Despite a general rise in property prices across Belgium, Brussels was the region that was most stable, largely due to the fact that purchasing power among homebuyers is also the lowest in the Capital Region.

2023 saw the property market cool considerably with a 15.2% drop in sales. The first quarter of 2024 registered a slight growth in real estate sales (+0.7%), according to figures reported by Immoweb on Tuesday. This shift was largely driven by stabilising interest rates (now at 3.4%).

"The slight fall in interest rates plays a crucial role in strengthening household purchasing power. This has increased by 6 square metres (m²) on average since December 2022 to 109 m²," said Piet Derriks, Managing Director of Immoweb. Derriks added that wage indexations also boosted the purchasing power of Belgian households.

At the end of 2023, the property purchasing power among homebuyers averaged 105 m². The latest figures for 2024 show that those in the market to buy a home can still not afford as much as in January 2022, when interest rates were 1.35% for 20-year loans which raised the purchasing power to the highest level in recent years.

Highest price per m²

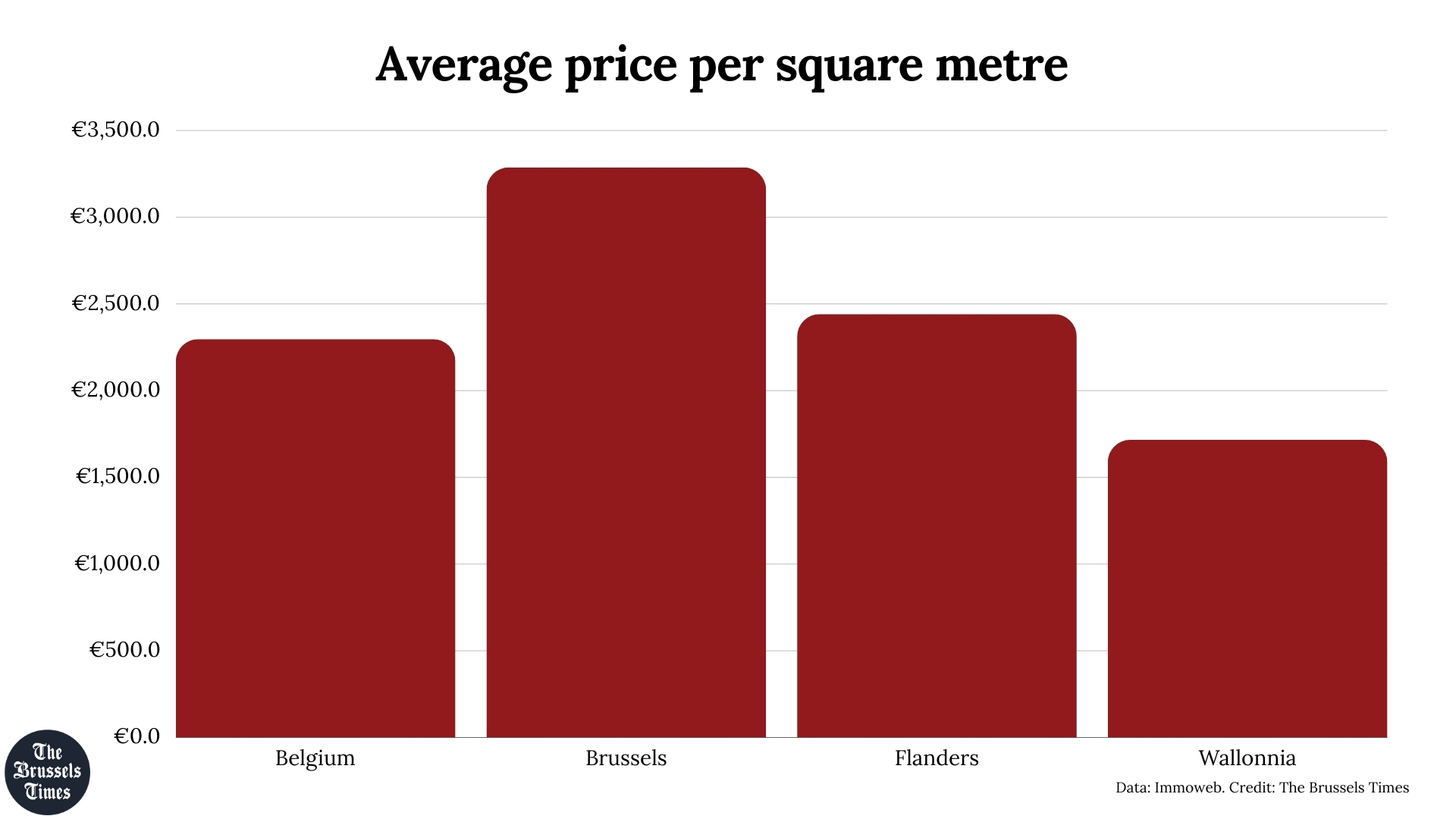

The average price per square metre for properties across Belgium stood at €2,297 at the start of this year – up 0.7% increase compared to the previous quarter, when no growth was recorded.

"This increase is more pronounced than the 0.4% rise seen in the first quarter of 2023," Derriks noted. "Nevertheless, growth remains below the levels seen in the post-Covid period (1.9% in Q1 2021 and Q1 2022) and in the post-financial crisis period from 2016 to 2022."

The growth was more moderate in Brussels (+0.2%), which can be explained by the fact that the region has the highest prices in all of Belgium. "Buyers are reaching their maximum borrowing capacity faster due to higher prices," Derriks observes.

He explains that a slight drop in house prices in Brussels (-0.1%) is also due to houses in the region having the worst EPC (energy performance certificate) scores with 61% of houses in F and G. This comes at a time that this score is increasingly impacting selling prices. Among flats, prices increased by 0.5%.

At €3,287, the Capital Region still has the highest price per m². This is almost double the cost of Wallonia (€1,716/m²), and around €800 more expensive than Flanders (€2,441/m²). Wallonia recorded the largest price increase during the last quarter (+1.2%).

Logically, the real estate purchasing power is also the lowest in Brussels at 60 m², more than half the level in Wallonia (146 m²) and also significantly lower than in Flanders (104 m²).

A further fall in interest rates is possible from the summer, which could see more buyers gradually find their way back to the property market, an effect that may be amplified with the arrival of spring, which traditionally sees real estate activity rise. Immoweb therefore advised people looking to buy now to negotiate the lowest price.