With elections in just over a month, Belgium's political parties have been launching proposals left, right and centre. But are they fully costed or costly promises? And which might actually yield results?

Since 2014, all party election proposals must be costed by the Federal Planning Bureau (the government agency that produces economic studies and forecasts). Whilst this is not an exhaustive calculation, the Federal Planning Bureau takes into account up to 30 of a party's main proposals to assess whether they can be implemented effectively.

The full calculations can be found here.

Reining in the deficit and restricting tax revenue

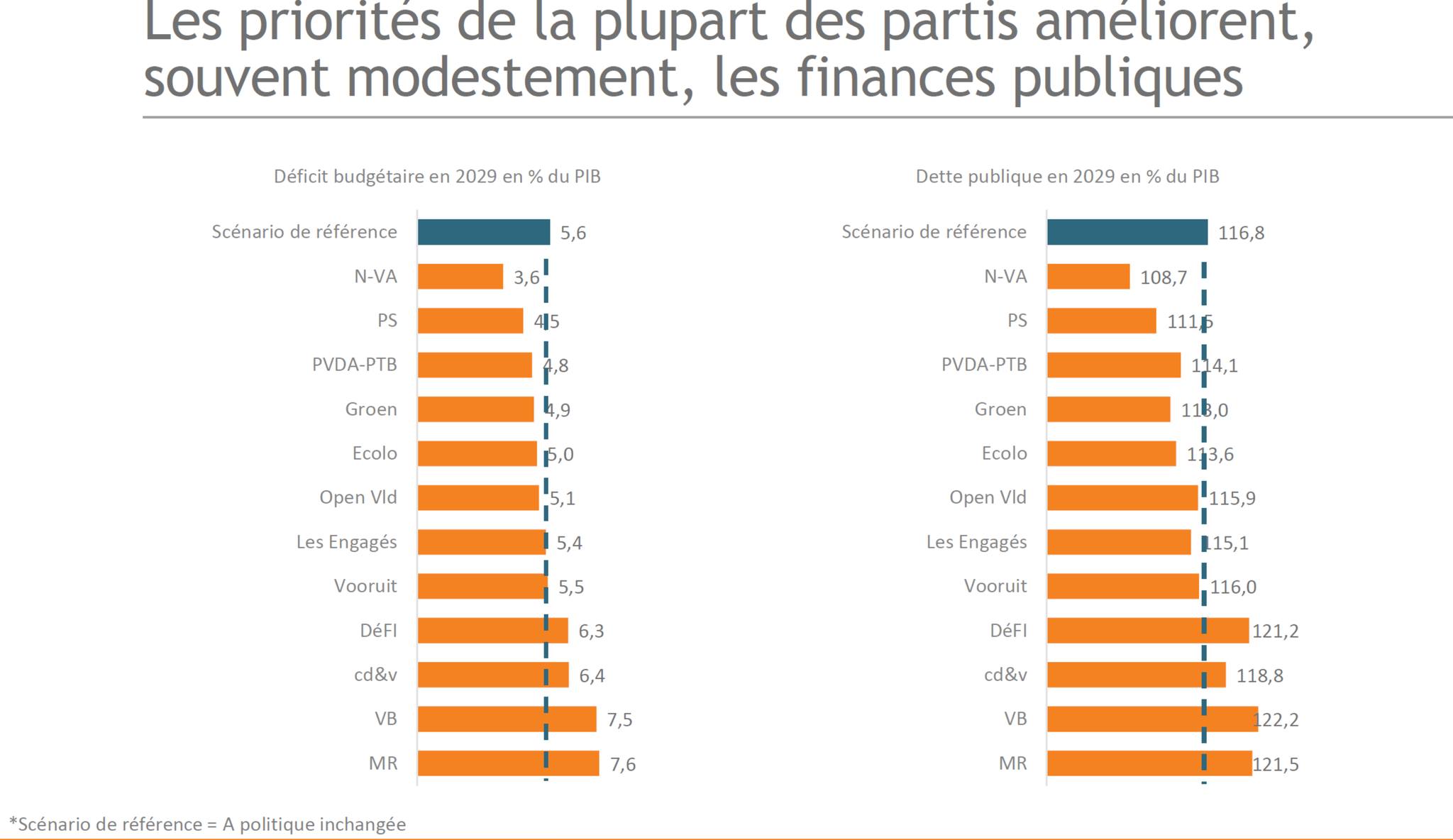

One of the most important questions of this election campaign is how the next government will get Belgium's budget back on track. The Planning Bureau calculated the impact of each party's measures on the budget deficit, which is currently on course to reach 5.6% of gross domestic product (GDP) in 2029, with public debt standing at 116.8%.

Based on the proposals submitted by Flemish far-right Vlaams Belang and Flemish Christian-Democrat CD&V, the budget hole gets even bigger: for Vlaams Belang, it would increase to 7.55%, for CD&V to 6.39% of GDP.

Translation: The priorities of most parties to improve, often modestly, public finances. Left: Budget deficit in 2029 as a % of GDP / Right: Public debt in 2029 as a % of GDP. Credit: Federal Planning Bureau

The other Flemish parties are more frugal, which would bring the deficit below 5.6% scenario, though it would continue to grow in the coming years. Only the Flemish rightwing N-VA submitted proposals would set Belgium's finances on a downwards trajectory – N-VA's plans would bring the deficit down to 3.6% and the debt to 108.7%.

The next best improvements come from Francophone socialists PS, Belgian Workers Party PTB-PVDA and Flemish ecologists Groen. Nationwide, PS has proposed the most consequential fiscal efforts after N-VA, with measures that would bring the deficit to 4.5% in 2029.

Proposals from the Francophone liberal MR would see the deficit rise the most of all Belgian parties – to 7.6% of GDP. The priorities suggested by Vlaams Belang, CD&V and Brussels Francophone DéFI would see the deficit rise to over 7.5% and would lead to a debt ratio of over 120% in the case of Vlaams Belang.

