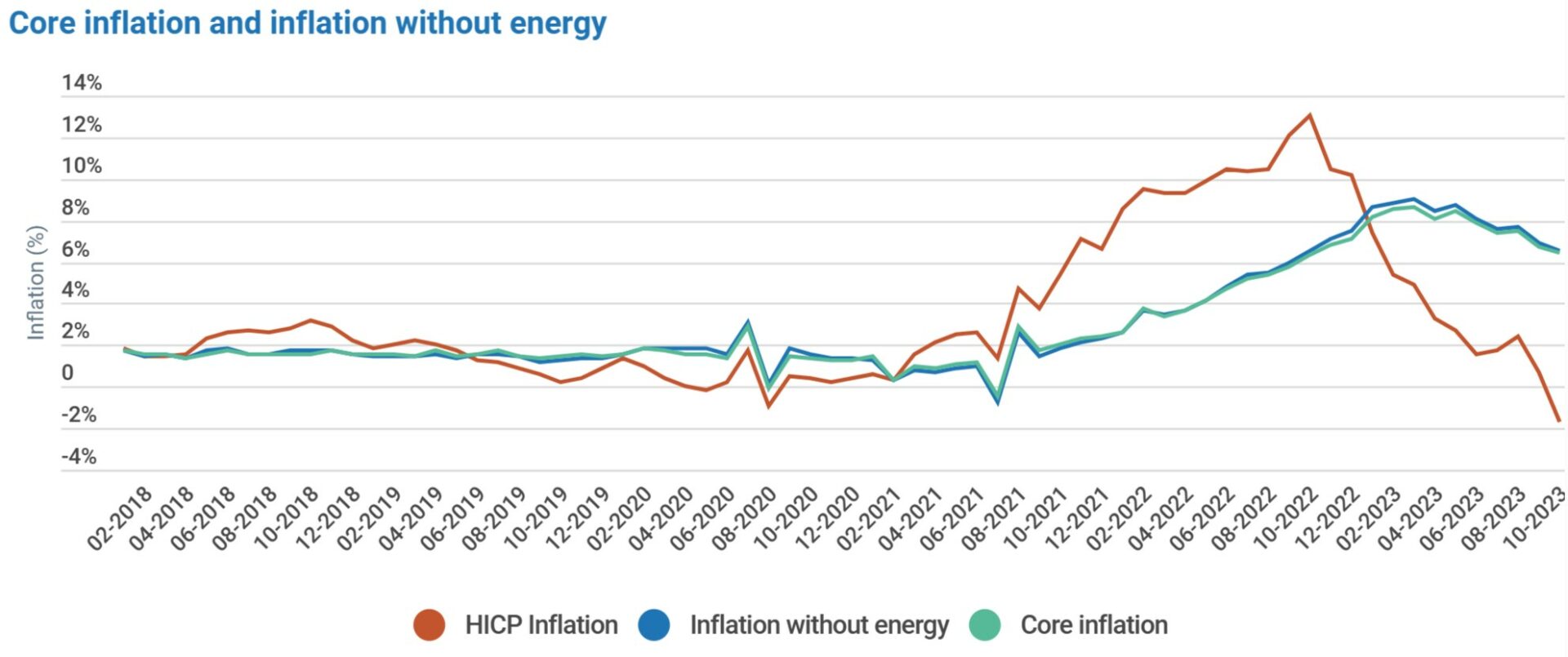

Belgium's annual headline inflation rate slipped into negative territory in October, as easing energy costs caused price pressures to fall to the lowest level ever recorded.

According to figures released by Statbel, Belgium's year-on-year inflation rate fell from 0.7% in September to -1.7% in October. This matches the all-time record low set in July 2009.

The report noted that "most of the decrease in inflation can be associated with lower energy prices", with gas and electricity now 50.7% and 77% less expensive respectively compared to this time last year. Food inflation also underwent a marked decline, from 11.4% to 9.2%.

Credit: Statbel

Belgium's core inflation rate, which strips out energy and volatile food prices, remained significantly higher than the headline rate. However, it also underwent a noticeable decrease, from 6.7% to 6.4%.

