Belgium is still suffering from the economic impact of the war in Ukraine, with a number of core areas in the economy still struggling to recover from the global shockwaves being sent from Russia's invasion of its southern neighbour.

The new impact assessment came as part of an updated document of the Purchasing Power and Competitiveness Expert Group of the National Bank of Belgium, which released its impact assessment on 3 June.

Turbulent energy markets, high inflation, market volatility, weakened public finances, and reduced profits still trouble the Belgian economy and are all partially linked to Europe’s solidarity with Ukraine and international sanctions against Russia.

While market volatility and global trade have both recovered since the start of the war, energy prices and rapidly escalating inflation have not. More than ever, ordinary consumers are feeling the burden of the war in their household bills, at the pump, and during their weekly supermarket shop.

The Bank analysed financial indicators 100 days after the start of the war in Ukraine in order to see how the economy had reacted to the largest armed conflict in Europe since World War Two.

Belgian energy market

Across Europe, the rising price of natural gas has been felt by economies across the European Union. Decreasing reliance on Russian gas and diversification through the EU’s REPowerEU plan have led to a surge in the global price of gas. On the Dutch TTF futures market, prices more than tripled between 16 February and 7 March, reaching highs of over €227 per megawatt hour.

In Belgium, these huge spikes in the price of wholesale gas were reflected two-fold in consumer bills, according to experts from the National Bank.

“With the gradual phasing out of fixed price retail contracts, residential and small businesses have to bear rising natural gas prices despite the measures taken to reduce taxes and levies,” the report states.

It equally notes that the “cost competitiveness” of European gas consuming industries has also been strongly affected. Both businesses and consumers have reduced their consumption of gas. Many fuel-intensive Belgian producers also massively cut down on production due to the high price of gas and electricity.