Paul Magnette during the New Year's wishes of French-speaking socialist party PS (Parti Socialiste) in Charleroi. Credit: Belga / Laurie Dieffembacq

Under CD&V, MR and Vlaams Belang, the budget deficit would grow due to the drastic tax cuts they propose. If enacted, these would significantly reduce government revenue.

Importantly, no party's proposals would bring the deficit below the 3% limit required by the European Union by the end of the legislature.

N-VA and Flemish liberal Open VLD aim to intervene mainly on expenditure and less on revenues. Groen and PS policies would increase revenue (more than PTB-PVDA) but they would also spend more. MR and Vlaams Belang policies would have a net reduction of government revenue.

The Planning Bureau calculated that economic growth would be highest with MR and lowest with PTB-PVDA: an average of 1.7% and 1.3% of GDP over the period 2024-2029, respectively.

Millionaire tax could raise billions

Several parties also had their proposal of a tax on large assets (often called the "millionaire's tax") scrutinised. Such a tax could raise billions, but how much depends on how high the tax will be – something that varies from party to party.

Interestingly, the PS's proposal brings in almost double compared to the Belgian Workers Party PTB-PVDA's.

The Flemish socialist Vooruit and ecologists Groen parties also added another tax to target the very wealthy. Vooruit wants income from financial assets to be included in the personal income tax base, which would raise €9.7 billion. Several additional taxes on capital gains that Groen is considering would raise as much as €11.3 billion, according to the Planning Bureau.

N-VA congress. Credit: Belga

Just about every party announced in its election manifesto that it wants to widen the gap between working and non-working people – an ambition mostly reflected in the parties' fiscal plans.

Particularly in Flanders, nearly all parties want to ensure that working people are left with significantly more money than those who are not working. That calls for a reduction in taxes on labour, which will increase the net wage of someone who works.

However, this will cost the government a lot of money. For all Flemish parties, this measure is in the top three most expensive measures. With N-VA, the tax cut is the smallest at €1.2 billion. Vlaams Belang's big tax cut adds up to more than €14 billion. With Vooruit, it involves a tax cut of more than €13 billion.

