Businesses in the Belgian capital are increasingly caught in a tug-of-war over the future of payments. On one side, dedicated crusaders are battling to ensure that cash remains king in Belgium, while on the other a new generation of tech-savvy teens are doing away with euro bills in favour of contactless or QR code payments.

The Covid-19 pandemic revolutionised the way we pay and since 2020, the share of Belgians that reported having made a contactless card payment almost doubled, according to statistics from Febelfin. Now, four in five Belgians report preferring digital payments and over half of young people report not having made a cash payment in recent memory. Only 15% of Belgians reported in 2024 that they now preferred using cash.

This change in consumer habits is not universally welcome. Older generations in Belgium remain statistically attached to cash. The mass abandonment of cash payments during the pandemic was met with fierce resistance from some citizens, who took online to name and shame businesses refusing to accept cash payments, with some even occupying a bar in Brussels’ Cimetière d’Ixelles nightlife hotspot to denounce the non-acceptance of cash.

This struggle between card and cash payments did not go unnoticed by the Federal Government. On 1 July 2022, Federal law was altered to force businesses to offer at least one form of electronic payment, while maintaining the obligation for the businesses to accept cash payments. In theory, customers now have the choice to pay in their format of choice, but in practice this is often not the case.

Vous payez par carte?

Card payments are widely accepted across Brussels. While in Germany, cash is strongly preferred in most settings, Belgians now regularly use their bank cards for an array of transactions. Social stigma around using digital payment methods for small purchases has largely evaporated and new portable card readers and payment systems have enabled even small businesses to accept digital payments.

Despite this, many visitors to Belgium may find their payment options limited in some businesses. The Brussels Times recorded numerous examples of restrictive practices, especially in Brussels, intended to force consumers towards cash payments. In one popular snooker club, customers are instructed they can pay exclusively in cash or with American Express, a payment option with a less than 1% market share in Belgium as of 2022. When our journalist asked to pay by Amex, staff at the venue announced that the machine to accept this payment type was not even in the building.

Transaction fees for American Express are some of the highest among payment methods. While fees on Visa and Mastercard are capped by the EU’s Interchange Fee Regulation at 0.2% for debit card transactions and 0.3% for credit cards, Amex operates on a closed-loop system, exempting it from these limits. To this, the merchant is also charged fees of 0.1-0.16% depending on the card type, as well as 0.4-0.8% for the acquiring bank fee.

As a result, businesses can face transaction fees of up to 20 cents on a €5 transaction with Amex, compared to less than 2 cents for Bancontact, Visa, or Mastercard. These figures exclude additional charges imposed by the business’s POS provider.

Business’ decision to favour Amex digital payments is likely an attempt to covertly disincentivise card payments and force customers to pay in cash. The Brussels Times attempted to reach out to this pool bar, and numerous others involved in similar schemes, but did not receive a reply.

Credit: Dylan Carter

This attempt to discourage customers from using their card can be observed in numerous other Brussels businesses, especially in bars and local stores. In one popular chain of bars, customers are offered discounts if they pay by cash. Customers who insist on paying by bank card face various limits.

