Whatever way you dice it, there's no getting around the fact that 2024 was a bad year for job losses in Belgium.

Exactly how many people lost their jobs this year won't be clear until early in 2025 but we already know that 2024 has seen massive layoff announcements – most notably in the auto manufacturing sector.

April saw the family-run Belgian bus manufacturer Van Hool announce one of the biggest mass redundancy programmes in national history, with up to 1,850 job losses expected.

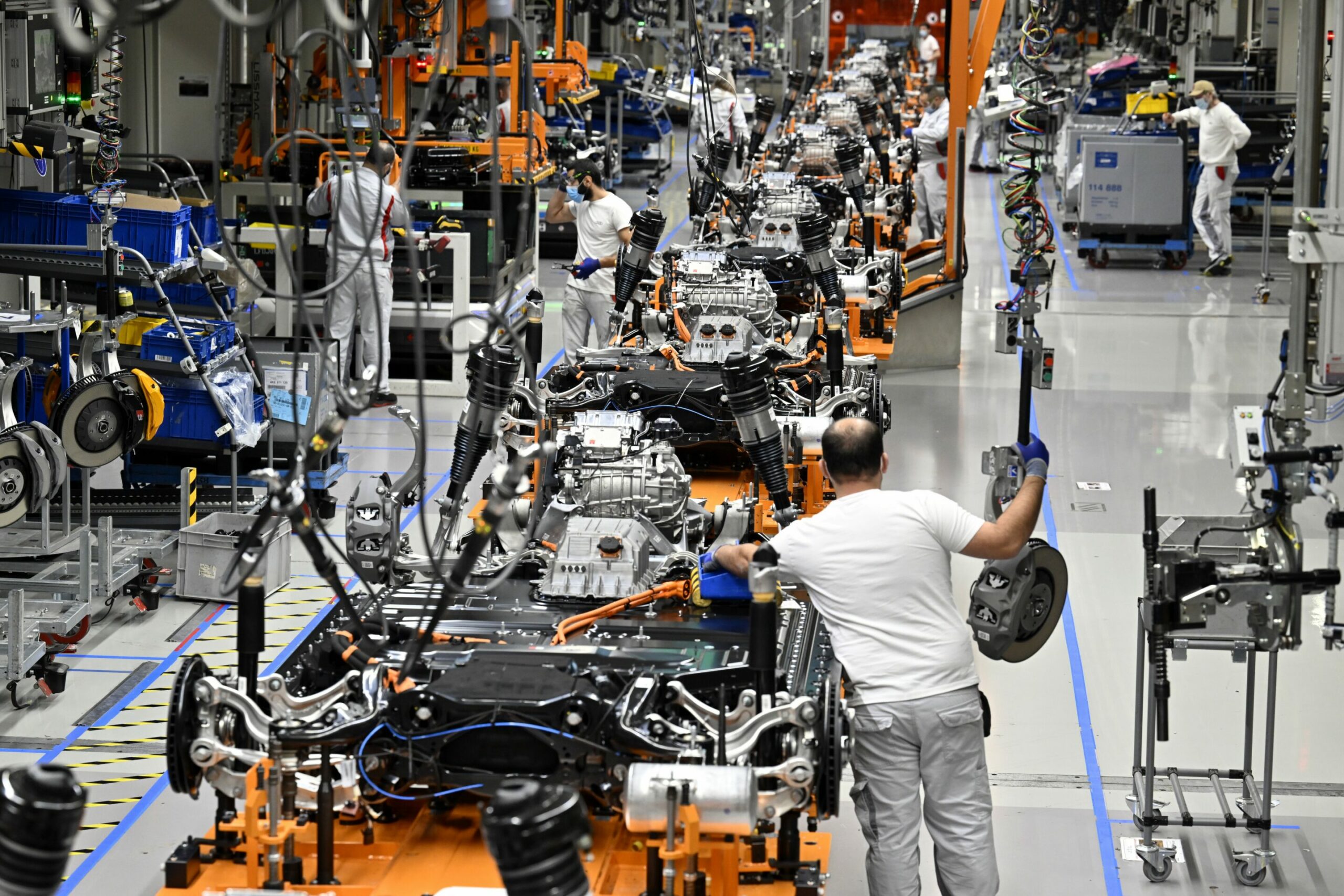

By July, Volkswagen announced restructuring plans for its Audi production site in Brussels which employs around 3,000 people. Despite searching for a buyer and protests on the streets of Brussels, the factory is set to close next year. Management are currently trying to reach agreement with workers and unions about redundancy payouts.

Car tyres resembling the Audi logo are set alight outside of the Audi Brussels plant in Forest, Brussels, 9 September 2024. Credit: Belga / Jonas Roosens

Other major job cuts announced this year in Belgium included more than 500 roles at chocolatier Barry Callebaut, almost 500 jobs at personal hygiene group Ontex, up to 530 roles at imaging technology company Agfa, 385 redundancies announced by freight and delivery company FedEx, 255 job cuts by pharma giant Pfizer, and 225 jobs at Tupperware.

The latest figures from Belgian statistics office Statbel show that a total of 10,065 companies went bankrupt in the first 11 months of the year – 7.9% more than in 2023 and up 18.9% compared to 2022 figures. These bankruptcies have led to the loss of 29,711 jobs. Still with a month left in the year, the 2024 figure is already higher than the total for 2023 (27,517) and 2022 (22,400).

