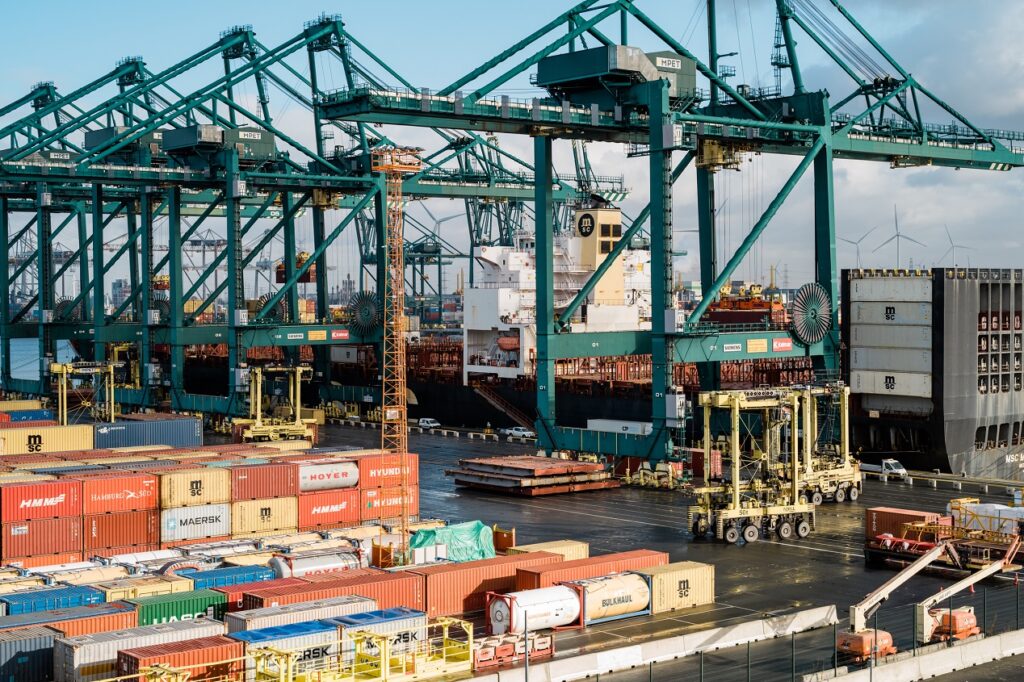

Multicoloured freight containers from countries all over the world are stacked as far as the eye can see across the Port of Antwerp. Hundreds of berths are lined with cranes to lift these containers, known as twenty-foot equivalent units (TEUs).

Ships of all shapes and sizes, from tugboats to ocean liners, move through the Scheldt River, the port’s waterway. Wind turbines dot the vertical landscape. Oil refineries and a nuclear power plant belch steam into the air. Importer storage facilities form their own distinct villages.

At the base of Antwerp’s port, connecting the maritime zone with the city is the stunning Havenhuis, or Port House. It is an old firehouse retrofitted with a modern glass building on top, its thrusting lines recalling a ship’s bow. Its fourth floor is open air with views overlooking the harbour and canals like the deck of a liner. Designed by Zaha Hadid Architects, it visually represents both the past and future of Antwerp’s port.

The port’s past, dating back to the 12th century, was preserved during the Second World War thanks to the Allies securing it and using it to transport supplies (in recognition, there are docks named Marshall, Liberation and Churchill - the latter inaugurated by Queen Elizabeth II in 1966. The port is still used by the US military today).

Its future is tied to an April 2022 merger with the Port of Zeebrugge, making the combined Port of Antwerp-Bruges the world’s 13th largest in containers and second in Europe in maritime freight movement. In 2022 alone, it moved 287 million tonnes of goods. It is a major driver of the Belgian economy, accounting for 4.5% of the nation’s gross domestic product (GDP) – more than tourism in 2021 (4.3%) – with an added value of €21 billion.

The Zaha Hadid-designed Port House

The port hopes to become even more important to Belgium and the world as it shifts to a circular economy and green energy as the first carbon-neutral port by 2050. That’s a big deal considering industry and shipping at the port currently account for 14 million and four million tonnes of carbon dioxide (CO2) emissions, respectively.