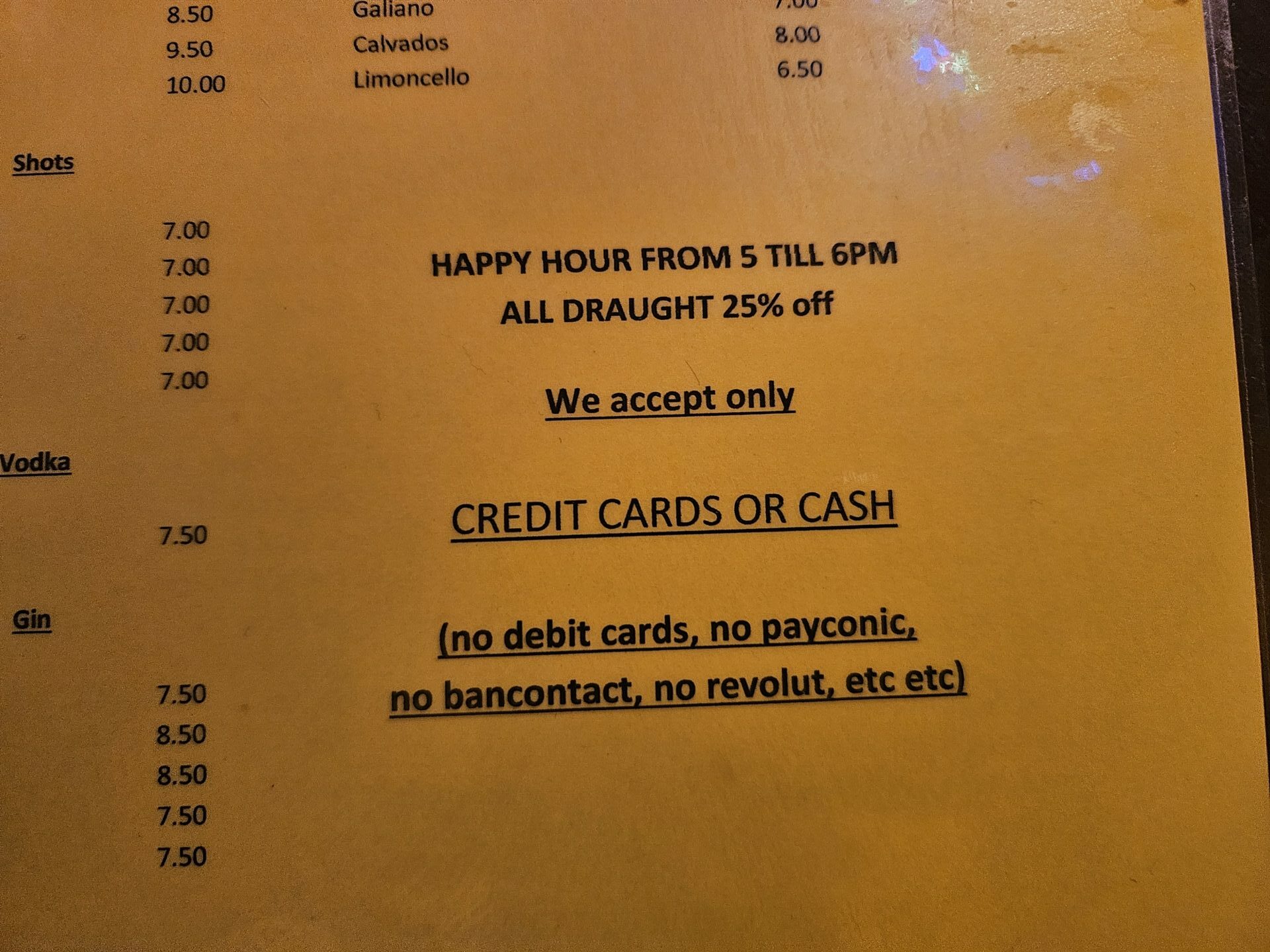

At numerous bars in the Schuman area, customers are told they cannot pay with Bancontact, Revolut, Payconiq, or debit cards. Only credit cards are accepted, despite usually entailing higher fees for the merchant. This again is likely an attempt to discourage customers from paying by card and instead to pay by cash.

All this is bad for the consumer, argues Belgian consumers association TestAchats, which pushes for customers to be able to pay in their preferred payment method.

“Despite federal laws requiring that both cash and card are accepted, many businesses still push for cash, especially in sectors like bars, restaurants, and salons. It’s not just inconvenient; it’s illegal. But enforcement is weak,” explained France Kowalsky, domain coordinator for financial services at TestAchats.

Cash only?