Looking at companies that restructured this year (rather than going completely bankrupt), the first three quarters of 2024 saw 68 businesses announce redundancy plans, affecting 8,878 employees. Again, these figures have already surpassed annual totals for previous years: 7,339 workers were affected by redundancy announcements in 2023 and 3,075 in 2022 (although that year was the lowest for mass redundancies in more than a decade).

Exceptionally bad or a sign of things to come?

Eva Van Belle, assistant professor at VUB who specialises in labour economics, tells The Brussels Times that while it's difficult to put an exact figure on it just yet, "it has been a bad year".

She explains that exceptional layoffs like those at Audi Brussels have had a big impact on this year's figures. This makes it hard to tell whether rising job losses overall is a trend that will continue into 2025.

While the sheer size of companies operating in the automotive industry means that any layoffs they announce will be significant, Van Belle notes that the sector has "not been doing very well" for several decades. "If you look at the overall mass layoff statistics, you clearly see jumps in the years where there has been mass layoffs in the automobile sector because we are immediately talking about a larger number of jobs that are affected."

"But there also seems to be a trend in the automobile sector that is not doing very well over the last decades. And it's not just in Belgium, we also see it in the rest of Europe."

In October, the European Association of Automotive Suppliers (CLEPA) raised the alarm on record job losses in the European automobile industry, with nearly 86,000 positions cut since 2020.

Labour-intensive industries in Belgium and elsewhere in Europe are struggling to compete with cheaper wages in places like China or Mexico, and more specifically in the automobile sector European companies are facing steep competition from cheaper Chinese electric vehicles.

Production of the Audi e-tron at the Audi Brussels plant, in Vorst-Forest, Brussels. Credit: Belga / Eric Lalmand.

While the EU has recently imposed steep tariffs on imported Chinese EVs in an effort to level the playing filed for European manufacturers, Van Belle points out that "we don't know how China is going to retaliate" and it is unclear what next year could hold for Europe's automotive industry.

Added to this is the uncertainty over potential tariffs which could be introduced on European exports to the US by incoming president Donald Trump.

High labour costs

Regardless of geopolitical developments, there is no escaping that labour for the manufacturing industry is expensive in Belgium.

"The whole reason why the manual industry is having a tough time is because it's a labour-intensive sector and labour in Belgium is expensive. Even if workers in Belgium are more productive than in other countries this doesn't compensate for the additional labour costs in Belgium or elsewhere in the European Union," Van Belle explains.

"Companies are shifting their production to Mexico or China or countries where labour is much cheaper. Unless there is a technological shift to make these sectors less labour-intensive, I don't see these movements changing." And if technologies evolve to make manufacturing less labour-intensive, this will not stem the tide of job losses.

"Maybe a technological shift could help companies stay in Belgium. But then Belgian workers will be replaced by a robot rather than a Chinese or a Mexican worker. It doesn't make much difference for them."

Positives in employment levels

Despite a spike in job losses, overall the labour market remains tight in Belgium. The country's unemployment rate reached 6% in the third quarter of the year, while the employment rate is at 72.3%.

Van Belle said that Belgium's current employment rate and labour force participation rate are "historically high" with more people employed or actively searching for a job than in previous decades. Unemployment rates are historically low.

"Overall, our labour market still looks very healthy. We're coming from a peak in tightness of the labor market right after the Covid-19 pandemic. So we do see some tendencies towards increasing unemployment and lower job vacancy rates, which will probably continue. But we're coming from an incredibly tight situation so we're not in a slow labour market by any means."

A job centre. Credit: Belga

A tight labour market is good news for employees and job seekers as there are fewer candidates for open roles. As a result candidates have more bargaining power to negotiate a better salary or contract.

"In general it's good for employees as employers have to fill their roles and be more accepting of the conditions set by employees. Of course, this is from a very global perspective and that isn't the case for all sectors and all roles. There are still sectors in which unemployment is higher and other sectors where unemployment is lower."

Looking ahead, that demographic trends will keep the labour market tight as the Belgian population ages and more people retire.

Invest in re-skilling and lowering taxes

Van Belle believes there is little the next Federal Government can do to prevent more mass layoffs next year. "It's very difficult to prevent collective job losses. We've seen it with the example of Audi Brussels – the government invested a lot of money trying to avoid the situation that we are in, and to no avail."

"In the long term, industries are seeing their costs increase and their demand decrease. As a small country I don't think there is much you can do to keep these companies in the long term. Money used to these ends could probably be used more efficiently to look at how can we prevent job losses on a global level."

Van Belle highlights taxation rates, which could be lowered to help reduce high labour costs in Belgium. There also could be greater investment in re-skilling people who lose their jobs, including by ensuring a high base level of education to make it easier for people to retrain.

She also notes that a more efficient benefit system, where unemployment payments are relatively well matched to previous income, could act as a "buffer" when there are significant job losses in one area. If the system is too stringent and people suddenly lose a large portion of their household income, she warns of the ripple effect on the wider local economy as households suddenly stop spending.

"This triggers a vicious cycle where people consume less, demand goes down and that may affect other jobs."