Typos can have colossal effects. A trader from U.S multinational investment bank Citigroup sent markets spiralling with a simple wrong input on 2 May, the Wall Street Journal has reported.

The trader unwittingly created an extremely large sell order which sent trading floors across Europe into panic. This “flash crash” wiped €300 billion in stock market value in just a few minutes. Market losers will not be compensated for their losses if they sold their stock in a panic.

This costly error was likely caused by a “fat finger”, also known as a simple typo. For example, instead of creating 10 sell orders, the trader may have accidentally sold 1,000, or worse.

Some trading terminals include functions which automatically add a certain amount of zeros, speeding up trades but increasing the risk of “fat fingers.” Unfortunately, it is unlikely that the trader will ever work in the industry again.

Trading was halted on several stock markets after several catastrophic plunges were observed, however most resumed trading by 10:00 CET.

“This morning one of our traders made an error when inputting a transaction,” a Citigroup spokesperson said in a statement. “Within minutes, we identified the error and corrected it.”

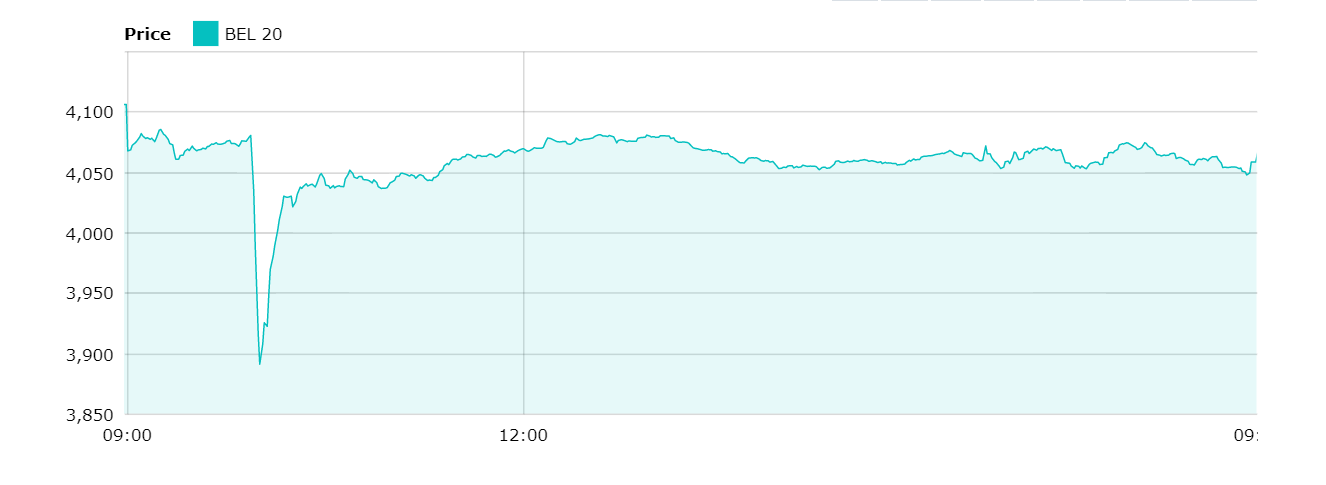

Belgium's BEL20 market plunged significantly on the back of the "flash crash." Credit: Euronext

Belgium’s BEL20 fell by more than 5% before rebounding at the end of the day. Sweden’s OMX Stockholm All Share fell 5.8% and the Dutch AEX Index dipped by 4.1%. Indexes finished the day around 1-2% percentage points lower by the end of the day.

Related News

- Brussels stock exchange down to same level as 5 years ago

- Brussels stock exchange opens with a loss after Russian invasion

- Euro hits lowest value in 5 years: How will it affect you?

This is not the first “fat finger” to send traders scurrying to secure investments. In 2009, an oil trader, drunk after a golf weekend with colleagues, placed approximately $520 million in trades of crude oil. His company ended up with losses of nearly $10 million.

In 2012, Knight Capital submitted millions of trades in under an hour due to a glitch. The result- $440 million in losses.

The BEL20 has now almost entirely recovered, closing at €4,065.34 on 4 May.