Merged assets

Strategically located in the centre of Europe, the merged port has excellent links by water, road and pipeline to the European hinterland. Some 60% of Europe’s purchasing power is within 500km.

The port areas cover more than 120 square km, including 11,000 hectares of waterways and quays. That’s almost the size of the Brussels-Capital Region. It can welcome the world’s largest container ships with more than 24,000 TEUs (while Antwerp’s port is 85km inland, it is accessible to such ships thanks to high tide and the deepening of the Scheldt in 2010.)

The port is home to 1,400 companies, including the largest integrated chemical cluster in Europe as an anchor of the Belgian economy. This cluster includes BASF, Bayer Agriculture, Borealis, Ineos, Esso, ExxonMobil and TotalEnergies – the latter three of which have oil refineries — among other companies (oil tankers berthing in Rotterdam send up to 40 million tonnes of crude oil per year via pipeline to Antwerp).

It is also a global leader in roll-on/roll-off cargo, primarily cars, and is now the largest automotive port in the world with 3.5 million new cars moving through it a year, largely in Zeebrugge.

Zeebrugge also receives 15% of Europe’s total supply of natural gas. Moreover, fresh fish caught in the North Sea is processed in Zeebrugge and auctioned online by shipping companies. Called the Flemish Fish Auction, it is the second largest of its kind in Europe. Ocean cruise ships dock in Zeebrugge while river cruise ships go to Antwerp.

Port officials say the Antwerp and Bruges merger has created synergies, as it is now Europe’s top entry point for steel, fresh fruit (like bananas and pineapples), coffee, cacao and tobacco.

Traded items are in four categories in order of volume: containers (TEUs), liquid bulk, rolling stock, breakbulk and dry bulk. Containers include reefer cargo that requires controlled temperatures such as fresh fruit as well as life science and healthcare products. Liquid bulk includes petroleum derivatives, chemicals and liquefied natural gas. Rolling stock refers to cars. Breakbulk includes metals like steel, granite, and forest products. Examples of dry bulk goods are coal, building materials, fertilisers and grains. These items are distributed throughout Europe by truck (45%), barge (40%), train (10%) or pipeline (5%).

Greening the blue economy

The port’s trade has tripled in the last 20-25 years, according to Wim Dillen, International Development Manager at the Port of Antwerp-Bruges. “If we play our cards right and if we realise what we have here ahead of us, the Port of Antwerp-Bruges will have its Golden Age. Our goal should not be to be the biggest port but the best,” he says.

He also says the merger helps them to jointly cut emissions – and their latest sustainability strategic plan focuses on “people, planet and profit” in line with the EU’s Green Deal and the UN Sustainable Development Goals. The climate plan is to make the port 55% carbon neutral by 2030 compared to 2018 and 100% by 2050. “If you want to clean streets, you have to sweep your doorstep first,” Dillen says.

Decent work, pay and gender equality underpin the people plan. The port employs a total of 165,000 people directly and indirectly, accounting for 3.8% of Belgium’s workforce. The economic plan is to expand Antwerp’s container capacity from 15 to 22 million TEUs (Zeebrugge is static at two million TEUs).

The plan embraces language about the circular economy, including reusing old materials instead of mining to get raw materials. Officials say the port aims to become a green “bunkering” (refuelling) hub with hydrogen and other biofuels replacing marine fuels, maximise wind and solar energy, provide electric power for docked ships and other vehicles, capture and reuse or store carbon dioxide, and be an incubator for new technologies.

The port says at least €8 billion will be invested in the energy transition over the next five years. It aims to be a major player in the import, production, processing and shipment of green hydrogen and its carriers. The plan is for Antwerp to be the consumer part of the hydrogen hub and Zeebrugge the producer, with the latter already boasting state-of-the-art liquified natural gas infrastructure.

The shipping industry was not covered in the Paris climate agreement, but the port is taking steps to move to greener operations. It will be the first in the world to offer methanol, a low-carbon fuel, along with other biofuels. It will pilot several green technologies, including electricity, in its own tugboat fleet, which accounts for 85% of the port’s direct carbon footprint. This fall, the port will launch the world’s first tugboat powered by green hydrogen.