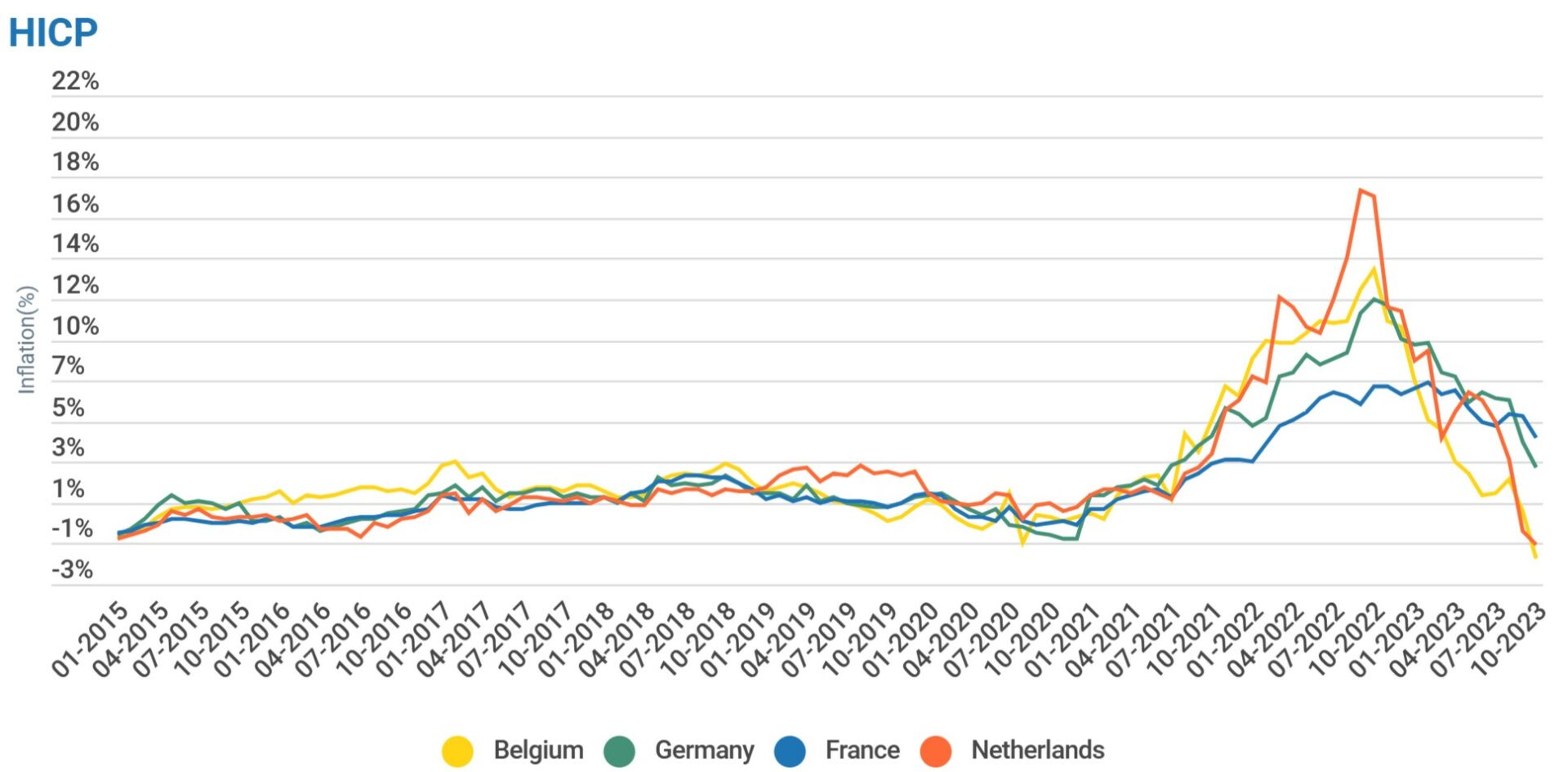

Belgium's inflation rate was also found to be significantly lower than in neighbouring countries, despite the fact they, too, all experienced an easing of price pressures. This includes the Netherlands (where inflation fell from -0.3% to -1.0%), France (5.6% to 4.5%) and Germany (4.3% to 3.0%).

Credit: Statbel

Headline inflation in Belgium has fallen fairly steadily since peaking at 13% in October last year. Core inflation has also steadily declined since reaching a record high of 8.6% in March.

'The disinflationary impulse will be less prominent'

In its Autumn 2023 Economic Forecast published on Wednesday, the European Commission predicted that the eurozone's annual headline inflation rate will fall from 5.6% in 2023 to 3.2% in 2024, before dropping even further to 2.2% in 2025. This is close to, but still above, the European Central Bank's (ECB) 2% target rate.

Speaking to reporters, European Commissioner for Economy Paolo Gentiloni claimed that "the disinflationary impulse from energy prices over the forecast horizon is set to be less prominent".

He also suggested that the rapid decline in inflation in the eurozone over the past few months is largely a consequence of the fact that energy prices were so high last year.

"Inflation is set to continue declining in 2024 and 2025, though at a more moderate pace. Given the recent rise in energy commodity prices and the assumed expiry of energy measures, consumer energy prices will no longer push inflation lower in a decisive way."

'Increased uncertainty'

The European Central Bank (ECB) has raised interest rates ten times in the past year-and-a-half in its efforts to dampen persistent price pressures throughout the eurozone, bringing its benchmark deposit facility rate to a record high of 4.00%.

In a recent interview with The Financial Times, ECB President Christine Lagarde suggested that the current crisis in the Middle-East could lead to further price hikes – and, hence, additional ECB rate increases – in the near future.

Related News

- 'High interest rates not welcome': Trade unions send mock gift to eurozone bankers

- Belgian economy will be among the worst in Europe, says IMF

"The kind of supply shock that could possibly hit us, depending on how the situation evolves in the Middle East and how Iran is brought into this and what is the global reaction – these are huge question marks and massive worries on the horizon," she said.

Lagarde's comments were echoed by Gentiloni. "Heightened geopolitical tensions have further increased the uncertainty and risks clouding the outlook," he said.