The Brussels Times has received numerous complaints from members of the Brussels international community concerning KBC Brussels. They say the bank routinely refuses to open current accounts for foreign nationals unless they commit to subscribing to expensive add-ons, such as insurance policies or business accounts.

In a call for testimony published on 14 February, many readers told The Brussels Times that they were denied the possibility of opening an account unless they agreed to take out professional liability or home insurance, savings accounts, or other credit products.

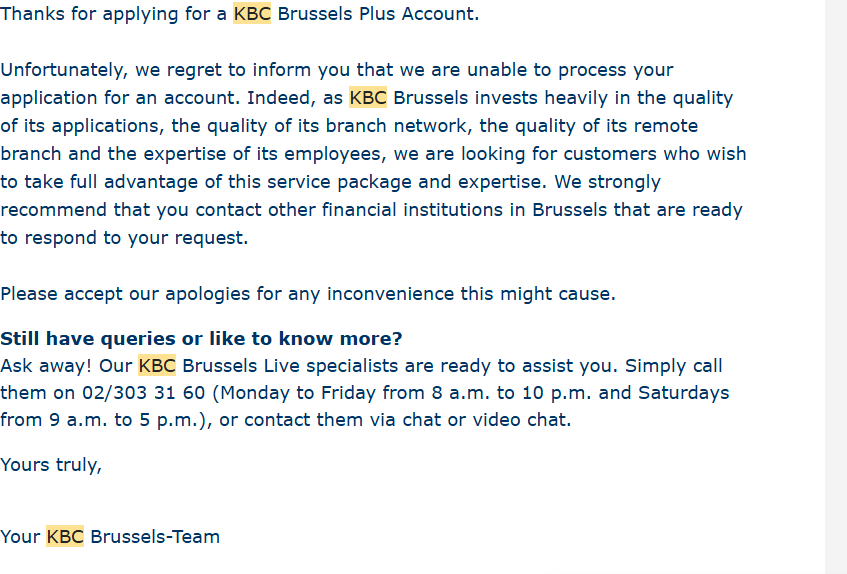

Communications sent to potential clients, as viewed by The Brussels Times, show that customers were routinely told that they would not be allowed to open a current account unless they subscribed to additional products, a policy not advertised on the official KBC Brussels website.

“KBC Brussels invests heavily in the quality of its applications, the quality of its branch network, the quality of its remote branch and the expertise of its employees,” an automated rejection emails sent to numerous readers states. “We are looking for customers who wish to take full advantage of this service package and expertise. We strongly recommend that you contact other financial institutions in Brussels.”

In another email, a bank adviser tells the customer that they would “not open the account” if the customer’s intention was “not to extend their business relationship to private and/or insurance.” In justification to this, the bank advisor stated that KBC Brussels did not wish to be a “transit bank account".

The Brussels Times attempted to open an account at a local branch and was also told that they would need to take out an insurance policy to open a bank account with KBC Brussels.

'Try another bank'

Complaints about this practice came from across Brussels, but the bank’s branch in the Merode neighbourhood was most frequently cited for this practice.

“I tried to open an account at a KBC Brussels branch at Merode, but was flatly refused,” one reader emailed The Brussels Times. “They said they do not even open accounts unless you have other products with them, like insurance. The situation was the same at KBC Brussels Schuman”

Credit: The Brussels Times

The annoyed customer, who is a lawyer by profession, stated that he believed the practice could be classified as “tying”, the practice of selling one product or service as a mandatory addition to the purchase of a product. This is illegal under competition law in the finance sector in Belgium and the rest of the EU. Test Achats, Belgium’s leading consumer protection association, told The Brussels Times that the true picture may be more complicated.

“The joint provision of financial services is prohibited," a representative of the association confirmed. “A bank cannot ‘oblige’ a future customer to take out insurance, open a savings account or use another service if they only wish to open a current account. However, a bank is not obliged to accept all customers who come to them and ask to open a current account.”

Test Achats explains that current accounts are often a “loss leader”, which allow banks to lead customers to more profitable products. Test Achats receives frequent complaints from around the country that it has become increasingly difficult to open a current account without additional offers.

“If the banks are to be believed, current accounts don’t bring in much for them. But nowhere in general terms and conditions or on the bank’s websites or in their promotions will you find an obligation to subscribe to one financial service in addition to another, as this is legally prohibited,” Test Achats noted.

