Europe's largest trade union confederation sent a "housewarming gift and card" deriding the European Central Bank's (ECB) tight monetary policy at the inauguration of the Frankfurt-based institution's new Brussels liaison office last week.

Instead of attending Thursday night's event marking the opening of the so-called "House of the Euro", European Trade Union Confederation (ETUC) General Secretary Esther Lynch dispatched a doormat reading "High Interest Rates Not Welcome".

The leader of the confederation, which represents approximately 45 million workers across 41 different European countries, also included a card which read: "Congrats on your new home. High interest rates are pushing working people out of theirs."

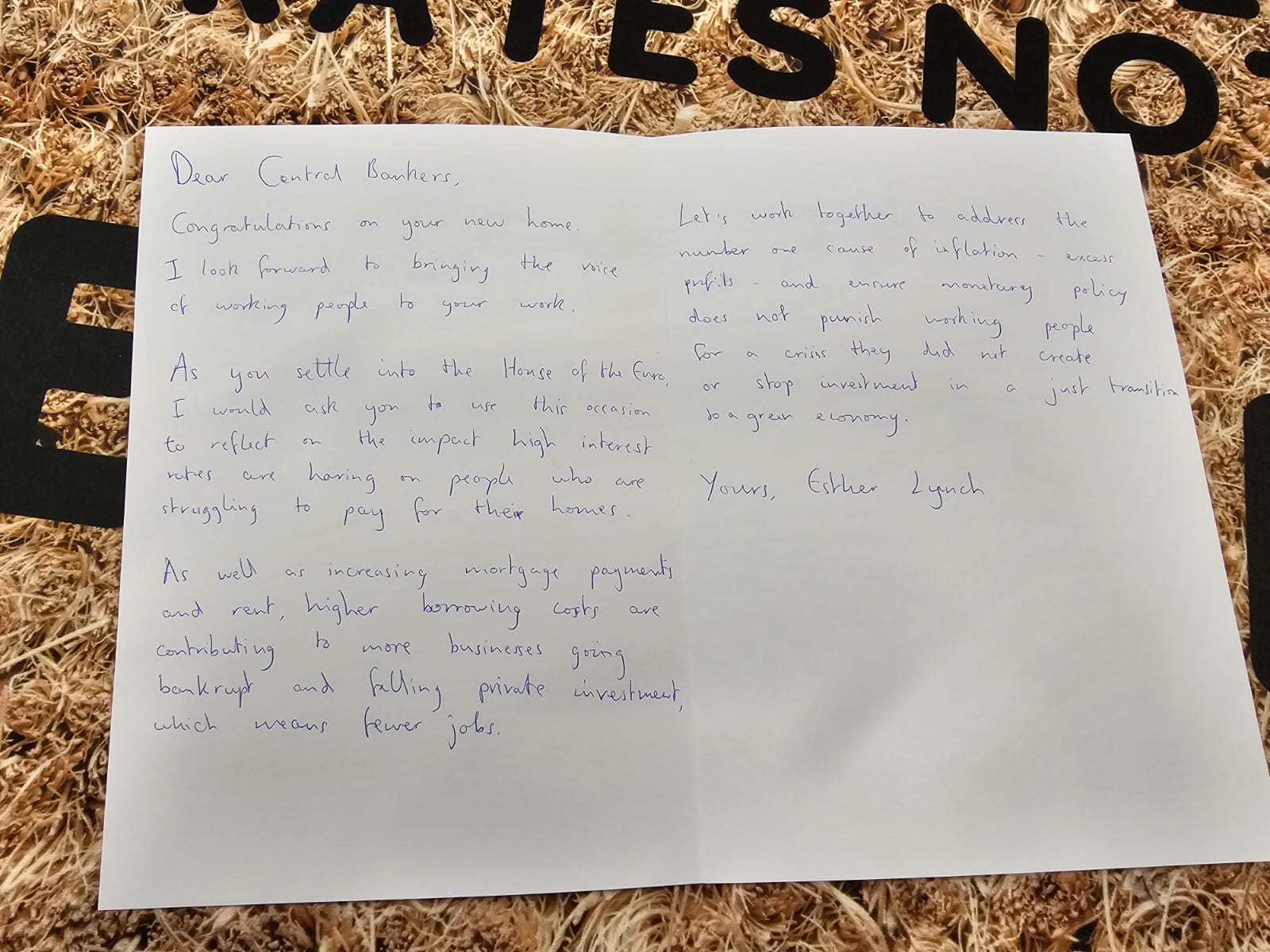

In a letter written on the inside of the card, Lynch reiterated her oft-repeated point that high interest rates are exacerbating, rather than alleviating, Europe's deepening economic crisis.

Credit: ETUC

"As you settle into the House of the Euro, I would ask that you use this occasion to reflect on the impact high interest rates are having on people who are struggling to pay for their own homes," Lynch wrote.

"As well as increasing mortgage payments and rent, higher borrowing costs are contributing to more businesses going bankrupt and falling private investment which means fewer jobs."

Credit: ETUC

"Let's work together to address the number one cause of inflation – excess profits – and ensure monetary policy does not punish working people for a crisis they did not create or stop investment in a just transition to a green economy," she added.

Lynch's comments are not without merit. In recent months both the International Monetary Fund (IMF) and the ECB have concluded that rising corporate profits, rather than increasing wages, are the principal cause of Europe's high inflation rate.

Related News

- Trade unions announce joint demonstration against EU austerity measures

- 'Complete breakdown of responsibility': CEOs accused of 'asset-stripping' EU economy

The House of Europe is located on Square Frère-Orban, a fifteen minute walk from the ECB's former Brussels office on Schuman roundabout. According to Politico, it includes 900-square metres of shared office space and costs €20,000 a month to rent.

"The House of the Euro will increase euro area central banks' cooperation and visibility in Brussels, which has become increasingly relevant for us," Boris Kisselevsky, the Head of the ECB Representation in Brussels, told Politico when the plan to open a new building was announced in December 2022.

More pain to come?

The ECB has raised interest rates ten times in the past year-and-a-half as it attempts to dampen persistent price pressures throughout the eurozone, bringing its benchmark deposit facility rate to a record high of 4.00%.

Last week, Lagarde told reporters that, despite headline annual inflation in the eurozone having dropped to 2.9% last month, down from a peak of 10.6% in October 2022, the ECB will most likely not cut interest rates for the "next couple of quarters".

European Central Bank President Christine Lagarde. Belga / Hatim Kaghat

In an interview with The Financial Times published last month, Lagarde also claimed that she "should have been bolder" and raised rates more rapidly after Russia's full-scale invasion of Ukraine in February 2022 sent prices soaring across the EU.

She also hinted that the current crisis in the Middle-East could lead to further price hikes – and, hence, additional ECB rate increases – in the near future.

"The kind of supply shock that could possibly hit us, depending on how the situation evolves in the Middle East and how Iran is brought into this and what is the global reaction – these are huge question marks and massive worries on the horizon," she said.