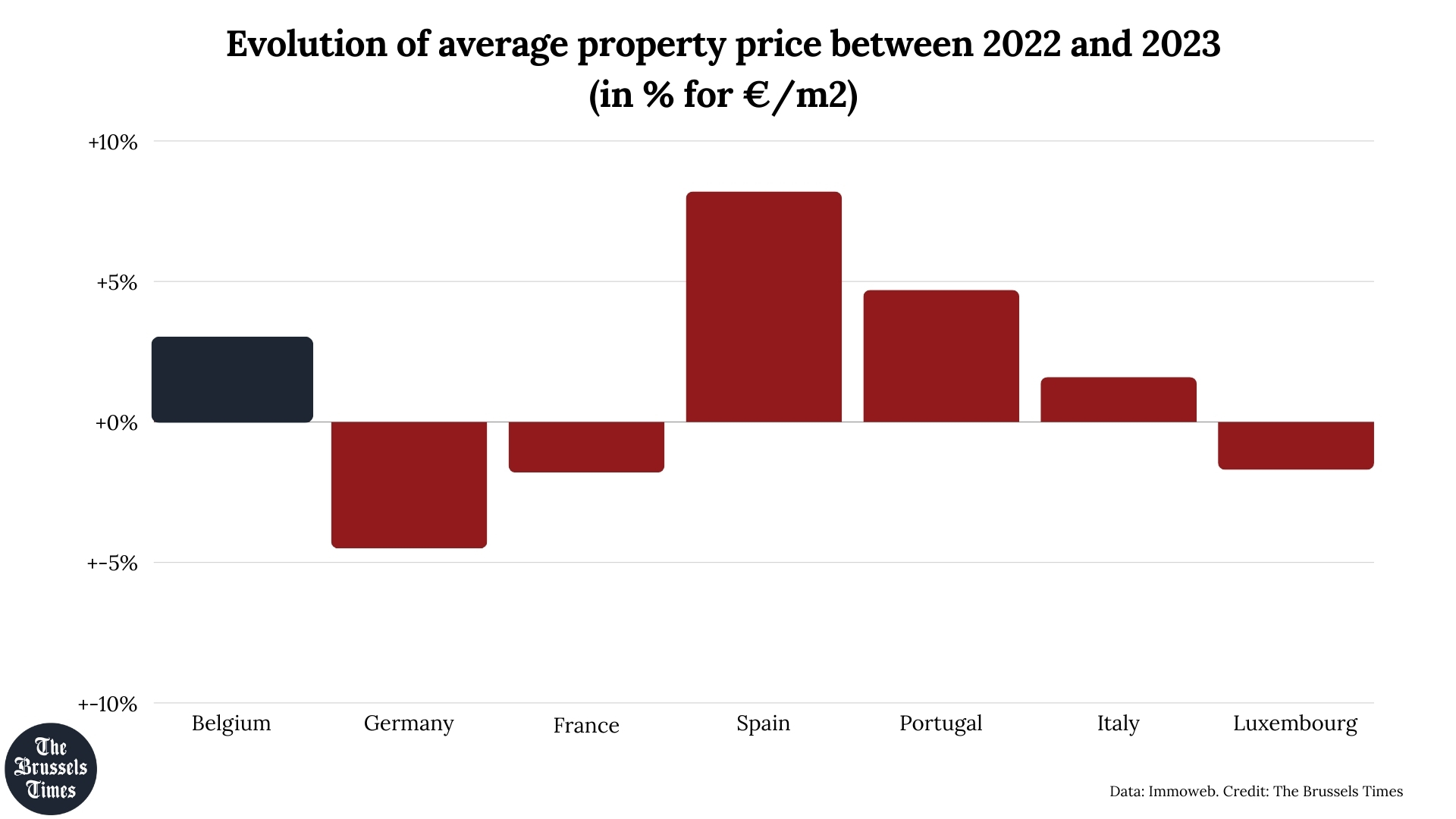

Flats and houses in Belgium's surrounding countries became cheaper in 2023, while here, they continued to rise despite high interest rates. Still, the property purchasing power in Belgium remains much higher.

Following a steady upward trend of property prices in Europe in recent years, largely driven by the skyrocketing demand during the pandemic, European property markets experienced significant slowdowns in price increases in 2023.

Despite the cooling down of the national market driven by rising interest rates and stricter mortgage conditions, which saw demand decrease, the cost of houses and flats in Belgium still rose last year.

However, house and flat price increases recorded a stark slowdown: they rose by just 3% in 2023, the lowest in five years and down from an average of 10% between the end of 2020 and 2021, Immoweb stated in its AVIV report covering the last quarter of 2023. The slowdown, which was most noticeable in Brussels, is expected to "continue for the next 12 months."

The report compares the situation in several European countries with that in Belgium and shows that in neighbouring countries, the drop in demand led to a decline in prices and even ended the year with negative annual property price growth. This was the case in France (-1.8%), Germany (-4.5%) and Luxembourg (-1.7%). In southern European countries, the prices did increase compared to 2022.

Two fewer rooms

Rising interest rates have put palpable pressure on Belgians' real estate purchasing power over the past year due to the significant impact on household borrowing capacity.

According to the latest harmonised figures from the European Central Bank (ECB), interest rates in these countries hovered around an average of 4% at the end of 2023. By comparison, in January 2022, 20-year mortgages were available at attractive interest rates averaging 1.5%.

The property purchasing power of Belgians now stands at 144 m2 (-16%), the lowest in two years and down by almost two rooms compared to recent years. However, in terms of purchasing power, Belgium still comes out on top when compared to other European countries. In Germany, France and Luxembourg, the purchasing power was 99 m2, 81 m2 and 63m2.

This can be explained by the relatively low average price per m2. With an average price of €2,301/m2, Belgium's price level is close to that of southern European countries (around €2,000/m2). By comparison, the cost is €3,013 and €3,127 in Germany and France, respectively. In Luxembourg, the average price per m2 is a whopping €8,342.

Meanwhile, the median household income is significantly higher in Belgium than in other European countries. "Belgians earn about €58,548 a year, which even puts them ahead of Germany (€51,888) and France (€45,954)," Immoweb explained.

Banks are anticipating a possible cut in the ECB's key interest rates by the summer of 2024 and have therefore already cut their mortgage rates, including in Belgium. This resulted in purchasing power here rising by 9 m2 (from 135 m2 to 144 m2) between 1 November 2023 and 1 January 2024.

Related News

- All Brussels homes must have energy performance certificate by 2030

- The blight of 'illegal' Airbnbs: Brussels takes steps to protect affordable housing

- Property prices steady, but noticeably fewer sales in 2023

This positive trend can also be seen in Germany and Luxembourg, with increases of 11 m2 and 6 m2 over the same period respectively. "With the ECB about to cut interest rates, purchasing power in most European countries is expected to increase in 2024," Immoweb noted.

"Unfortunately, the expected improvement in credit conditions may not be enough to revive demand in some countries. There, it will take longer to reach their original affordability levels, even despite any price drops."