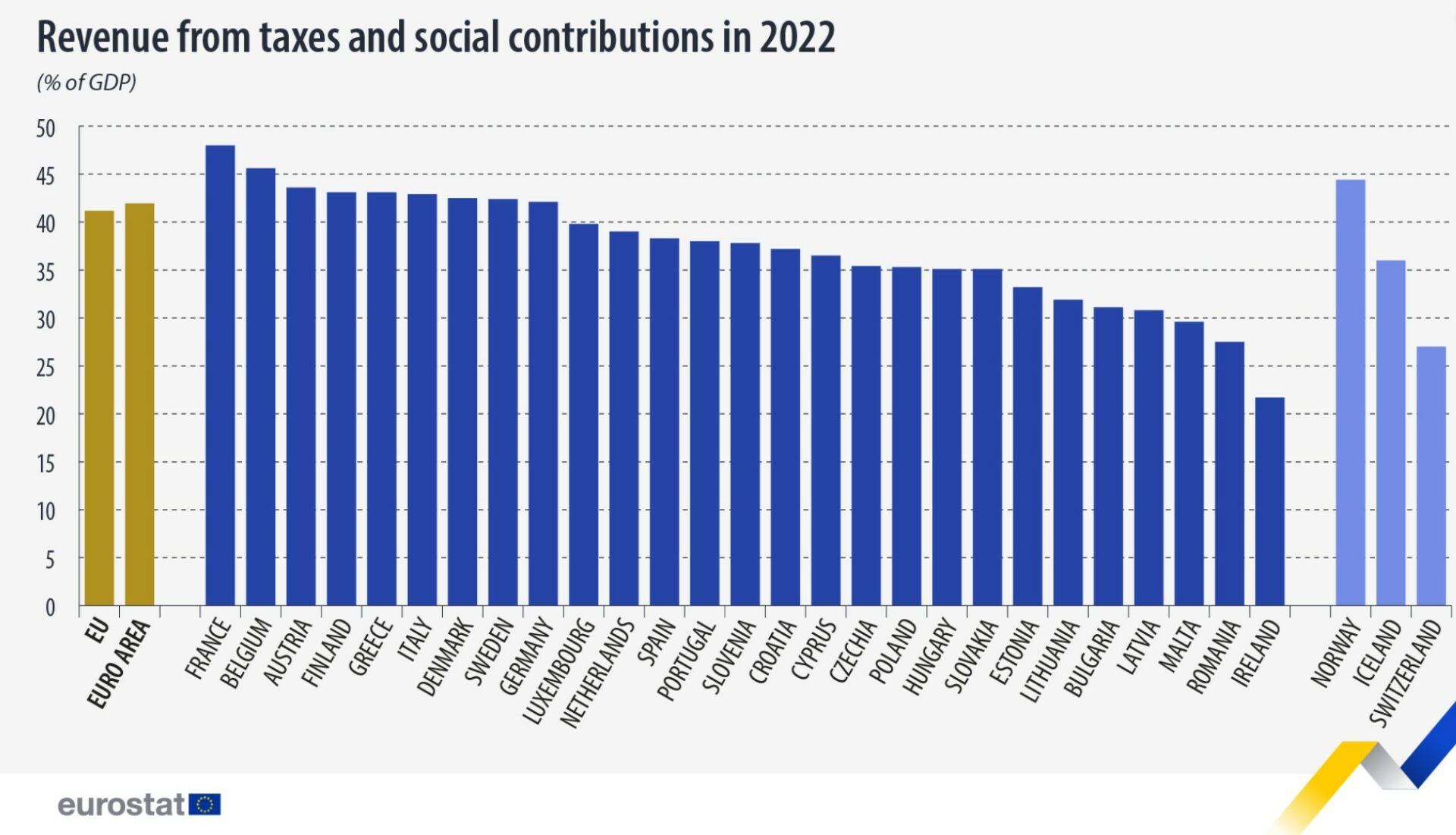

According to a recent study by Eurostat, the EU statistics office, Belgium's tax-to-GDP ratio was 45.6% last year: the second highest percentage in the bloc after France (on 48.0%).

Belgium's ratio was also substantially higher than the overall EU average of 41.2%, and well above the percentages posted by neighbours Germany (42.1%), Luxembourg (39.8%), and the Netherlands (39%).

The study also found that Belgium's tax-to-GDP ratio had actually increased compared to the previous year, albeit by a modest 0.1 percentage point.

Meanwhile, France's ratio rose by a full percentage point; Denmark, which recorded the EU's highest tax-to-GDP percentage in 2021, dropped to seventh place.

Belgium's tax-to-GDP ratio has remained relatively stable over the past three decades. In 1995 – the first year in which Eurostat began collecting data – it was 45.3%, well above the then EU average of 40.5%.

Who's taxed hardest?

Eurostat's study follows another report published earlier this year by the Organisation for Economic Co-operation and Development (OECD), a group of mostly rich countries, which found that Belgium's labour "tax wedge" – which measures the difference between workers' before-tax and after-tax wages – is the highest among OECD countries.

In particular, the study found that Belgium's labour tax wedge is the largest in the OECD for single people without children and for families with two earners and two children. It is the third highest for families with a single earner and two children.

Related News

- Belgium has world's highest median wealth per person

- 'I would tear it down': Leading economist condemns Belgium's high labour tax rate

In a recent interview with The Brussels Times, Associate Professor of Economics at Ghent University Stijn Baert argued that Belgium's current tax code disincentivises work and is "not commensurate" with the poor state of Belgium's public services.

"For workers, high labour taxes make employment less interesting because their take-home pay is lower," Baert noted. "Meanwhile, higher labour taxes encourage employers to automate jobs or move them to other countries."

"Take the situation around Brussels-Midi. We pay so much taxpayers' money to a government which does not even manage to make us feel safe at the railway station. It's disgraceful."