Belgium is famed for its high tax burden but some shrewd actions this year can help those looking to reduce their payments to the Belgian State in 2024.

From funding a start-up to buying an electric charging station, giving money to charity or simply paying your bills in time, here are a few last-minute fiscal benefits to consider before the year ends.

1. Start saving for your retirement

Anyone aged between 18 and 65 who pays tax in Belgium can get tax relief on pension savings, which is why people are advised to start their 'pension saving fund' sooner rather than later.

Not only does it ensure that you have some money put aside for later, you can also enjoy a 30% tax reduction now if you have saved a maximum of €990. That translates into a maximum benefit of €297.

Making additional deposits of up to €1,270 per year is also possible, but then the tax reduction decreases to 25% – good for a maximum benefit of €317.5.

2. Give money to charity

Giving money to a good cause is also rewarded by the taxman – quite significantly. Donations to a recognised charity yield a tax reduction of 45%.

In practice, this means that if you were to donate €100 to Médecins sans Frontières the tax deduction would be €45. However, there are some conditions: the gift must be at least €40 per charity in a whole year and the total amount of donations may not exceed 10% of your total taxable income.

Credit: Didier Lebrun/Belga

3. Take out a life insurance

People who could afford to live comfortably now might consider taking out life insurance. There is a sizeable 30% tax break for new and current contracts up to a maximum amount of €2,350. At best, it can give you a benefit of €705.

However, if you already have a long-term mortgage loan that entitles you to tax deductions, life insurance will not give you any additional benefit.

4. Children in daycare? Pay the bills now

People who send their children to childcare enjoy a tax reduction of 45% up to a maximum of €15.70 per day and per child – giving them a net benefit of €7.06 per day and per child.

For a low-income single parent, this reduction can even reach a maximum of €11.77 per day per child.

However, to get those benefits, it is important to pay the bills this week: for the 2024 tax return, only payments made in 2023 will be taken into account.

Credit: Unsplash

5. Stock up on service vouchers

Service vouchers – often referred to as 'titres-service' in Brussels – are cheap (€9 each for the first 400) and they provide a tax advantage of 20% – up to a ceiling of €1,720 per person, which corresponds to 191 vouchers.

If you are not yet up to this, it pays to stock up before the new year starts. Since this benefit is calculated per person, you can also purchase another 191 vouchers in your partner's name. Interestingly, low-income earners can also enjoy this benefit to the maximum.

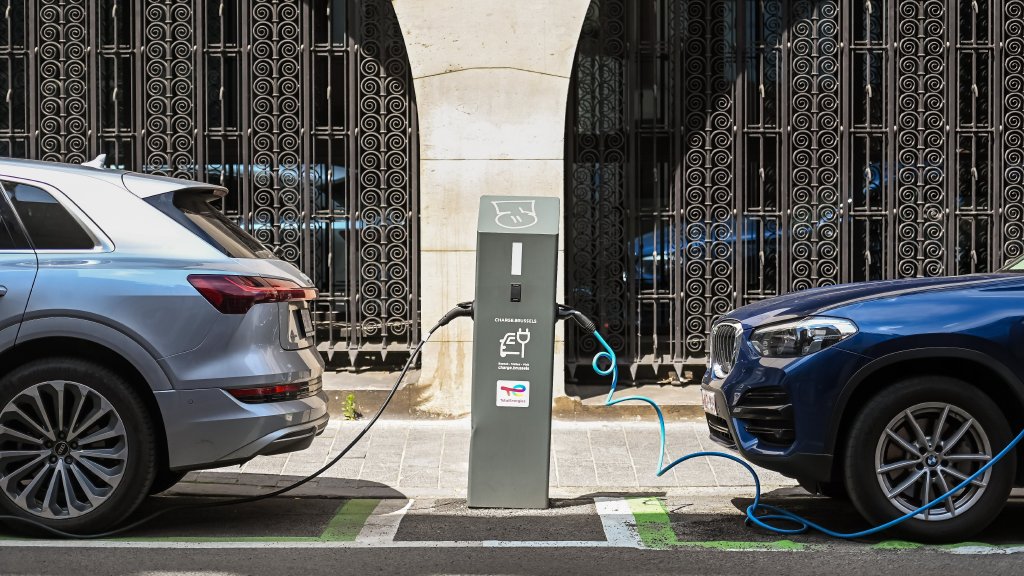

6. Waiting for an electric charging station? Pay your advance right away

Installing an ordinary charging station in 2023 would give people a tax reduction of 30% up to an investment amount of up to €1,750 (representing €525). For bi-directional charging stations (which not only charge the battery but can also 'discharge' energy from it), this even goes up to an investment amount of €8,000.

Starting from 2024, this benefit will be halved. To still benefit from a maximum benefit of €525, they can consider paying an advance already – but then they will have to be very quick: the money has to be transferred before 1 January.

Electric charging stations. Credit: Belga

7. Invest in microfinance for developing countries

Do you want to do your bit for a better world, but also for your own tax returns? Buy shares of recognised development funds that provide microcredits to local entrepreneurs in developing countries.

Starting from an investment of €390, you enjoy a 5% tax advantage on the purchase of shares of four recognised development funds: Alterfin, Oikocredit, BRS Microfinance and Incofin.

8. Put your money in a start-up

As the stock market climate is still unfavourable, it could be fiscally interesting to give start-ups or growth companies financial support. The Federal Government encourages this with a tax benefit of 25% to 45% for amounts up to €100,000.

You can provide capital directly through an approved crowdfunding platform or a start-up fund. For SMEs in Flanders, there is a win-win loan: in addition to an interest payment, the borrower receives an annual tax rebate of 2.5% on the outstanding capital.