Credit: National Bank of Belgium

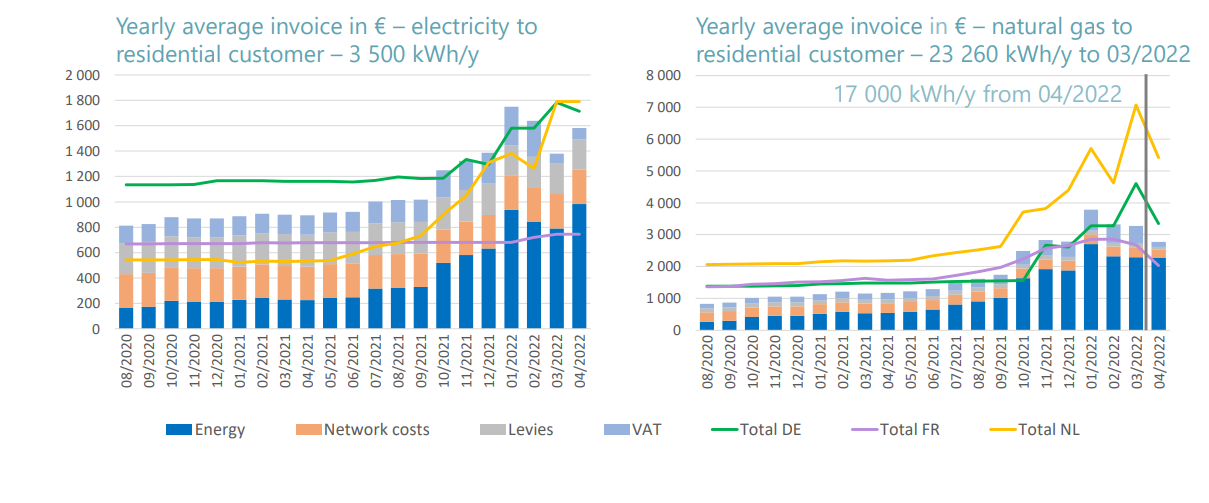

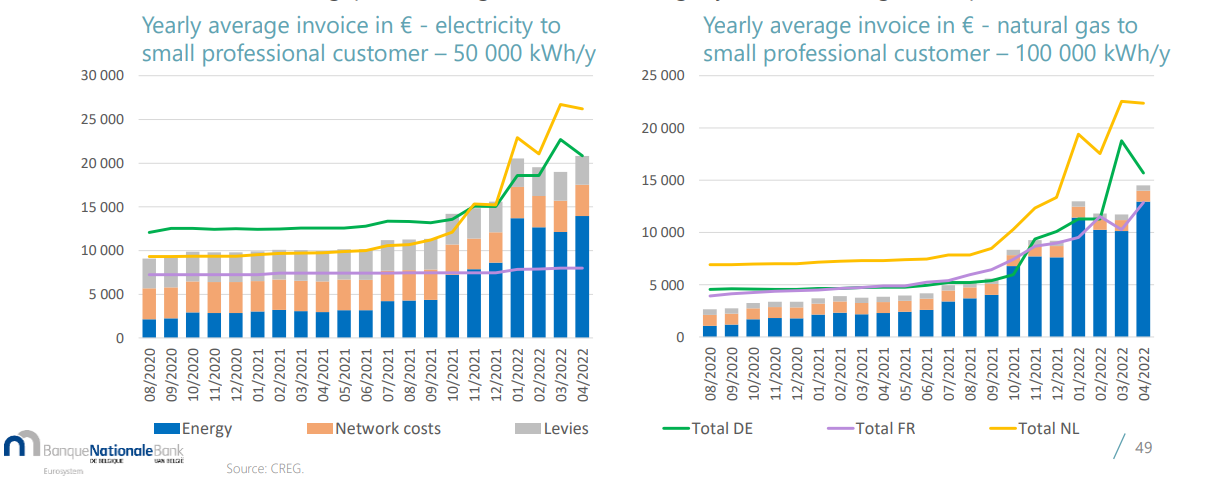

In Belgium, the average cost of electricity for a 3,500 kilowatt hour per year household rose from around 1,000 in July to nearly 1,600 in April, a 60% increase. In the same period, the average invoice for gas for a 23,260 KWh/y household increased by around 170%.

Small businesses using 50,000 kWh/y of electricity saw increases of 110% and for gas 250% (based on 100,000 kWh/y usage.)

Large Belgian industrial concerns are increasingly more energy conscious and compete increasingly in cost competitiveness in energy-intensive industries. “Since (Ukraine) invasion, total offtake is on average 15% lower to the corresponding average 2016-2019 (when not seasonally adjusted),” the National Bank notes.

Credit: National Bank of Belgium

The high price of oil has led to increased prices at the pump in Belgium. The consumption of petrol and diesel has remained below or in the lower ranges of the average consumption between 2016-2019, driven by the decreasing use of diesel.

The highest recorded money consumption of diesel in Belgium between 2016-2019 was 800 million litres of diesel. At peak consumption in 2021, consumers used around 19% less. However, the consumption of petrol has risen, compounding high prices at Belgian pumps.

Household finances

“Households are faced with major uncertainties, including the rise in prices (especially energy prices) which is temporarily weighing on their purchasing power; and the war in Ukraine and its economic repercussions,” the National Bank notes.

