The property market is showing increasing signs of stabilising after a rush on the market driven by low interest rates and the pandemic. While prices are not rising as much, however, purchasing power remains under pressure.

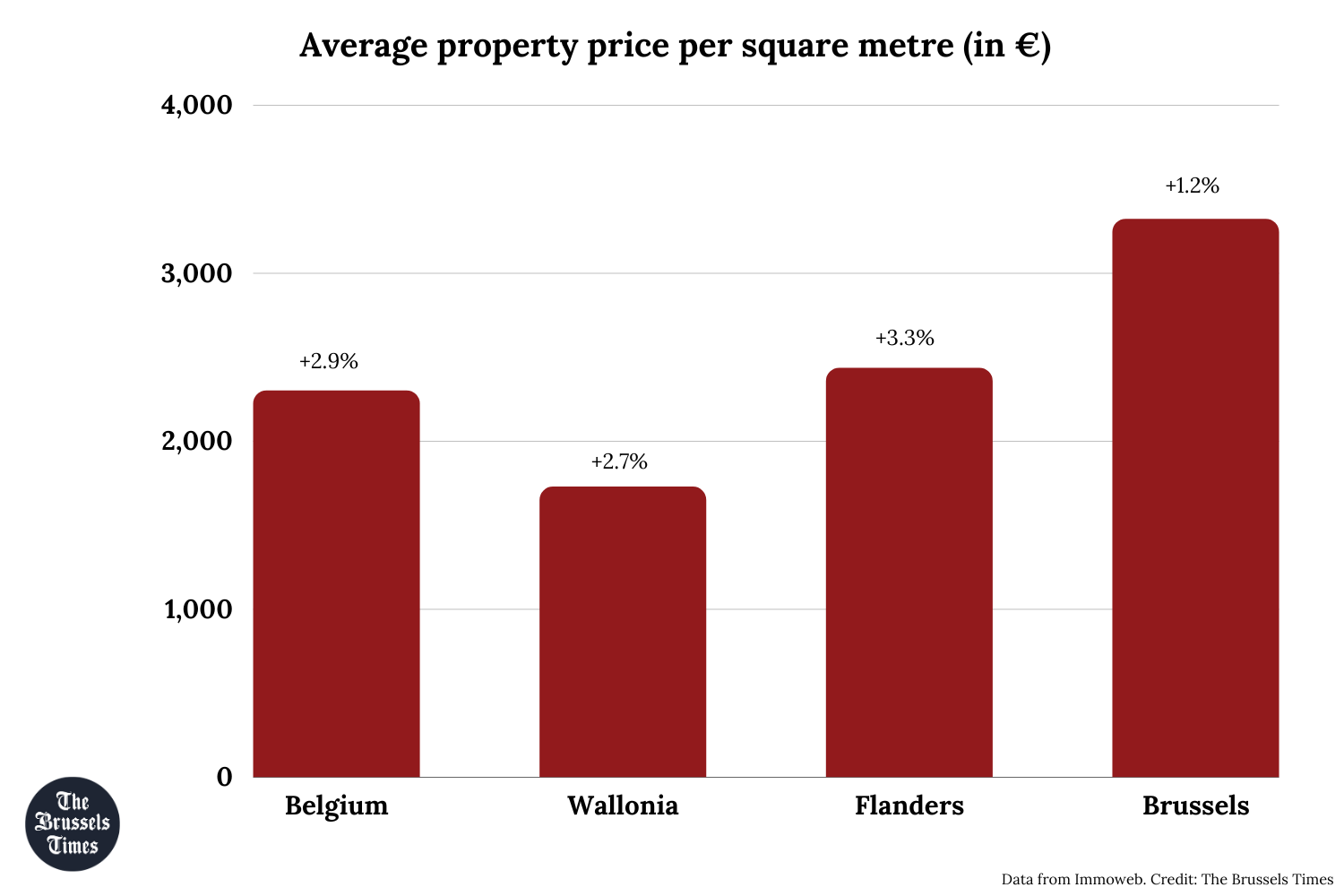

The average price per square metre (m²) across the country has increased by 2.9% since last year, now standing at €2,300, according to the price gauge for the third quarter of the year published by Immoweb, Belgium's largest real estate platform.

"This trend marks a significant change from the annual growth of property prices in Belgium, which averaged 4.6% between October 2021 and October 2022 and 5.7% in the same period between 2020 and 2021," the company stated.

"With the current increase of 2.9% since October 2022, this growth has almost halved compared to previous years." Belgium has not experienced an annual price increase of less than 3% since the beginning of 2018.

On a regional level, the price hike was the lowest in Brussels (+1.2%), but the price was still the highest of all regions at €3,322. In Flanders, the price per m² was €2,435 (+3.3%), while it reached €1,727 in Wallonia (+2.7%).

With an increase of 40.1% since 2011, Flanders shows stronger price growth than Brussels, where prices have risen 38.9% since 2011. It is striking that Flanders has overtaken Brussels in these terms, as the capital is normally the driver of property price growth in Belgium. However, this trend was reversed after the pandemic, and accentuated by the tightening of budgets and the rise in property interest rates.

This has prompted people to look for properties in more affordable areas. However, this shift has also been driven by those who are reluctant to take risks and thus to grant loans or high loan amounts, which increases pressure on the market.

"In Brussels, we are seeing a unique situation in the real estate market. As the region is already characterised by high prices and relatively low purchasing power, buyers in Brussels face major restrictions in terms of borrowing capacity," Managing Director of Immoweb, Piet Derriks, said.

"Against this background, changes in interest rates have an even greater impact on those looking to buy in the capital city."

Drop in purchasing power exerting pressure

The average property purchasing power of a Belgian household today is 101 m², down by 18 m² from January 2022 (-15%), and a slight decrease compared to this summer.

In Brussels, the average household can afford a mere 56 m² (-9 m²). In Flanders, it is slightly higher at 98 m² (-17 m²), while in Wallonia, due to lower property prices, it is 136 m², but here, the decrease was much higher (-23 m²).

Immoweb noted that these figures show that household purchasing power and prices remain under pressure, despite the major wage indexation earlier this year. "This fall in property purchasing power is exerting considerable pressure on demand and consequently on property prices."

Related News

- Second home in Ardennes remains sought after, but what does it cost?

- Property prices stay high despite significant drop in sales

Despite an expected increase in purchasing power due to wage indexations at the end of 2023, this will likely not be enough to compensate for the loss in purchasing power seen so far. This means a fall in prices remains a possibility in the coming months.

However, compared to last year, real estate interest rates are relatively stable, a trend which is likely to continue in the coming months. This situation, with slower price growth and more constant interest rates, should result in stable purchasing power by the end of 2023.