The Belgian economy is experiencing heightened costs due to supply shortages and logistical issues as a result of the war in Ukraine, according to data shared by the National Bank of Belgium. But not all industries are affected equally.

The National Bank of Belgium cites a recent study conducted by leading industry groups and federations, who conducted a joint ad hoc survey of Belgian companies and self-employed people.

The results reveal that very few Belgian companies had any direct trade with Russia. Of the companies surveyed, only 0.7% of sales and 1.6% of supplies were linked to Russia or Ukraine before the start of the war.

Some companies have been directly impacted. Companies involved in the manufacturing industry, transport, logistics, and agriculture often deal directly with Russian companies, making them more sensitive to international sanctions and supply shortages.

The data shows that the exposure of Belgian companies to Russia and Ukraine scales with the number of employees the company employs.

Around 30% of companies with more than 50 employees made sales to either country, compared to just 6% for companies with fewer employees. On average, only 5% of companies in Belgium sold products to Russia.

Belgium companies are still reasonably dependent on Russian supplies. 34% of large companies surveyed, and 12% of small companies sourced materials directly from Russia.

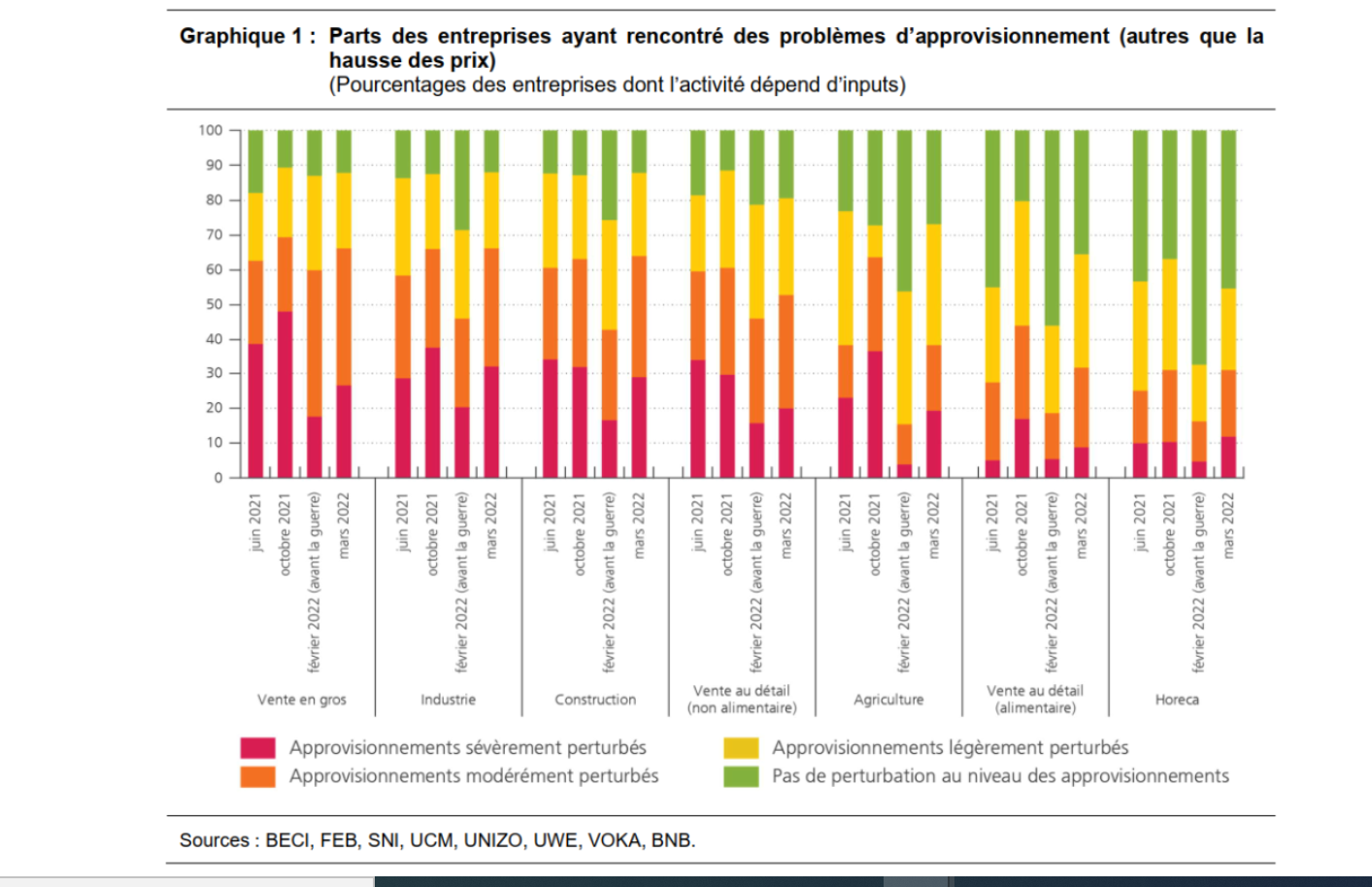

Supply problems abound

Belgium experienced strong recovery following the pandemic in Oct 2021, but supply problemsweighed upon the activities of Belgian companies. Before the start of the war, these issues looked to be all but resolved but this trend has now quickly reversed.

An increasing number of companies surveyed stated that they were experiencing “moderate” and “severe” supply problems. Almost all sectors of the Belgian economy are experiencing supply issues, in particular those industries reliant on imported shipments.

Nearly two-thirds of the companies in manufacturing, wholesale, and construction were disrupted in March. That accounts for over half of non-food retail and a third of agricultural companies.

The war in Ukraine is not the only thing affecting supply issues. China’s pursuit of “zero Covid” has paralysed supply chains. The large industrial hub of Shanghai has been completely locked down, causing mass food shortages and shutting down factories.

Nevertheless, data suggest a strong negative impact of the war in Ukraine and international sanctions on the international supply chain.

Credit: National Bank of Belgium

Translation of graphic: Sectors of business having encountered supply problems (other than an increase in price). Purple = severely affected; orange = moderately affected; yellow= lightly affected; green = unaffected (by percentage)