Many restaurants in the capital still display "cash only" signs. Credit: Dylan Carter

Many businesses still openly refuse card payments despite the federal legislation. During a visit to an up-market Asian restaurant in the city center in November 2024, more than two years after the start of the obligation to accept payment cards in Belgium, business owners told our journalist that they still only accepted cash. Other rural businesses and doctors' practices are slow to adapt to the new regulations.

But why the strong resistance from certain businesses to mandatory card payments? TestAchats suggests that some businesses use this method to hide certain transactions and lighten their fiscal burden.

“It’s no secret that when businesses push for cash, it’s often linked to tax fraud or working under the table. Card payments leave a digital trail,” Kowalsky explains. The hospitality sector in Belgium faces significant challenges from high taxes, elevated staffing costs and falling margins, encouraging some to find covert ways to save money.

Bar owners in the city paint a more nuanced picture. The choice to limit card payments sometimes arises as the result of arguments with their payment provider or the personality of individual merchants. “Doing cash transactions allows for some under-the-table earnings, which are useful for paying less tax, but now it's becoming more complicated with regulations,” an Ixelles bar owner told our journalist. “Cash is, of course, still preferred because it's more fluid. We can use it right away for small purchases.”

Operating as a “cash first” business is also challenging, with younger generations typically not carrying cash and preferring electronic payments, TestAchats noted. Many cash-only businesses receive negative online reviews for their practices. “In some cases, businesses avoid cards by claiming high transaction fees, but this is often just an excuse to keep things off the books."

Cashing out

On the other side of the coin, a few consumers complain that paying in cash can be difficult, with vendors operating card-only policies, despite laws to the contrary.

Across Brussels many businesses openly declare that they are now “cashless”, drawing the ire of the minority of Belgian consumers still reliant on cash for everyday transactions. Declining card transaction fees and easier contactless payments, businesses say, have made offering card payments more convenient. It is now cash, they say, which is causing headaches.

“Cash involves risks like theft, counterfeit bills, and the hassle of depositing it at the bank, which now happens less often due to the effort required,” the owner of a popular Brussels bar told The Brussels Times. Indeed, banks and ATMs across the country are rapidly disappearing as banks close branches in favour of online banking.

Credit: Belga / Nicolas Maeterlinck

In 2018–2022, there were over 3,000 fewer cash points in Brussels, according to statistics from Febelfin. Only a small fraction of these ATMs accept deposits. Similarly, there are now 135 fewer bank branches. For bars, restaurants and other customer-facing businesses, this means fewer opportunities and longer times between deposits.

“There are fewer ATMs accepting cash deposits, and bank appointments are required to deposit cash, making it administratively burdensome,” the TestAchats expert commented. This has led some businesses to purposefully ignore the federal legislation.

According to the law, there are only a few circumstances in which businesses can legally refuse cash payments. If businesses believe that accepting cash would put them in danger, they are allowed to refuse cash payment. However, this measure cannot be a permanent solution.

Related News

- Struggling for cash? Frustration high about lack of ATMs in Belgium

- Dutch banks tell consumers to keep cash at home due to geopolitical threats

- Belgium in Brief: The payment systems ruining Belgium's events

Businesses can also refuse particularly large cash payments, such as payment with more than 50 coins, for goods over €3,000 or payments with a disproportionate amount of cash, such as a €500 note for a €5 purchase. These circumstances, however, are relatively rare.

While non-compliance with the law is technically punishable by a fine of up to €80,000, enforcement is weak. Businesses are usually reported by citizens through the Consumerconnect portal, operated by the Economy Ministry, and receive several warnings before being issued with fines.

In the first half of 2024, 785 reports were received for businesses refusing to accept a form of payment. Just over half of these were related to the refusal to accept cash.

This tug-of-war over payments reflects deeper societal shifts in how we interact with money. While cash continues to hold symbolic and practical value for some, the tide of convenience, security, and digital efficiency pushes businesses and consumers alike towards cashless transactions. But the Finance Ministry is clear: “[Digital payments] can in no way replace cash payments.”