A senior Belgian politician has claimed that Brussels could become bankrupt within the next few years and called on fellow policymakers to implement "urgent" measures to ensure the city's financial survival.

In an interview with l'Echo, former Auderghem mayor and current Brussels MP Christophe Magdalijns of DéFI (a centrist Brussels-based French-speaking party) argued that the capital's skyrocketing public debt cannot solely be put down to recent crises such as the Covid-19 pandemic or the war in Ukraine.

"The figures are clear, the Brussels-Capital Region is falling into bankruptcy," he said. "If nothing is done, it will experience its worst ever budgetary and financial crisis. It's only a matter of time."

"The Region's expenses are growing more than its revenues and the deterioration of the balances is not solely due to crisis spending. The majority of politicians don't live within budgetary constraints."

A fiscal fiasco

Magdalijns' views appear to be strongly supported by the data: Brussels' public debt has nearly tripled over the last five years, from €4.7 billion in 2018 to €13 billion today.

Moreover, a recent analysis by economists at the University of Namur forecasts that without radical budgetary adjustments, the capital's debt will rise a further 50% (to €19.4 billion) by 2028. The study also predicted that the city's ratio of expenses to revenues will grow from 190% to 285% over the same period.

The city's mounting debt comes against the backdrop of a fiscal crisis deepening across the rest of Belgium. According to the EU's official statistics office, Belgium's total government debt-to-GDP ratio of 107.4% is the sixth highest in the bloc and nearly twice the EU's 60% legal threshold.

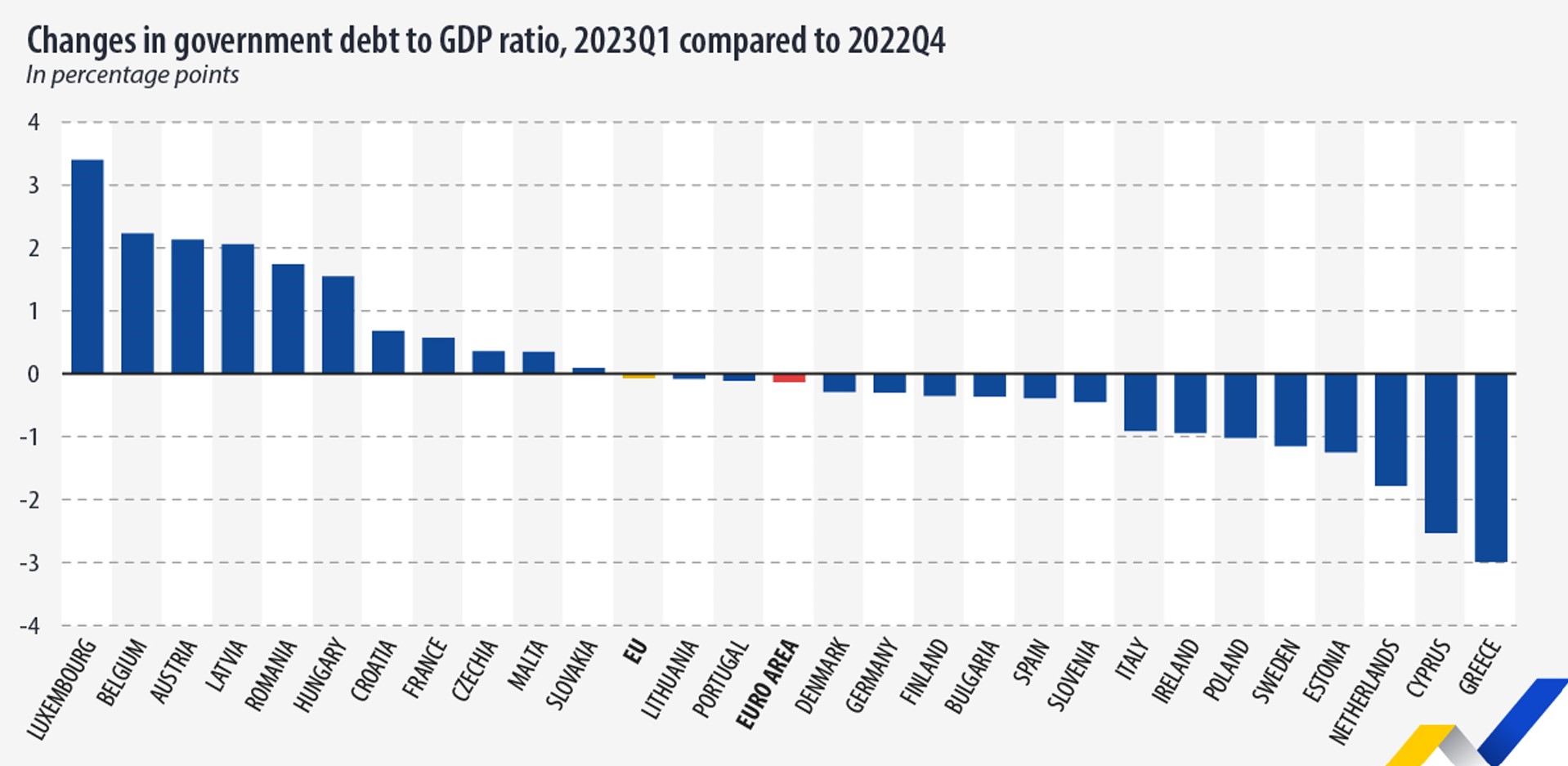

Even more worryingly, Belgium's debt levels are rising far more rapidly than the majority of other EU Member States. In the first quarter of this year, Belgium's debt-to-GDP ratio grew by 2.2 percentage points – surpassed only by Luxembourg.

Credit: Eurostat

Even relative to the rest of Belgium, Brussels' debt crisis is particularly severe. The Institute of National Accounts (l'Institut des comptes nationaux) recently reported that between 2018 and 2022 the public debt in Brussels grew one-and-half times faster than in Flanders and two times more rapidly than in Wallonia.

For Magdalijns, the way to remedy the situation is obvious: public spending must be cut, and soon. "A significant multiannual decrease in spending by 2027 is becoming an urgent and unavoidable imperative," he said.

"Time is running out. The Brussels Government should take responsibility to avoid being awarded the title of worst managers in the political history of Brussels."

Related News

- Belgium's economic forecast revised downwards for 2023-24

- Belgian economy growing at just half OECD average rate

Unfortunately, cuts in public spending would likely only exacerbate Belgium's already severe cost-of-living crisis. More than half of all Belgians (53.3%) reported experiencing some financial difficulties in 2022: a 4.3 percentage point increase compared to the previous year.

Indeed, a recent study by the National Bank of Belgium (NBB) noted that Belgium's public funds are primarily allocated to programmes which help poorer citizens. Half of the country's total budget is spent on social protection and healthcare, while public services, economic affairs, and education each account for roughly 13% of public expenditure.