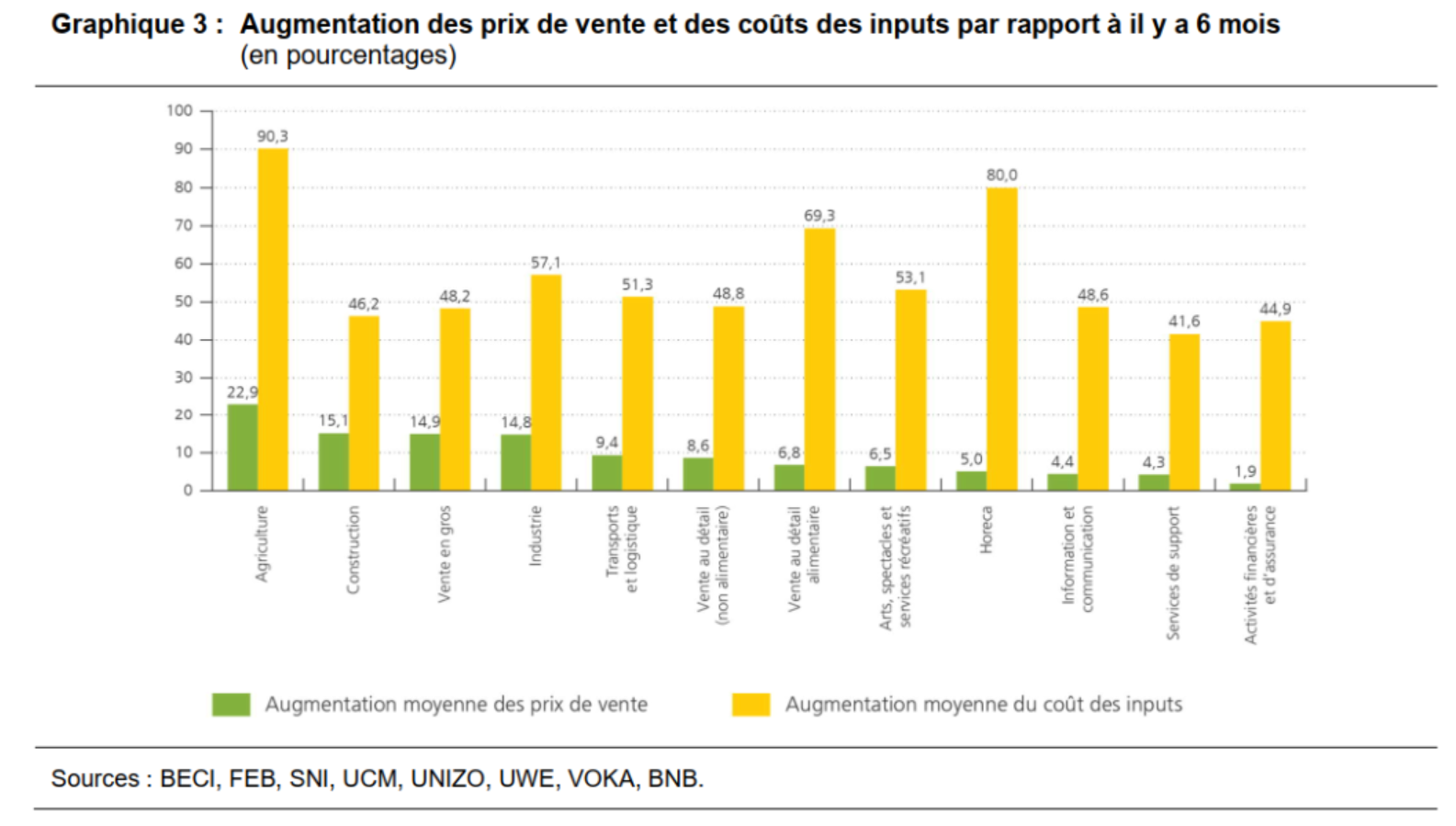

Massive costs for businesses

Supply issues necessarily mean higher costs. Companies revealed a strong, sharp rise in their input costs. Only 5% of companies stated that the cost of their inputs had not increased over the last six months.

For around two-thirds of companies, price increases on inputs (such as energy, intermediate products, raw materials, packaging) raised by over 20%, with some exceeding over 50%. The sectors most heavily impacted were agriculture, transport, logistics, horeca, food retail, and food production.

The soaring cost of energy in Belgium is hitting certain companies extremely hard. On average, energy costs account for about 11% of their inputs. However, around 10% of Belgian companies, on average, spend around 20% of their total costs on energy.

According to the National Bank of Belgium, high costs in supplies, materials, energy, and other inputs have reduced production among Belgian companies by an average of 7% since the end of February.

Wages up, production down

High inflation, which reached 8.31% in March, has driven up wage indexation, adding further pressure on employers. On average, wages have gone up around 5% across the companies interviewed by the survey. 31% of small businesses and 49% of large businesses viewed higher wages as an obstacle to production.

Related News

- 40% of Belgian food producers to halt or reduce activity

- Russian sanctions to have low but not insignificant impact on Belgium

The most commonly cited factor for reducing production was the high price of energy, which around 45% of companies said had impacted them. Similarly, 35% have reduced production because of “high uncertainty” in the market.

