Are you feeling better off? I hope so – and so do European policymakers. The eurozone economy is entering its fifth year of recovery since the recession in 2012-3, the one caused by the panic that almost destroyed the euro and the lurch into extreme austerity. Growth in 2017 is expected to be at its strongest since 2010, when the economy was bouncing back from the financial crash.

Better still, there are good reasons to think the upturn will be sustained this year. Unemployment continues to fall, while inflation remains very low, so consumer spending looks set to continue rising. Business investment is finally picking up from its post-crisis doldrums. The European Central Bank is holding interest rates ultra-low and buying large quantities of government bonds to boost the economy. Fiscal policy – changes in tax and spending – is providing a slight stimulus too. And the eurozone is being lifted by a global economy that is finally firing on all cylinders, with stronger growth in all the major economies – the United States, China and Japan – except Brexiting Britain.

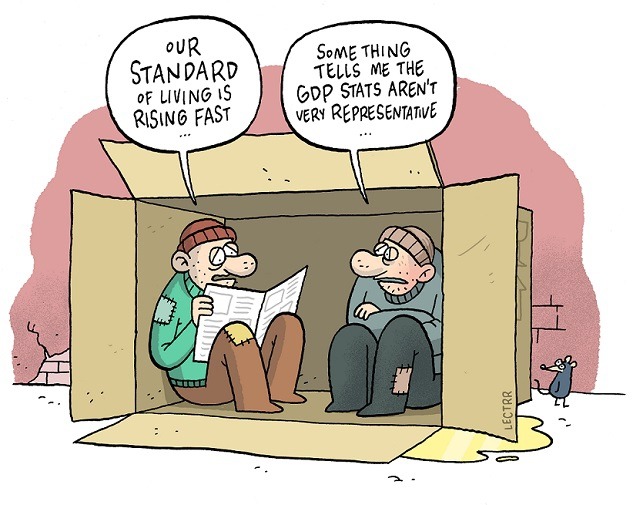

But how do you feel? To be more precise, do you think your standard of living is rising? According to the latest official figures, the eurozone’s gross domestic product (GDP) expanded by 2.6% in the year to the third quarter of 2017, but that tells us very little about how ordinary people are faring, let alone your own individual experience.

For a start, GDP is a flawed measure of economic activity and only a rough approximation of societal wellbeing. Moreover, the growth of the economy as a whole tells us nothing about how that increased prosperity is distributed. Over the past 35 years, the richest 1% of the population in western Europe captured as much of the total income gains as the poorest 51%, according to the World Inequality Report 2018. In North America, the top 1% took as much as the bottom 88%. So the growth of GDP per person greatly overstates how much most people’s living standards have improved.

Many reports have been written, books penned and conferences held on the deficiencies of GDP as a gauge of economic performance. It struggles even with the basics: distinguishing between increases in the quantity of spending on cars and improvements in their quality, let alone measuring the value-added of advertising or the contribution of financial services to the economy. Often it measures inputs – teachers’ salaries – rather than outputs: the value of the education that they provide. Services for which people aren’t paid aren’t counted. If two neighbours look after their own children, this adds nothing to GDP; if each pays the other to look after their children, GDP rises.

Worse, it counts some negatives as positives. Because it does not record changes in the valuation of assets or liabilities, GDP rises when an earthquake demolishes a town: the destruction isn’t counted, but the rebuilding effort is. A country that suffers a crime wave and ups its spending on security seems better off. The economic contribution of a factory that emits choking smoke is triply exaggerated: the harm to locals breathing filthy air isn’t deducted, while increased healthcare spending and the cost of cleaning up the pollution add to GDP.

One consequence of the crisis is that the estimated added value of the financial sector has shrunk, and GDP with it. But if much financial activity before the crisis actually generated little or no benefit to society – or was even harmful – the fall in GDP may exaggerate the decline in prosperity. On the other hand, the fall in GDP understates how much poorer Spaniards, whose home has plunged in value, feel. It also underestimates the mess that Greeks are in, given that their government has crippling debts to its eurozone counterparts.

