Belgium is a nation of savers, with the average person having more than €25,000 in savings – a large part of which is squirrelled away in saving accounts growing at little more than the rate of inflation. But the conventional prudence with which many approach money management is being shaken up as new possibilities create new investors.

Whilst some are reluctant to let go of physical cash as card payment systems become more widespread, others see opportunity in the emerging digital asset markets. From a niche innovation that traditional investors wrote off as a nonsensical fad, cryptocurrency has defied sceptics by attracting millions of investors – and evangelists – around the world. And with endorsement from America's new president, crypto feels more legitimate than ever, despite not being linked to any tangible commodity or having the backing of any government.

Notoriously volatile, energy-intensive, and some would say useless, cryptocurrencies are nonetheless gaining in popularity – worldwide and in Belgium. Are we becoming a crypto-nation and how will this market impact the Belgian economy? The Brussels Times spoke to Leo Van Hove, economics professor at VUB and specialist in cryptocurrency.

Follow the money

If cryptocurrency presents money-making opportunities, the digital "coins" are much harder to follow than stocks and other capital investments, often unaccounted for by established financial checks and balances. To get a clearer idea of cryptocurrency in Belgium, Van Hove worked on the Digital Payment Barometer, a survey conducted by Ipsos to track payment trends and technologies.

The latest Barometer marks a distinct rise in awareness of crypto: 89% of Belgians know about it; even the 84% of the 75+ age group. "The vast majority of Belgians has heard about crypto," Van Hove confirms.

But when it comes to ownership, the demographics are much more pronounced. "There's a clear age effect and also a gender effect. It's mainly a young male thing and mainly Bitcoin," observes Van Hove. Among 16-24 year-olds, 46% own crypto – a +10% rise on 2023 figures and significantly higher than the rest of the population, for which the average is 18% across all ages. Virtually nobody aged 75 and older owns crypto.

The gender split is even more interesting: 24% of Belgian men own crypto whilst just 12% of women do.

Europe's crypto-havens

Cryptocurrencies depend on blockchain technology – an innovative accounting system that allows payment to be decentralised and not underpinned by a bank or government. This also makes them harder to track and regulate.

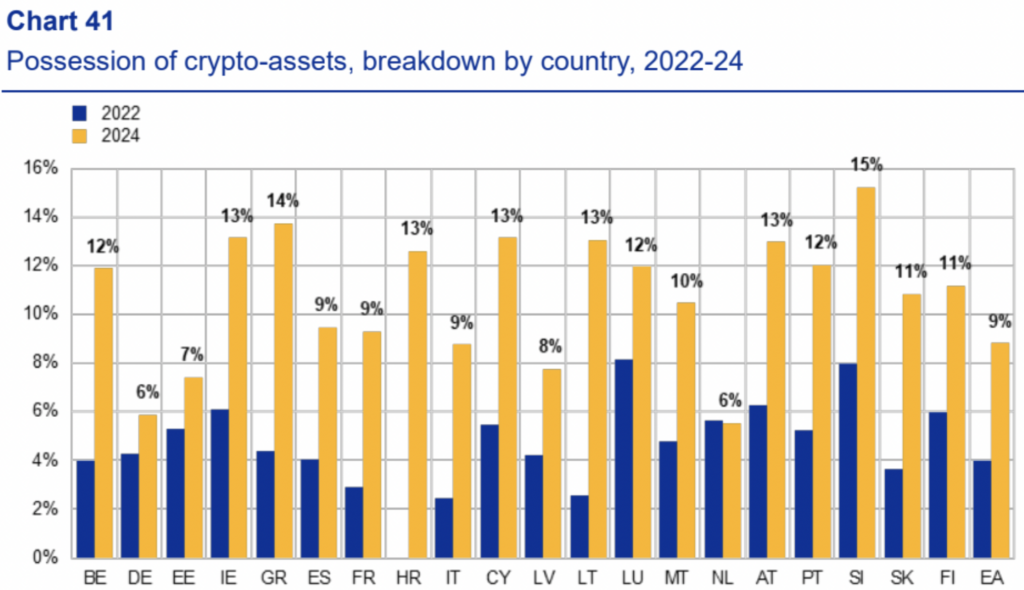

Take-up varies across Europe, with a survey by the European Central Bank (ECB) pointing to Slovenia as the country where ownership is highest (15%). The ECB survey found Belgium to have an ownership of 12%, less than the Barometer that Van Hove worked on. The gap highlights the challenges in collecting data about crypto.

And whilst crypto ownership is higher in Belgium than the EU average, ownership in neighbouring Germany and the Netherlands is lowest in the bloc (just 6% in both).

Credit: ECB

Van Hove couldn't confirm whether the apparent popularity of cryptocurrency in Belgium is due to the lack of a capital gains tax – something that marks Belgium out as an attractive country for investors. This is something the new Arizona government plans to change but the VUB expert is sceptical that it will impact cryptocurrency investments: "I doubt anyone declares profits from crypto because let's be honest, the Belgian government does not know who owns bitcoin and they have no way of finding out."

The momentum gathering behind cryptocurrencies is no doubt also driven by the ease with which they can be bought. "In the early days, you had to be somewhat knowledgeable to invest in Bitcoin. But now there are many mobile apps that facilitate it, making it really easy," Van Hove says. There are even banks that offer crypto investments on their mobile apps.

To HODL forever?

Cryptocurrency might be growing more prominent, but Van Hove is eager to stress the downsides. Not only is it exceptionally volatile, the energy cost is "really substantial". This will keep rising as more people get into the digital "coins".

And this looks likely to happen, now that crypto has the backing of the US government. "It's not just a niche nerd kind of idea, now it's gone mainstream."

That said, there are still very few places where cryptocurrencies can actually be used as a means of payment. If they were, this might be a way for the State to harness some of the value. But at present, Van Hove says it will take supranational entities like the ECB to impose robust regulation.

Financial advisors Tuerlinckx Tax Lawyers also highlight how difficult it is to calculate what you need to declare and to meet your tax obligations. "From the moment they are taxed, cryptos will become legitimate in a way."

And whilst crypto investors are notoriously evangelist, with phrases like "HODL" (= hold on for dear life) common parlance, the attitude in Europe is still largely reserved. But this could all change, and quickly if crypto were given the blessing of a central bank, or personalities who are not populist cheerleaders.