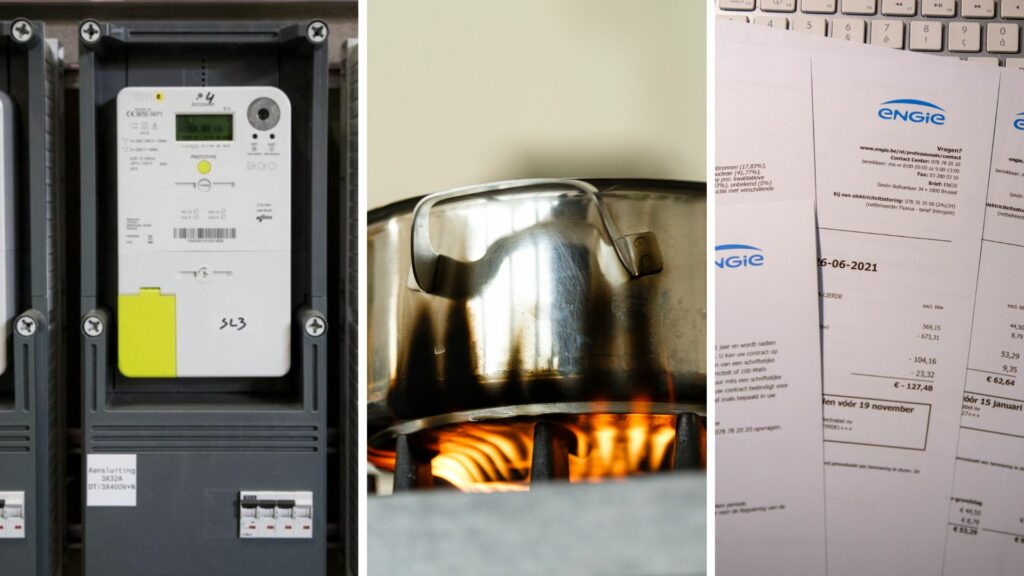

Nearly six in ten Belgian households have not (yet) increased their monthly/quarterly advance payment bills in recent months, a survey commissioned by electricity supplier Luminus finds. In light of the sky-high energy prices, the company warns of a "bill shock" on their final bill at the end of the contract year.

Most consumers receive their advance payment bill on a monthly basis. But this is an estimate based on the previous year's meter readings or the consumption history of the past three years. This allows customers to evenly spread the cost of their energy bills over the entire year. At the end of the contract year, the settlement for the annual consumption follows, taking into account the advance payments already made.

In practice, this means that households whose consumption and energy costs this year are higher than last year, will likely have to pay extra at the end of their contract year. If the costs are lower than last year (unlikely considering the current energy crisis), the supplier will refund the excess.

'Bill shock'

For those with a fixed-rate contract, the sum of their 12 monthly advance payments should approximately amount to the total on their final annual bill – meaning they will not have to pay extra or be refunded a large amount if they consume roughly the same amount of energy year after year.

Households with a variable contract, however, are in a very different situation. While the amount on their advance payments remains unchanged throughout the year, the energy supplier adjusts its prices monthly or quarterly, depending on the prices on energy exchanges.

The sharp price rises will likely lead to a "bill shock" for many households on a variable energy contract, as their real cost of consumption this year will be much higher than what they have already paid in monthly advances.

Related News

- European Commission opens door to temporary EU gas price cap

- Belgian households consumed 18% less gas in first half of year

- Belgium to make reduced 6% VAT for gas and electricity 'permanent'

Still, overpaying in advance to save yourself the shock is not advisable either. If the proposed advance amount seems unusually high, households are effectively bankrolling their energy supplier. Should their energy supplier go bankrupt, they may not be able to recover the advances paid.

That is why, Luminus stresses, it is advisable to match advance payments as near as possible to the actual consumption costs, even if that means your monthly bills are higher than usual.

Since nearly no fixed-rate contracts are being offered today, most households are expected to see their real consumption costs rise sharply. Yet the survey of 2,000 Belgian households by Ipsos and Sia Partners shows that only 42% have already increased their advance payments, and another 13% are still planning to do so.

Credit: Belga

People wanting to increase their advance payments can make a realistic estimate using Fluvius' user portal and the apps of several energy suppliers, if they have a digital meter. Those with an analogue meter would do well to report their meter readings regularly.

In addition to the variable prices, household composition and living comfort also affect real energy consumption. A family with children who have moved out this year may suddenly consume a lot less. The same goes for a house that has just been insulated or equipped with renewable energy.

In that case, it may be advisable to reduce the advance payment. However, given the current volatile prices, another option is to first wait for the next final bill and then see whether it is possible to adjust the advance amount.