If things get worse, this could signal that companies are getting ready to lay off staff. The Belgian government has already extended its furlough system from the Covid pandemic by several months, suggesting that the government expects an uptake in unemployment.

Softening the blow

For the time being, companies are doing their best to avoid passing on all of their costs to the consumer.

Almost all of the companies interviewed by the economic survey revealed that they had raised their prices, but over three quarters did not increase their prices by the same rate as their costs.

The gap between the rate of increase in costs and prices is growing and, as such, profitability is becoming a real issue. So much so, it has led many companies to simply stop production.

Around 40% of Belgian food producers plan to halt or reduce production due to low profitability and high costs. Food producers equally complained that supermarkets were not ready to talk seriously about price increases on their products.

Credit: National Bank of Belgium

Translation of graphic: Increases of sales prices (green) and input costs (yellow) compared to 6 months ago (by percentage)

In for the long haul

The National Bank of Belgium warns that the negative impact of these high prices will likely continue for some time.

Most companies interviewed stated that they believed that high costs would last for over six months. 36% believe that they will continue to feel the negative impacts for up to two years. 26% believe it could be even longer.

Belgian companies are already revising their investment plans, cutting back, and closing their purses. Investment plans will be reduced by an average of 12% as a result of supply issues, and production is expected to fall by 2% within a year.

This isn’t the end of the road for most companies. 96.4% of companies don’t anticipate going bankrupt, yet. But concerns are similar to levels seen during the height of the pandemic.