On a positive note, we may be better off than GDP figures suggest because they fail to capture the benefits of all the new technologies that we get for free. The smartphone revolution and explosion of useful apps such as WhatsApp and Twitter have happened since the crisis; Apple only launched its first iPhone in 2007. Cloud-storage services like Dropbox are also new. And we now have immediate access anywhere to a huge variety of music from streaming services like Spotify, not to mention all the TV shows and films that you can watch on Netflix for a fraction of the cost of a cable TV subscription.

Clearly, governments ought to try to measure economic performance better. They should attempt to measure national wealth – physical, human, natural and social capital – as well as incomes. And they should try to gauge our wellbeing too: the value of increased leisure time, better health, longer life expectancy and so on.

The United Nations Development Programme’s Human Development Indicators are one attempt to do this. Its composite index charts slow but steady progress in Belgium so far in this decade. Clearly, though, no measurement is perfect. It is impossible to pin a number on our wellbeing that captures all the various facets of what makes a good life, still less to aggregate those numbers reliably.

Distributional divide

Trickier still is doing the opposite: trying to deduce how well citizens are doing from an aggregate figure like GDP.

The eurozone’s overall growth rate conceals huge disparities. The most striking ones are between countries. Between 2007 and 2016, GDP per person rose by 8% after inflation in Germany but fell by a quarter in Greece. Broadly speaking, richer northern Europe got richer and poorer southern Europe got poorer. Belgium (up 1.8%) did slightly better than the eurozone average (up 1%).

But there are also huge differences within countries. The wealthiest Greeks, who often squirrel away their wealth abroad out of the taxman’s grasp, have done just fine since their country’s debt crisis struck in 2010. The poorest tenth of the population have seen their meagre incomes plunge by 40%.

While averages are deceptive in unequal societies, median incomes provide a better measure of typical living standards than the mean. Imagine there are nine people in a Brussels bar who each earn between 20,000 and 40,000 euro a year. The richest one leaves the bar and Microsoft co-founder Bill Gates, who earns say ten billion euro a year, walks in. Suddenly the “average” person in the bar is a billionaire, even though the eight Bruxellois are no richer than before. So the median income – that of the fifth richest and fifth poorest person in the bar – seems more representative; it is unchanged.

To get a more accurate picture of people’s purchasing power, we also need to take account of taxes and government transfers, such as pensions. So it is better to compare net incomes rather than gross ones, although they still omit the benefits of tax-funded public services such as education that are provided free. Household size and composition matter too. A single mother with two children is in a very different situation to a professional couple with no kids. More fundamentally, we all have different needs. For instance, someone with a physical disability may need a higher income to be as mobile as other people are.

The EU-SILC survey attempts to measure the net purchasing power of the median equivalised household. It suggests that the income of a typical Belgian household rose by 4.5% in 2016, although the top 10% did much better than the bottom 10%. But those figures should be taken with a pinch of salt, because the survey suggests median incomes rose substantially even in the depths of the financial crash in 2008-9. That seems unlikely.

So perhaps it’s best to look at the simplest measure of our living standards: wages. For people of working age and their dependents, they are typically the main source of income.

Regrettably, the share of national income that goes to labour in the form of wages has fallen in recent decades, while the share that goes to owners of capital in the form of profits has risen. Perversely, that is partly a consequence of official eurozone policy, which seeks to drive down labour costs – wages – to make exports cheaper. Thus while GDP per person in Belgium rose by 1.2% in 2016, the purchasing power of the average worker’s wages fell by 1%.

The good news is that wage rises finally outpaced inflation in the first half of 2017. A typical Belgian worker probably got better off last year. And with an average salary of 3,813 euro a month, Brussels is financially the most attractive region of Belgium to work in – even more so if you work tax-free for the EU institutions.

By Philippe Legrain