Consumers pressured to take out insurance

Reader testimony suggests that this policy extends beyond ordinary current accounts. One reader, a professional footballer who came to Belgium for work, was refused a rental guarantee account without also purchasing insurance from KBC Brussels. The bank rejected a variety of profiles, including EU officials and even the head of mission at a major embassy in Belgium.

"We do not open bank accounts just so that you can have a card," one reader was told by an employee of the Merode branch of KBC Brussels.

Credit: The Brussels Times

Other readers declared their initial applications were only accepted after they declared that they would “consider” applying for additional products. Before clients may open an account at KBC, they are required to complete a questionnaire sent by one of the bank’s staff. Questions focus heavily on the client’s interest in additional products and the quantity of money that will pass through the current account.

“I honestly answered that I want to use the account for daily transactions and wasn’t planning to invest or open pension savings there,” one user emailed us. “I received a refusal to open the account.”

Some months later, the same client reapplied to the bank, instead indicating on the account survey that she “would consider” adding additional products. “Not surprisingly, they then approved my account,” she remarked. Another reader remarked that they promised to attend a “compulsory” meeting with an insurance advisor and did not attend. Their current account remains active.

Online reviews and testimonials posted on local Reddit threads confirm this trend. Dozens of internet users attest that they were also refused access to a current account for either their personal or business finances without signing up for expensive add-ons. "They refuse to open a bank account unless I invest or purchase insurance?" one Google user fumed about the Merode branch. "Bad customer service – refuses to open an account for you without your agreement to invest or take insurance, contrary to KBC’s policy online," another concurred.

On one Reddit thread posted on 10 February, 13 users testified that they had received the same reply from KBC Brussels when attempting to make an account. "They told me that KBC Brussels is not the best option for me because I don’t want to do investment nor house insurance with them, so they would prefer not to to open an account for me," one user stated.

Blocked from banking

In almost all the cases emailed to The Brussels Times, the account refusals were issued to EU nationals residing in Belgium. For non-EU residents, KBC Brussels’ refusals are even less transparent.

“When I moved to Belgium in February 2023 under a family reunification visa, I was filled with hope and excitement for a new chapter of my life,” one reader writes. “Little did I know that something as basic as opening a bank account, a necessity for daily life, would become a significant challenge.”

Illustration picture shows the installation of the mobile phone app of bank KBC in Dutch, Monday 9 April 2018 in Charleroi. Credit: Belga/ Virginie Lefour

The Brussels Times reader, originally from India, applied for an account to manage his expenses and receive payments but was quickly rejected by the bank. The reader claims that the bank cited internal policies without providing clear explanations. The Indian national was, however, able to open an account at ING Belgium “without any problems” and with the same documents.

Related News

- Belgian banks rent tens of thousands of safes to customers

- KBC nets €800m in customer deposits after State bonds mature

- KBC bank boosts profits in 2024

He says that many other non-EU residents face similar boundaries with KBC Brussels and other banks in Belgium, especially those moving to the country on family reunification visas.

“Why are legal residents, who are actively trying to integrate into Belgian society, being denied access to essential banking services?” he complained.

Test Achats says that banks sometimes reject account openings in due diligence procedures relating to suspected money laundering and terrorist financing and states that some professions are even viewed as "suspicious" in the eyes of banks. "They remain very discreet in this respect and this lack of transparency, which is understandable in terms of combating money laundering or the financing of terrorism, is very problematic for the average consumer," they explain.

If consumers suspect that they have unreasonably been refused an account or that their bank is attempting to tie banking products, they can report this to the Economic Inspectorate or the Financial Services and Markets Authority (FSMA) but Test Achats warns that this is not always effective, especially in the case of in-branch account openings.

All Belgian residents are entitled to basic banking services. In the case that customers cannot open a current account anywhere, banks must provide a "basic banking service" which cannot be refused. In practice, this is often a lengthy and complex procedure.

KBC Group declined to comment on the cases presented above, stating that due to legal reasons it could not comment on individual customer files. It did however state that it was "committed to building long-term relationships with its customers."

"KBC Brussels examines, together with its clients and in function of their specific needs and requirements, which are the best possible financial solutions for them," the bank said in a statement.