Banks, insurance groups and pension funds are the biggest European investors in fossil fuel companies, new research based on January 2023 data shows. The Norwegian Government Pension Fund Global (GPFG) is the biggest fossil fuel investor in Europe and the 11th biggest in the world, with over €37,25 billion worth of shares and bonds in oil, gas and coal.

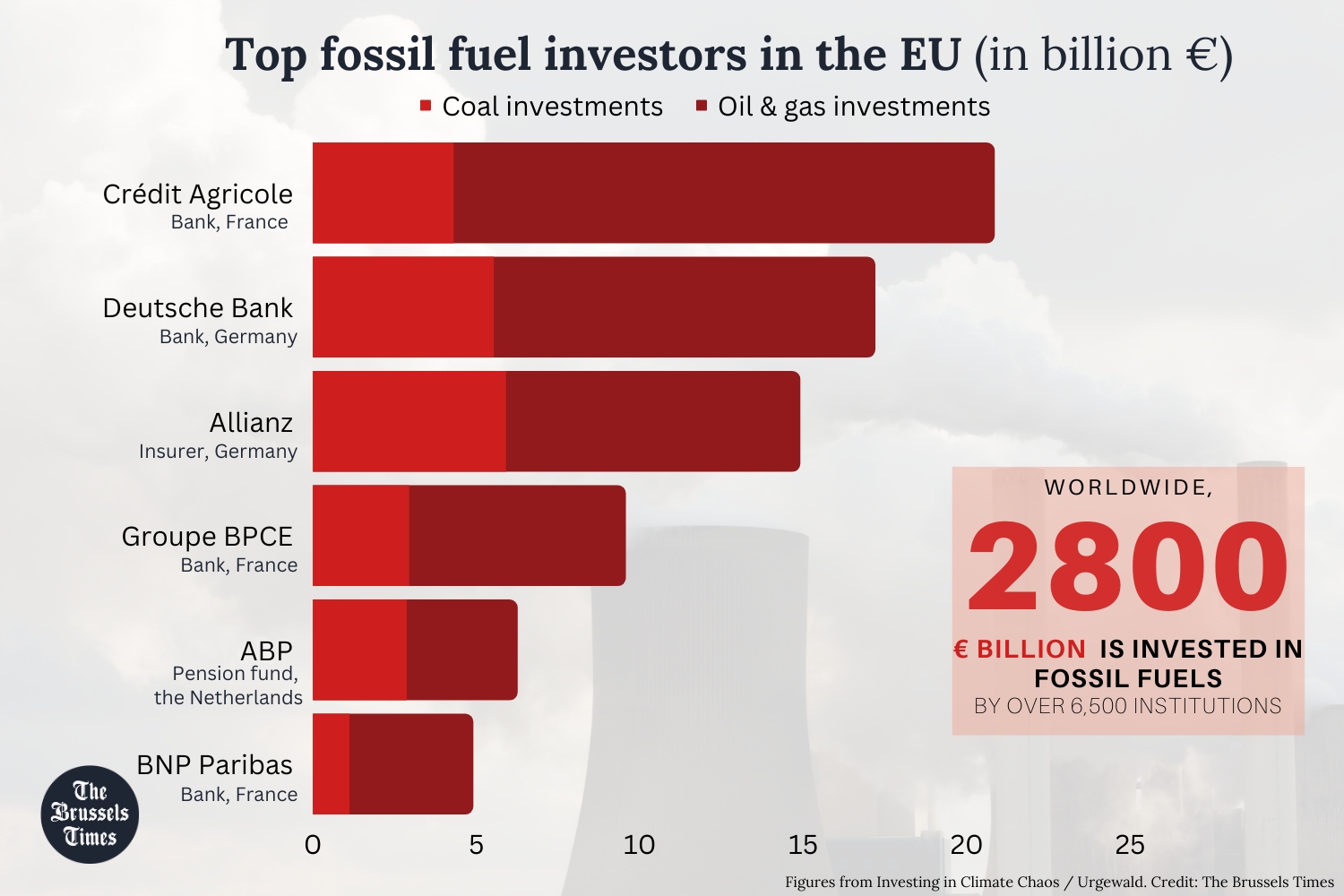

Banks and financial groups make up the bulk of European investors in the world's most polluting industry: Crédit Agricole (France), UBS (Switzerland), Legal & General (United Kingdom) and Deutsche Bank (Germany) are the top investors after Norway's GPFG. All have more than €17 billion tied up in fossil fuel shares and bonds, according to the financial data collected by the German environment NGO Urgewald.

"At a time when the UN warns that greenhouse gas emissions must be cut in half by 2030, pension funds, insurers, mutual funds and asset managers are still gambling away our future by sinking money into the world’s worst climate offenders," said Katrin Ganswindt, Urgewald's Energy and Finance Campaigner.

"By publishing our research online, we want to empower clients, regulators and the public to hold these institutional investors accountable," she added.

Fossil fuels supply around 80% of the world's energy and are the largest emitters of greenhouse gases, like CO2, which trap heat in the Earth's atmosphere leading to global temperature rise. The IPCC, the world's leading group of climate scientists, said that fossil fuel emissions must be halted over the next decade in order to prevent catastrophic climate scenarios.

In its latest report, the IPCC draws attention to the fact that global public and private finance for fossil fuels still exceeds funding for climate adaptation and mitigation.

Pensions for the future?

Besides the Norway fund's colossal investment, pensions of citizens from the Netherlands and Sweden are also massively used to bankroll the fossil fuel industry.

The Dutch Algemeen Burgerlijk Pensioenfonds (ABP) is the fourth biggest shareholder of fossil fuel companies in the EU and has over €6 billion in shares and bonds. For comparison, BNP Paribas – a bank named as the most polluting in Belgium by environmental groups and the first commercial bank to be sued over fossil fuel financing – has shares and bonds worth €4.82 billion in the industry.

ABP made headlines back in 2021 when it promised to divest away from fossil fuels and sell most of its €15 billion worth of assets by the first quarter of 2023. The Urgewald investigation specifies that they retrieved financial data in January 2023, but exact timestamps may vary, so it remains unclear just how far along ABP is now in its process of divestment.

The Swedish public pension fund is another major European public investor in fossil fuels, with €3 billion worth of shares, most of which are in US corporations like Chevron and Blackrock.

'Sustainable' partners

Eleven Belgian companies were found by Urgewald to have shares and bonds in fossil fuel companies. The biggest investment comes from Ackermans & Van Haaren, a company that markets itself as "a partner for sustainable growth," partly because of investments in offshore wind energy.

The report found that they have over €845 million in fossil fuel companies' shares and bonds. Most of it is invested in oil companies TotalEnergies and Shell.

Worldwide, Urgewald found that €2.8 trillion is being invested in fossil fuel companies, by over 6,500 institutions. They believe that figure is likely an underestimation, Ganswindt told the Financial Times. US-based investors make up 64% of global investments. Only two US investors, Vanguard and Blackrock, are responsible for 17% of all institutional investments in fossil fuels.

Related News

- Stricter EU climate laws: Households will soon pay for CO2 emissions

- NGOs take European Commission to court over gas

- European Commissioner 'deeply disappointed' by Flemish attitude to EU climate law

With 12% of the total, Europe has the second-highest number of fossil fuel investors, who poured over €336 billion in shares and bonds.

The report warns about investors making promises about sustainability. “Net zero commitments for tomorrow have zero traction if institutional investors continue backing the companies behind today’s fossil fuel expansion,” said Paddy McCully, an analyst for Reclaim Finance.