Electricity will power the port’s trucking fleet and ships while they are docked, which account for 70% of their emissions in the port. Cruise ships, for example, can be connected to the grid in Zeebrugge.

Solar and wind energy also spare emissions by reducing the need to burn fossil fuels. The port has 134 wind turbines that generate enough power for 230,000 households, but there is room for growth in onshore wind production and solar energy.

A solar park in the village of Kallo near Antwerp generates green heat based on concentrated sunlight in mirrors – a first in Europe led by the Belgian start-up Azteq. A project called HyOffWind will use both wind and solar energy to create green hydrogen as the first industrial power-to-gas installation in Belgium (Zeebrugge).

The port has also joined forces with Air Liquide, BASF, Borealis, ExxonMobil, Ineos, Fluxys and TotalEnergies to explore Carbon Capture Utilisation & Storage in a project called Antwerp@C. The project’s goal is to capture half of the CO2 emissions at the port by 2030. These emissions will be captured as liquefied carbon and turned into methanol or sent to empty gas fields. The project will be realised in 2026 as the largest of its kind in Europe.

Another project called ECLUSE will capture steam, a waste product of incineration, to heat industrial processes and buildings. Run by the Antwerp-North Heat Network, the project already supplies residual heat from six incineration plants to surrounding port companies, reducing carbon emissions by about 100,000 tonnes per year. Harnessing steam from Antwerp’s large chemical cluster, ECLUSE aims to expand to heat the right bank of this city’s port and a nearby residential area.

Meanwhile, the new NextGen District will be built by 2025. Five companies – Triple Helix, Bolder Industries, Eko-Pak, Plug Power and PureCycle Technologies – will focus on repurposing and recycling port materials such as rubber, plastic and water.

Moreover, the port will work with the conservation group Natuurpunt to protect up to 5% or 650 hectares of green space containing 100 species of birds.

Scuppering crime, anchoring security

Separately, the port faces criminal and reputational challenges over its role as a gateway for drugs. The European Monitoring Centre for Drugs and Drug Addiction has highlighted Antwerp’s position as the main conduit, with customs officers seizing 110,000 kilograms of cocaine there in 2022.

Port officials admit more and more drugs are coming into Antwerp, sometimes hidden in legitimate commodities like fresh fruit from Ecuador and Colombia.

As drugs imports have risen, so too has competition between criminal networks, along with murders, kidnappings and intimidation. The violence is even impacting those outside of the drug world. For example, former Belgian Justice Minister Vincent Van Quickenborne and Antwerp Mayor Bart De Wever have police protection due to death threats.

The port says it is amping up efforts to tighten security. From January 15, 2024, all transport operators at the port need to use a new Certified Pick Up digital platform for container release, which cuts the time between pick-up authorisation and collection.

Previously, picking up a container required a unique PIN code, which could be shared, but the new fingerprint system makes it identity-based and auditable. Most importers already use it and all must do so by the top of next year.

“We do not control supply chains, but we try to create solutions for their weak spots,” says Guy Janssens, Chief Corporate Affairs Officer at the Port of Antwerp-Bruges. “When we look at cybersecurity, our own personnel are a weak spot, so we’re putting a lot of effort into awareness. It’s working.”

An expanded infrastructure with 460 cameras and 22 radars enables continuous monitoring of the entire port and all shipping movements. It creates a digital twin of the port, so computers can detect anything awry in real time.

In March 2023, the port launched BVLOS (Beyond Visual Line of Sight) automated drone flights in the port areas: the six drones scan the entire port area to support berth management, monitoring, infrastructure inspections, oil spill and floating waste detection, and security partners during incidents. There are 18 remotely controlled, daily BVLOS flights at random times 24 hours a day. Night-time drone flights have infrared vision to see what port lights may not show.

Rough seas

Economic uncertainty and inflation at the end of 2022 led to a global slowdown in container shipping and the cancellation of sailings, particularly from the Far East. Along with the ongoing conflict in Ukraine, which reduced Russia-related traffic, the slowdown has caused a 6.6% drop in container movement in tonnes and 5.7% in TEUs as of Q1 2023.