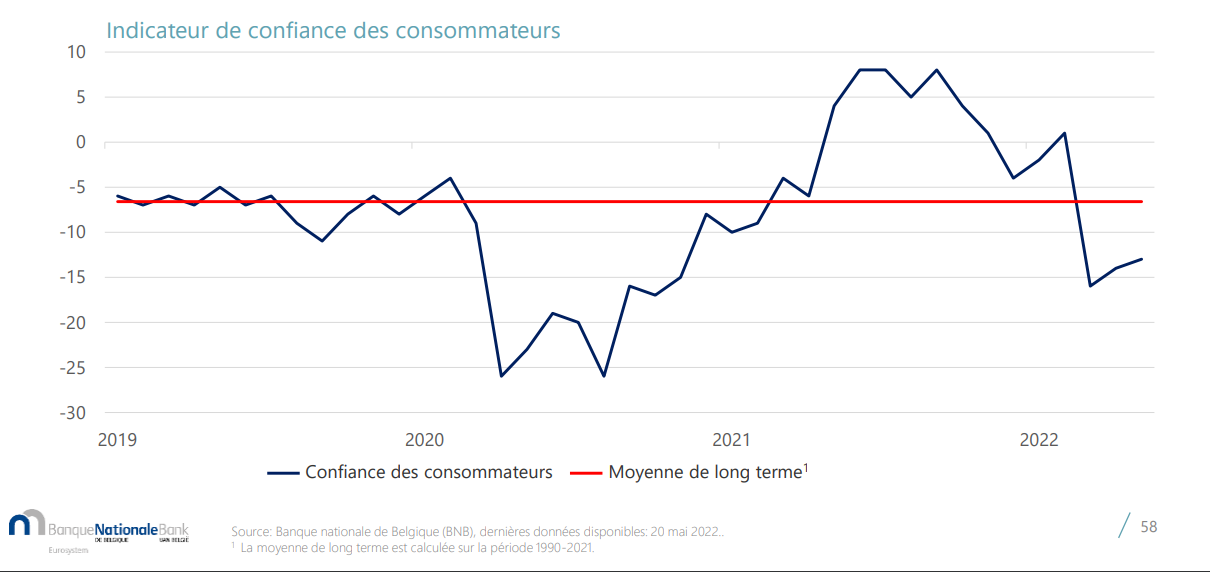

Compared to previous years, a larger portion of consumers are demonstrably more anxious about their financial situation. As previously reported by the the Brussels Times, following strong recovery at the end of last year, consumer confidence collapsed in March, dropping 17 points to lows unseen since 1985.

“This is reflected in particular in the consumer confidence index, which is below its historical average; household consumption is on a downward trend for the coming years, but supported by a fall in the savings rate, wage indexation, and social benefits,” the bank notes.

Credit: National Bank of Belgium

On the back of high inflation, cost of living, and dwindling purchasing power, there has been a steady sharp increase in demand for benefits, financial aid, and food aid.

According to the bank, the lowest income households are the most affected by cost increases as a result of the war in Ukraine and European energy crisis, but the risk of poverty did not increase in 2021.

Related News

- Belgium's state bonds raise nearly €40 million

- Belgian Budget Minister cautious about future public support measures

- Workers party collects 100,000 signatures for fuel price freeze

The cost of food and agricultural products has exploded in Belgium since 2020, increasing 110%. Inflation on foodstuffs surpassed 6% in May and shows now sign of decreasing, as grain bound for Europe remains trapped in Ukrainian ports.

A whole basket of goods has been hit hard by price increases. According to estimates, inflation in May reached 9.9%. The most notable price increases were for holiday resorts (30.2%), oils (+23.8%), newspapers (+14.9%), butter (+13.7%), and bread (+10.3%).

Fortunately, the bank did note that they had “not yet observed any consequences of the war in Ukraine on employment” in Belgium, which remains high after a strong recovery following the global Covid-19 pandemic. In the first trimester of 2022, a record-breaking 5.1 million people were in work across the country.

Belgian firms

Large companies in Belgium must contend with a complicated financial landscape, exacerbated by hangovers from the pandemic and Belgium’s unique wage indexation, which protects employees but heightens stress on firms.

“The difficulties that companies face are significant,” the bank stated. “Supply chain issues are escalating again, the cost of inputs has increased sharply (energy, food inputs); there is an increase in labour costs.”

The most significant and visible impact of the war in Ukraine has been an increase in energy prices, but this has not impacted all sectors equally. Industries heavily reliant on just one fuel type are spending a large share of their inputs on energy (Refining >50%, Fishing 38%, Forestry 31%, Aviation 30%, passenger transport 25%).

The price of oil now accounts for between 24% to >50% of input costs for oil-intensive industries. For gas intensive industries, between 2% and 14% of total costs, coal 1% and 10%, and electricity 4% and 16%.

Higher energy costs typically mean lower profits. Using financial modelling, the bank predicts that high energy prices could lead to big losses in the fishing, chemical, pesticides, and forestry sectors. Despite this, most industry bosses still tell the national bank that they are hopeful for the future.

However, some companies have not survived these additional stresses. After a significant decline in April, bankruptcies have returned to pre-Covid levels.

In May, the majority of bankruptcies occurred in the transport sector, followed by agriculture and fisheries, and trade. All these sectors have been impacted by the escalating price of fuel and fertilisers.