Open VLD and Groen are spending about €4 and €6 billion, respectively. With CD&V, it is about €7 billion.

How do parties compensate for lower taxes?

Left-wing parties plan to finance a reduction in charges on labour by raising taxes on people with large assets. By contrast, Open VLD, CD&V, Vlaams Belang and N-VA want to impose time limits on unemployment benefits, meaning that unemployment allowances would stop after a few years.

How much this would yield for the government would depend on the exact conditions: Open VLD proposals would bring €750 million more whilst N-VA's would generate almost €2.5 billion. Importantly, Open VLD and N-VA would need to slow Belgium's healthcare spending to realise the projected gains from cutting unemployment allowances.

By contrast, tax cuts proposed by CD&V and Vlaams Belang would create a bigger hole in the budget.

Energy Minister Tinne Van der Straeten (Groen) and Prime Minister Alexander De Croo (Open VLD). Credit: Belga/Philip Reynaers

The calculations also reveal the classic contrasts between left and right. Those with the lowest incomes – mostly people on a living wage or benefits – stand to gain from the measures proposed by Groen and Vooruit. But the proposals by Open VLD and N-VA would see their incomes fall and the risk of poverty grow.

Groen is notable for aiming to raise all benefits and wages to the poverty line, which would certainly reduce the poverty risk. However, this would cost over €9 billion.

For PTB-PVDA, the Planning Bureau did not calculate the impact on the various income groups.

Selling Bpost and Belfius would provide record revenues

N-VA and Vlaams Belang have both included in their programme the sale of "non-strategic government shareholdings". The Federal Government (partly) owns Belfius, Bpost, Proximus and the National Lottery, among other assets.

The Government could generate significant funds by selling its shares. According to the Planning Bureau, N-VA proposal along these lines would bring in €10 billion; Vlaams Belang might even generate €15 billion this way – the most of all measures the Planning Bureau calculated.

Those billions would be used to reduce Belgium's national debt. However the long-term loss of income from selling shares was not calculated.

PTB-PVDA slows down the economy, Vlaams Belang stimulates it

The impact of proposals on the growth of Belgium's economy was also calculated. For most parties, the economy would grow faster by 2029 than in the current scenario. The one exception on this is PTB-PVDA, whose measures would see the economy grow 0.33% less than the current trajectory for 2029.

The policies of Belgium's largest parties (N-VA and PS) would see economic growth remain virtually unchanged from current forecasts.

The biggest GDP growth would come with the proposals of MR, whose measures would deliver a 1.72% growth by 2029. CD&V also performs strongly on this front; Vlaams Belang proposals would deliver 1.42% growth over the same period.

While high-spending parties ensure more economic growth, higher purchasing power and a higher employment rate, they would also enlarge the budget deficit in doing so.

Protest meeting of Flemish far-right party Vlaams Belang. 29 May 2023, in Brussels. Credit: Belga / Nicolas Maeterlinck

Before the Planning Bureau's calculations were even announced, Vlaams Belang and PVDA both expressed their disagreement and questioned the institution's calculations.

PTB-PVDA cited "far-reaching and important" measures that were excluded from the calculations, which it argued are based on a "neoliberal logic."

Vlaams Belang meanwhile was frustrated that its proposals which would require a constitutional amendment or would conflict with European and international regulations were not calculated. For instance, its policy to ring-fence social security for newcomers was not accounted for.

Related News

- Belgians know the least about the EU despite being host country

- 'Austerity 2.0': EU budgetary rules approved despite long-standing opposition campaign

- 'You and I live on a different planet': De Wever and Magnette clash over (nearly) everything

In total, the Planning Bureau made its calculations based on 301 measures. It received 41 measures that could not be costed, but for each of which it made a qualitative fiche.

When the costing was first carried out five years ago, three parties didn't even propose ten measures whilst three others submitted over 40. This time around, each party submitted between 20 and 30 measures.