“We’re in a constant mode of crisis management,” Janssens says. “We used to say that we have one big crisis every decade in the port so when Brexit came in place in January 2020, we thought that dealing with its impact would be the big thing. Of course, we were wrong.” COVID, the blockage of the Suez Canal, the Ukraine war and the energy crisis followed.

Supply chain disruptions in China due to the pandemic have had a greater impact on the port than the sanctions against Russia. That’s in part because Zeebrugge remains a transit hub for Russian LNG, accounting for 17% of what is exported and making Belgium the third largest importer in the world after China and Spain, according to the NGO Global Witness.

Russia is now Europe’s second biggest supplier of LNG after the United States as sanctions only pertain to Russian crude oil and other petroleum products. Janssens defends the ongoing trade, insisting the port still complies with the EU’s sanctions regime and even arguing that it helps keep Europe’s lights on last year.

“It is well-known that the state-of-the-art Fluxys facilities helped Germany and other neighbouring countries through the harsh situation last winter, with prices peaking and east-west pipeline connections being cut off,” he says.

Connectivity at the Port of Antwerp-Bruges is expected to be enhanced in the 2030s with the completion of the Oosterweel Connection, a new highway connecting to Antwerp’s existing ring road, and the building of an extra container dock in Antwerp to increase TEU capacity. The port will also forge international green energy relationships. But for now, the port has weathered the storm. “The fact that we’re not a one-trick pony helps us,” Janssens says.

How to visit the port

The Port of Antwerp-Bruges is above all a gateway for commerce. But is also a vessel for tourism. You can walk through grassy nature reserves, cycle past massive ships, spot birds in ponds, admire old and new architecture and eat at fine restaurants.

Start at the Port House in Antwerp, a remarkable example of both historic and modern architecture with a renovated firehouse topped with a ship-like glass structure that stands out on the city’s skyline. Designed by Zaha Hadid Architects, it is located on a square named in Hadid’s honour: she passed away shortly before the building was completed in 2016.

The Port House is the head office of the Port of Antwerp-Bruges where 500 administrative staff work. During office hours, you can take a free look around the ground floor, which features a giant inlaid map of the port, modern sculptures and a café. Guided tours for individuals (Dutch only) and groups (multiple languages) can be booked in advance through Experience Antwerp.

The Polder Museum

In Zeebrugge, the top floor of the eight-story ABC Tower has a visitor centre and a rooftop restaurant called Njord. And, like the Port House rooms are available to rent for special events.

You can discover the port on your own or via guided tours by foot, bike, bus, boat or even scooter. De Waterbus at Steenplein in central Antwerp offers a water taxi service for €6 through the port north to Fort Liefkenshoek, a late 16th century defensive structure with hands-on displays about the river and surrounding area, and the village of Lillo, a former military fort where about 35 people live today. The village has a restaurant, café and the Polder Museum about tracts of lowland reclaimed from bodies of water like the North Sea.

Near the Port House is the Red Star Line Museum, which tells the personal stories of 20th century emigrants, encouraging dialogue about migration in the past, present and future. Also in the city centre, the MAS museum features the port of Antwerp in the current exhibition, Freight, about the history of shipping and world trade as well as Portopolis, a free, kid-friendly visitor centre.

Port facts and figures

287 million tonnes of maritime goods moved per year

26 million tonnes of cargo annually

€21 billion in total added value (€13 billion direct)

140 million tonnes of exports a year

14 million containers (TEUs) moved annually

9 million cubic metres of tank storage

300,000 shipping movements per year

165,000 indirect and direct jobs (150,000 in Antwerp, 15,000 in Zeebrugge)

49,000 inland vessels per year

20,000 seagoing vessels annually

14,322 hectares of surface area

11,000 hectares of waterways and quays

1,700 Port Authority employees, 500 of which work at the Port House

1,400 companies

1,000km of pipelines with 57 different products

800 destinations

300 liner services

200 shore power connection points

170 cruise vessels per year

134 wind turbines

120 square kilometres

40 million tonnes of oil refining capacity

15-25 people on average on cargo ships

15% of Europe’s natural gas supply

4.5% of Belgian GDP

3.8% of Belgian workforce